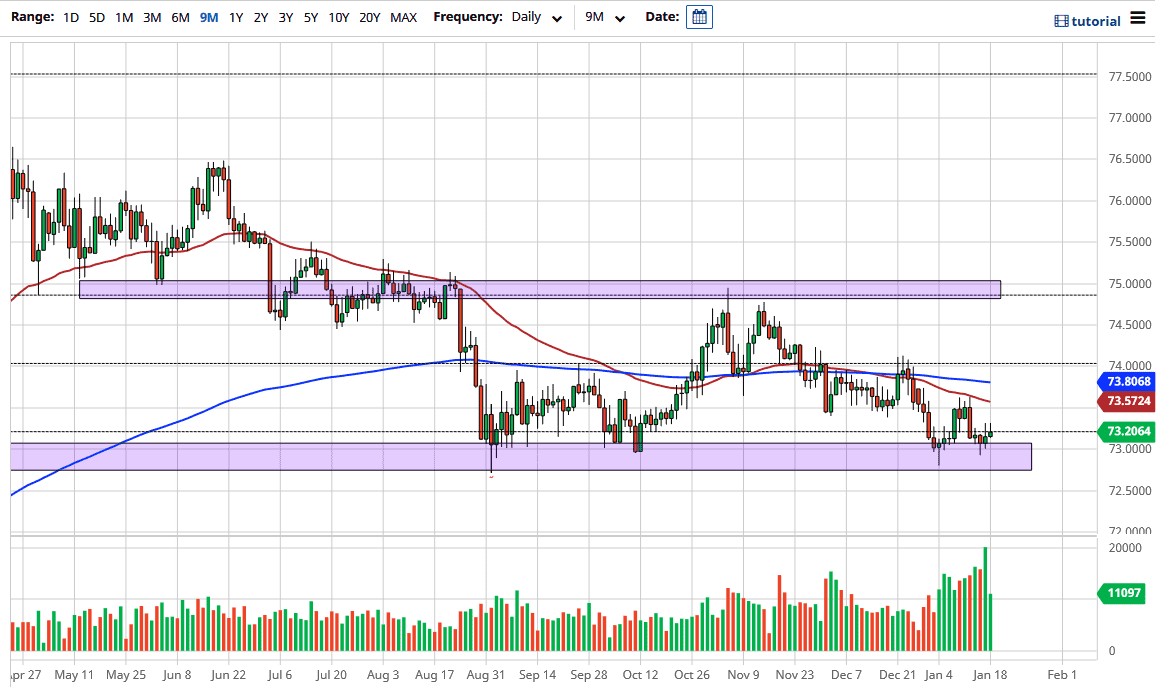

The US dollar rallied initially during the trading session on Monday, but gave back some of the gains to form a shooting star-shaped candlestick. This is the same thing that happened during the previous session, and it looks like we are going to continue to push to the downside. If we can break down below the ₹73 handle, it is likely that we could go down to the ₹72 level given enough time. A lot of this will come down to risk appetite, because as long as there are concerns out there, it is very difficult to believe that we will see the Indian rupee strengthen if we get a major “risk off move.”

If we can break above the top of the candlestick for the trading session on both Friday and Monday, the market is likely to go looking towards the 50-day EMA, perhaps even the 200-day EMA. There is a lot of noise above, and it is only a matter of time before exhaustion comes back into the marketplace. The market has been consolidating in a large range between ₹75 and ₹73 for a while now, and at this point we are still very much within that area. Nonetheless, this is a market that continues to be very choppy but negative. Eventually, sellers will continue to press even lower. The market will continue to see a lot of volatility more than anything else, as the stimulus in the United States could provide enough rush towards emerging markets that the Indian rupee should be a major beneficiary. In fact, I do not have a scenario in which I am looking at buying this pair, at least not until we break above the ₹74 level. Breaking higher than that could open up the possibility of move back towards the ₹75 level, but I think we would need to see a major “risk off scenario” for that to happen. I do recognize that the US dollar is oversold, but ultimately, this is a scenario that continues to favor shorting. Nonetheless, I like shorting this market every time we get an opportunity.