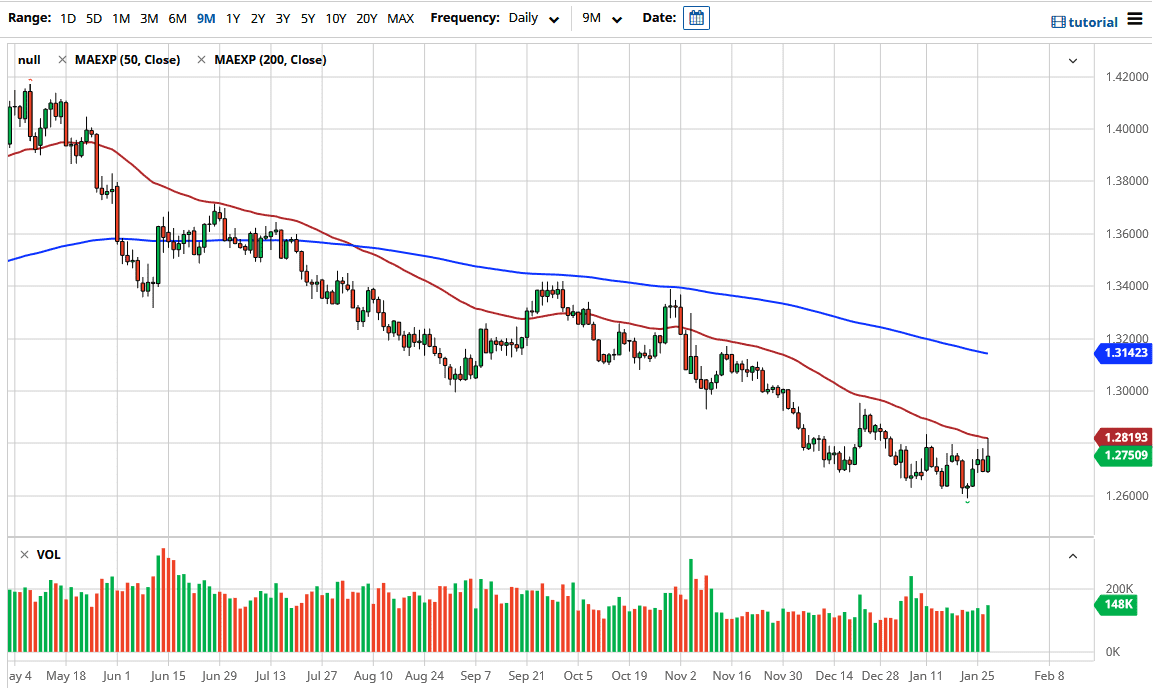

The US dollar has initially shot higher during the trading session against the Canadian dollar to reach towards the 50 day EMA. The 50 day EMA sits just above the 1.28 handle, so that of course is an area that is crucial for the longer-term downtrend, and it should be noted that we pulled back from that level rather quickly. We are still very much in a downtrend, but I would also point out that we could possibly be seeing the beginning of some type of basing pattern. Keep in mind that the 1.26 level is important on longer-term charts, perhaps extending down to the 1.25 level.

The 1.30 level above could be a target if we continue to rally a bit, but ultimately, I think that we need to pay attention to the crude oil markets, which are getting a bit stretched. That could be a catalyst to go higher to say the least, but they of course have been choppy as well. The US dollar should continue to be very noisy, but it is worth paying attention to the US Dollar Index, as it has been struggling to break down further. At this point, we could get a bit of a recovery for the greenback but given enough time it is likely that we will continue to focus on the idea of stimulus and of course the overall outlook for growth around the world. After all, as we continue to see more of a “risk on” type of situation, quite often the US dollar gets sold off.

We have been in a downtrend for a while, so I think that it still is easier to short this pair, but I would be very cautious about doing so right away. I think that perhaps looking for signs of exhaustion above probably continues to be the best trade, but overall, I think this is a market that is a bit stretched and trying to digest the recent gains by the Canadian dollar. The candlestick for the trading session does suggest that there is a little bit of bullish pressure underneath, but it also shows just how noisy it is going to be if we do in fact try to recover. I suspect that the short-term “ceiling in the market” is closer to the 1.30 level.