The Canadian dollar strengthened against the greenback during the trading session on Wednesday as the United States dollar continues to look very soft against certain commodity currencies. Canada released stronger than anticipated inflation numbers during the trading session, driving the value of the Loonie higher. The market reached down towards the 1.26 level, an area that has been massive support recently. That being said, it should be noted that it did not move in lockstep with crude oil, as it broke away from the usual correlation that we see between crude oil and the market. This is not to say that the two will not go back to the usual tethering, just that there was an actual fundamental reason beyond petroleum to start buying the CAD during the session.

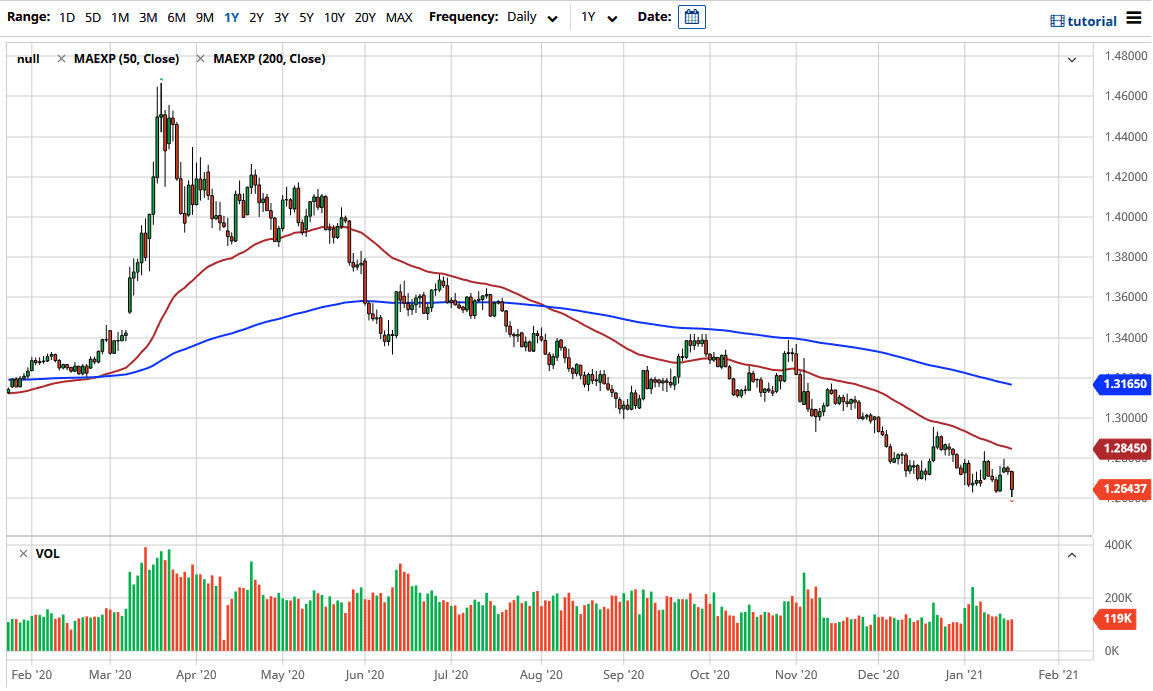

The market clearly has a significant amount of resistance above, especially near the 50 day EMA which is right around the 1.2850 level. That is significant technical barrier that a lot of people will be paying attention to, and therefore I think that if we broke above there the market would go looking towards 1.30 level. However, that would probably coincide more with increasing interest rates in the United States, and perhaps even crude oil dropping a bit. Yes, there is a massive amount of stimulus coming out of the United States, but we have seen more than our fair share of stimulus over the last several years, and ultimately it did not seem to drive up the demand for crude oil and other commodities. Yes, it is a short-term reflexive type of action, but at the end of the day demand for crude oil was falling long before the pandemic got here.

That being said, the short term market looks bullish, but we could see a turnaround if crude oil falls. I would keep an eye on the West Texas Intermediate Crude Oil market, and if it breaks down below the $50 level with any type of stickiness, that could turn this pair around quite drastically as the Canadian dollar is the first thing traders start selling in the Forex world if crude oil drops drastically. Nonetheless, I do recognize that we have been in a downtrend for a while, so you should also keep an eye on the US Dollar Index, which is approaching the crucial 88 handle. If that level gives way, then this chart will fall through the floor.