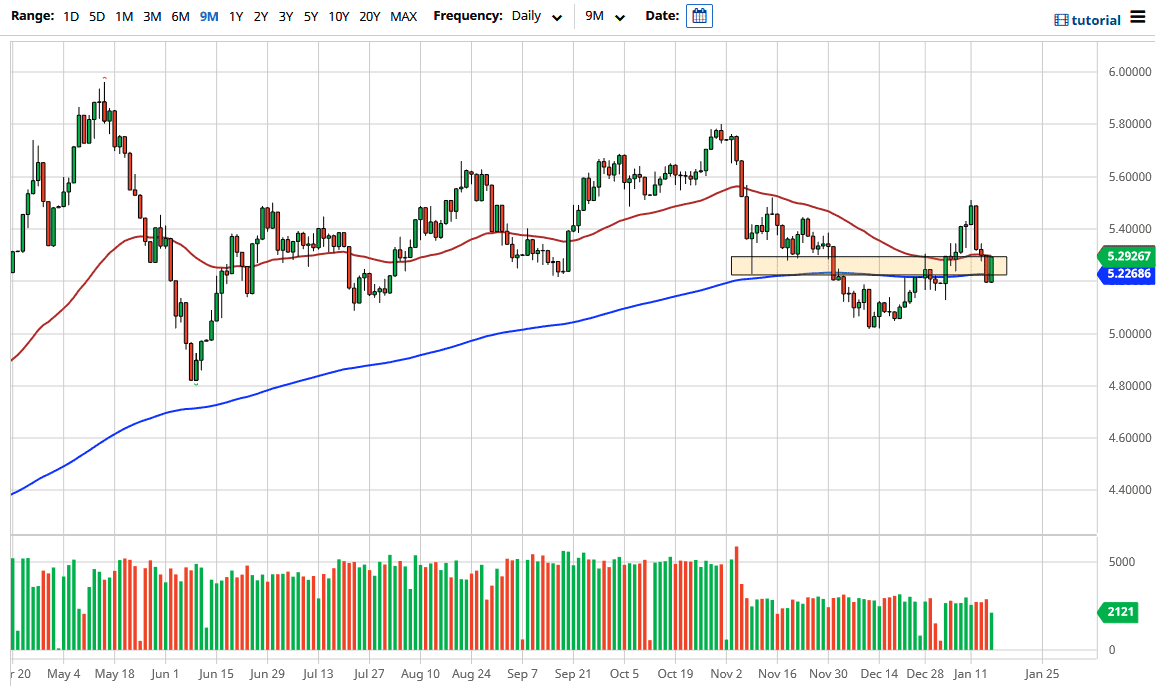

The US dollar has rallied a bit during the trading session on Friday to reach towards the 50 day EMA against the Brazilian real. It looks like we are ready to continue to see a lot of noise in general, but I think one of the biggest problems that we have is the fact that interest rates have rallied in the United States has played a little bit havoc with the Brazilian real and other emerging market currencies. I do believe that this is essentially a play on stimulus as the Brazilian economy is based heavily upon commodities. If stimulus gets threatened, and of course it has been due to the idea of the Joe Biden $1.9 trillion stimulus package was too much for Congress, then it causes a bit of concern as people start to show on the “risk on trade.”

That being said, we should also keep things in perspective in the sense that the trading session was Friday, and therefore people were worried about going into the weekend with so much uncertainty. I would not be overly concerned for the Brazilian real quite yet, and as a result it is likely that we will continue to see a lot of choppiness, but if we can break down below the lows of the last two sessions it opens up the move down to the 5.00 level. On the other hand, if we rally to the upside, we could go looking towards the 5.50 level, but I would anticipate seeing a certain amount of resistance in that barrier. In fact, I believe that the first signs of exhaustion in that area will probably be pounced upon.

At this point, it is all about stimulus and trying to devalue the US dollar. If we do end up with massive amounts of stimulus, eventually that should help the Brazilian real, especially if we get some type of vaccination in that country as it should open up the economy again. It is only a matter of time before that happens, but it should be noted that vaccines have been delayed in multiple countries around the world, so that does put a little bit of a “risk off” feel to the markets as well. The candlestick wiped out the previous candlestick, so that does suggest that we could get a little bit of a bounce, but I am not willing to buy into it, at least not yet.