The global recession caused by COVID-19 saw the bolstering of save-haven currencies, the most prominent of which was the USD. In March 2020, the USD/JPY pair collapsed to the 101.17 support level and, in the same month, jumped by more than 1000 points, reaching the resistance level at 111.72. Political and economic concerns in the US pushed the currency pair towards the support level of 102.88, closing the year's trading lower and stabilizing around the 103.25 support level. The future of the currency pair in 2021 hinges on the success of vaccines and government efforts to contain and eliminate the epidemic.

The number of Americans seeking weekly unemployment benefits decreased by 19,000 to 787,000, a level that remains historically high as the spread of coronavirus continues to dominate the US economy. While at the lowest level in four weeks, the numbers released last week are nearly four times higher than last year at this time before the coronavirus hit. As employers continue to lay off employees due to high infections keeping many people at home, state and local governments are re-imposing tougher restrictions on businesses and public activities.

Unemployment claims were about 225,000 just a week before the pandemic hit hard in March, at which point weekly jobless claims rose to 6.9 million and pushed the US economy into a deep recession. The total number of people receiving traditional unemployment benefits decreased by 103,000 to 5.2 million for the week ending December 19. That was still significantly larger than the 1.7 million a year ago, when the unemployment rate was hovering around its half-century low of 3.9%.

Unemployment claims peaked in May 2020 at 25.9 million. The four-week average of claims rose last week to 8,36,750, an increase of 17,750 from the previous week. Accordingly, economists believe that the holidays, in addition to the widespread confusion over the status of the COVID-19 relief package, halted requests for benefits last week, so the numbers could be worse than they look.

Congress has recently passed a $900 billion relief bill that would boost benefit payments and extend two programs to help unemployment linked to job losses from the pandemic. However, US President Donald Trump called the measure a "disgrace" and refused to sign, pressuring Congress to increase the stimulus payments to individuals from $600 to $2,000. The Democrat-controlled House of Representatives quickly passed legislation to meet Trump's request, but the Republican-led Senate rejected it.

Meanwhile, the US government began sending small payments to millions of Americans. The $600 payment will go to individuals earning $75,000. Accordingly, analysts believe that the $900 billion package as it is now will give the economy a boost, but only as long as there are no major problems with the introduction of COVID-19 vaccines.

Earlier last month, the Trump administration said it plans to distribute 20 million doses of the vaccine by the end of 2020, but according to data provided by the CDC, just over 11.4 million doses and only 2.1 million have been distributed to individuals. While Trump has distributed vaccines to the states, it is up to state governments to vaccinate their populations.

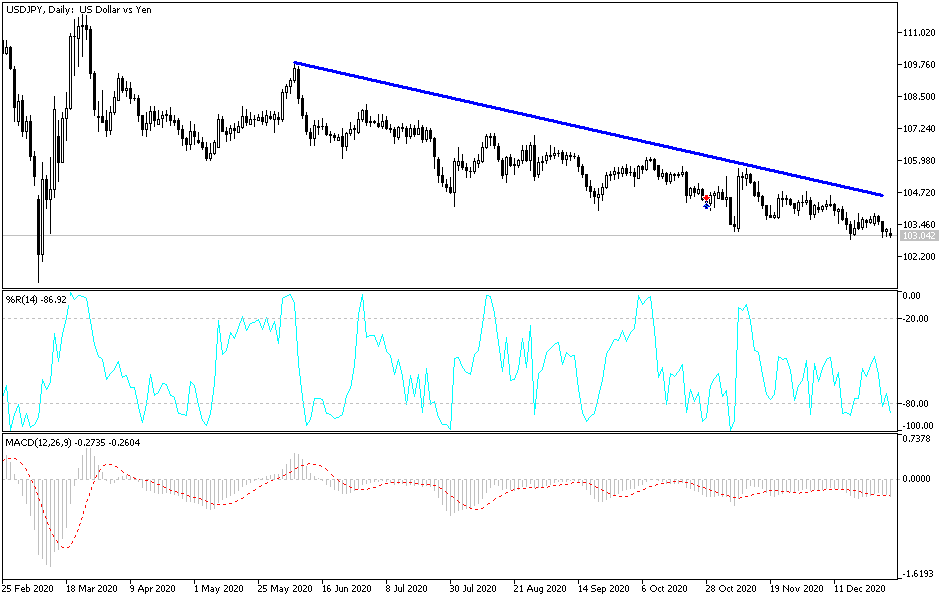

Technical analysis of the pair:

In the near term, and according to the performance on the hourly chart, it appears that the USD/JPY is trading within the formation of a sharp descending channel, which indicates a significant short-term bearish bias in market sentiment. Therefore, the bulls will look to extend the current rebound towards 103.49 or higher to 103.75. On the other hand, the bears will look to maintain control in the short term by targeting profits around 102.98 or less to 102.72.

In the long term, and according to the performance on the daily chart, it appears that the USD/JPY is trading within a bearish channel, which indicates a long-term bearish trend in market sentiment. Therefore, the bears will look to extend the current downtrend towards 101.97 or less, to 100.06. On the other hand, the bulls will target long-term bounces around 105.10 or higher at 106.92.

Today's eonomic calendar:

Regarding the JPY, the Industrial PMI will be released in Japan and China. Regarding the USD, the Construction Spending Index will be announced.