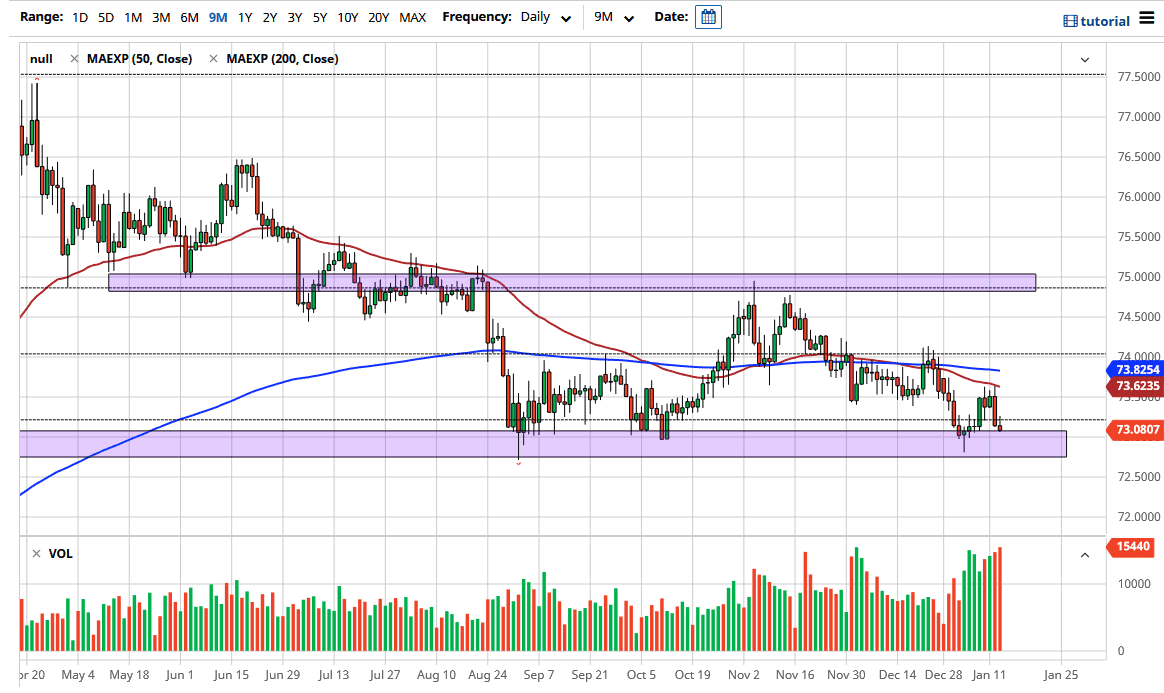

The US dollar initially tried to rally during the trading session on Wednesday, but gave back the early gains to form an inverted hammer against the Indian rupee. We are pressing up against a major support level, so it does look like we are going to try to break down below it. The ₹73 level is the beginning of a small area of support that has kept this market within a strong rectangle. However, the overall attitude certainly has soured a bit towards the greenback, and as long as that is going to be the case, people will start looking for yield in other countries, especially the emerging-market economies such as India.

Rallies at this point will continue to be sold into, and the market could very well respect the 50-day EMA near the 73.62 level that has recently offered resistance multiple times. On the other hand, if we were to break down below the bottom of the candlestick for the day and, perhaps more importantly, the ₹73 level, then I believe we will try to test the bottom of the hammer from last week, and then finally break down below there. Given enough time, that is exactly what I expect to see. At this point, it is simply a question of whether or not we will do it right away, or if we have to bounce first before having this happen.

Either way, I do not have any interest in buying the US dollar right now, because the overall sentiment is anti-US dollar, and people will start looking towards emerging markets for some type of return. India is a favorite, and the US dollar had gotten far too expensive against the Indian rupee for some time, and now we are starting to come back to earth from that move. If we break above the top of the candlestick for the trading session on Wednesday, then I will simply wait for signs of exhaustion above. After all, the most recent high was quite a bit lower than the one before it, and that typically means that we are putting more downward pressure on the market, something that eventually leads to a breakdown. It is really not until we break above the ₹74 level on a daily close that one would have to think the US dollar will save itself against the rupee.