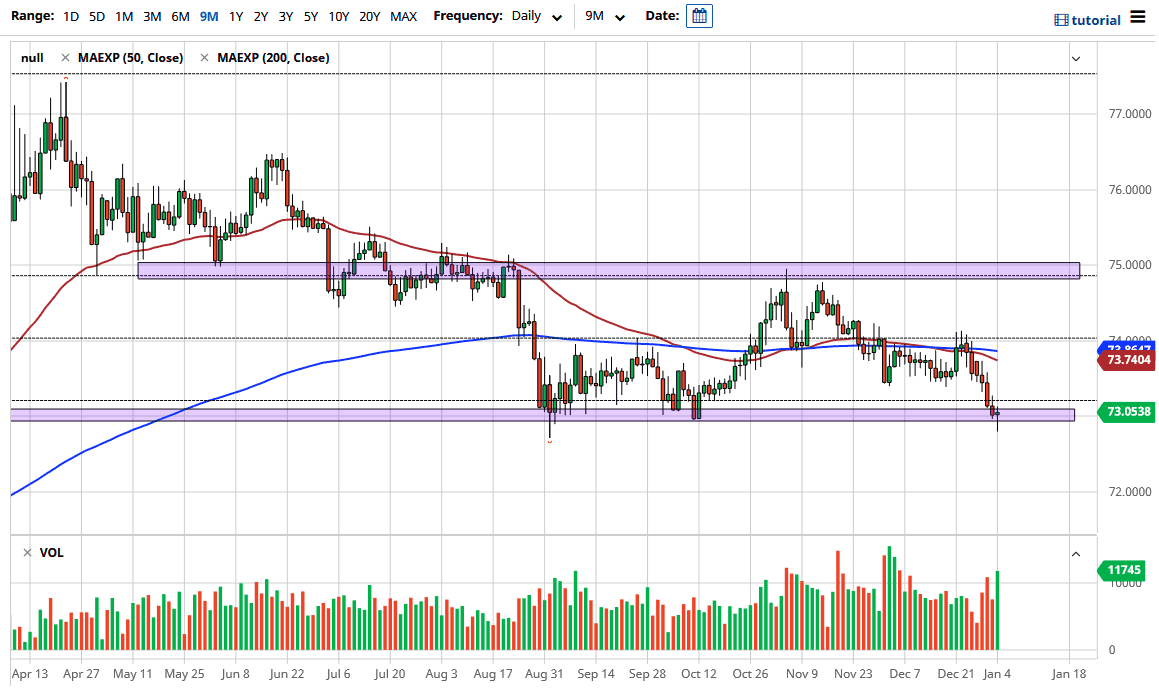

The US dollar had a rough trading session initially on Monday as it plunged below the ₹73 level. However, it bounced back above it towards the end of the session to form a hammer, which is a sign of potential support. What is even more interesting is that we have seen the ₹73 level offer support in the past, so a bit of “market memory” is starting to come into play.

By most accounts, the US dollar is oversold, so this should not be a huge surprise. But one has to wonder: how much longer can the greenback hang on against so much selling pressure? This will be especially true if we see continued talks of increased stimulus, and the possibility that the Democrats may take the Senate as well. That will weigh heavily upon the US dollar, and other currencies will benefit. This would play out to most of the majors, but the idea of extended stimulus could help emerging markets in general. In such a case, the Indian rupee will be one of the first places that people go looking towards.

From a technical analysis standpoint, if we do break above the candlestick during the trading session on Monday, then we will go looking towards the ₹73.50 level before we start selling off again, perhaps even the 50-day EMA, which is at the 73.74 handle. I am looking for selling opportunities, and not trying to buy, due to the fact that although this has been massive support in the past, we have attempted to break through it multiple times, and it is only a matter of time before that support gives away. As the old expression goes, “there is no since thing as a triple bottom”, so the support is probably being chipped away.

Rallies at this point will continue to be sold into, although if we broke above the ₹74 level, then we could make a bigger move to the upside. I suggest that is not going to be the case, though, as we have seen so much selling pressure for the last month or so when it comes to the greenback in general.