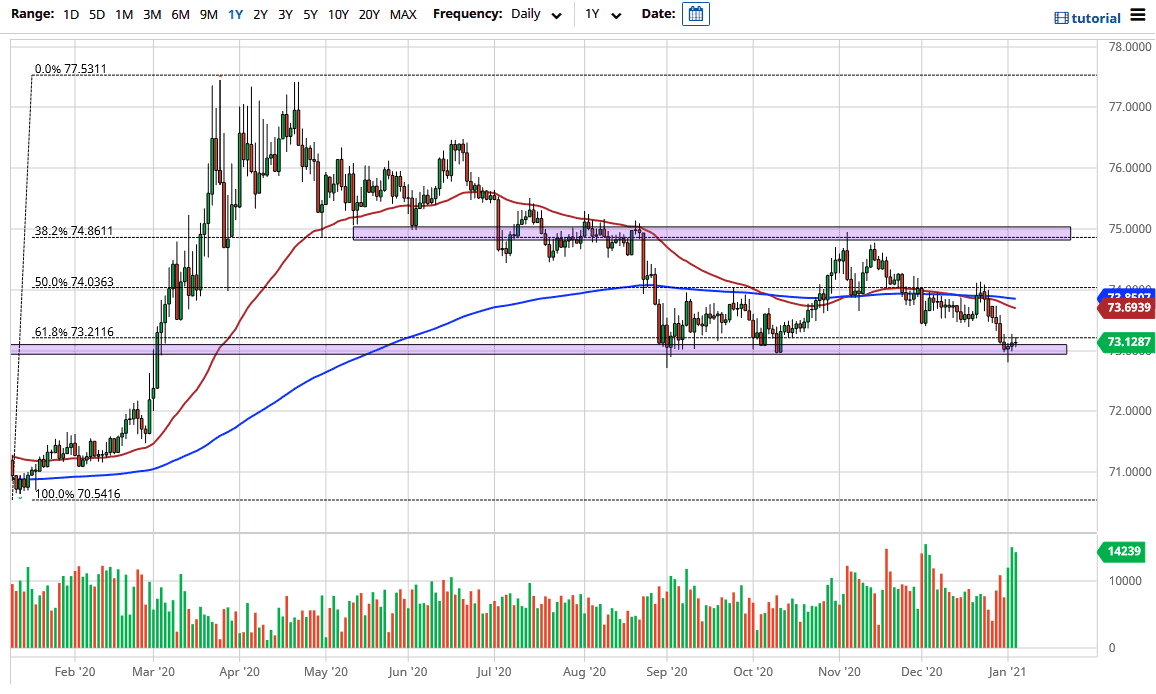

The US dollar fluctuated during the course of the trading session on Wednesday as the Indian rupee sits on the ₹73 level. This is an area that will be rather significant, as it has shown support more than once. Any rally at this point would probably be sold into, as we have seen so much in the way of bearish pressure. The 50-day EMA sits above at the ₹73.69 level, and the 200-day EMA sits just above there. I look to fade short-term rallies until we can break down below the candlestick from the Monday session.

Breaking down below the candlestick could open up the door to the ₹72 level, possibly even down to the ₹71 level. A lot of this is going to come down to the US dollar strength or weakness in general, so the Indian rupee is almost an afterthought when it comes to trading this pair. We are at the bottom of a larger consolidation area, and I think that given enough time, the ₹71 level will be targeted, based upon the measured move of the range that we have been in.

A lot of this could come down to stimulus in the United States and the idea that there is a global reflation trade, especially due to the vaccine being distributed around the world. Special attention will be paid to India as well, due to the fact that it is not only one of the world’s largest and most dynamic emerging markets, but it also will be facing a lot of scrutiny due to the latest coronavirus numbers. Remember, India had a massive amounts of infection rates recently, so if that is under control all of a sudden, people will be looking to invest in that country yet again. The interest rate differential continues to favor the rupee as well, so we will continue to see this move long term. It is not quite a head and shoulders pattern, but it is something similar that we are breaking out of, or at least trying to. That is another thing to pay attention to as well.