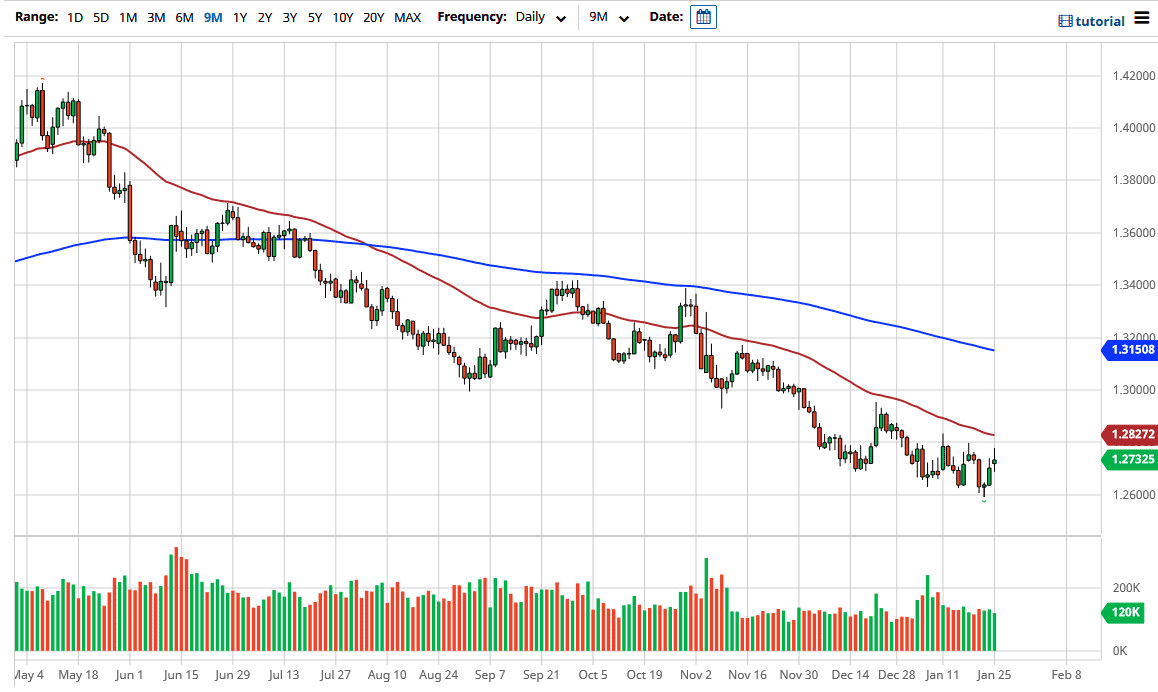

The US dollar fluctuated during the trading session on Monday, as it has been rather volatile in multiple markets. It rose to the 1.28 level against the Canadian dollar, but then pulled back just a bit. We are hesitating on the rally to the upside, and it makes sense that we would, as the 50-day EMA is just above. If we were to break above there, then it is likely that we could go to the 1.30 level, and I still believe that is entirely possible. A lot of this will come down to the overall strength or weakness of the greenback, and possibly even the crude oil markets.

The candlestick is shaped a bit like a shooting star, which suggests that perhaps we may pull back. I think this is more or less an area where we will fluctuate, perhaps using the 1.26 level as a massive support level, just as the 1.28 level offers a bit of resistance. There is an argument to be made that crude oil is starting to turn over again, which would make sense, considering that even though we are looking at the potential reflation trade, the reality is that demand for crude oil has dropped, and even with stimulus one would have to ask exactly how strong it would be over the longer term. This is because we were losing demand for crude oil before the pandemic, so I wonder whether or not this is really an environment that will be conducive for crude oil strength? I suspect not, and it is worth noting that we have most certainly hit a bit of a wall in the crude oil market, in which case it is difficult to imagine that there will be some type of “knock on effect” against the Canadian dollar.

This does not mean that I am looking to hang onto a huge position to the upside, rather that I think that a short-term trading opportunity may present itself if we break above the 50-day EMA. I would probably get out by 1.30, but if you are a little bit more conservative you may be looking at an opportunity to simply fade rallies near that area as it goes with the longer-term trend.