The USD/JPY tried to correct to the upside for the second day in a row, but the bounce gains did not exceed the level of 103.44 and it stabilized around the level of 103.18 as of this writing. The limited bounce came after the pair collapsed to the 102.59 support, its lowest level since March 2020. The US dollar lost against the rest of the other major currencies as the run-off elections in Georgia seemed to justify the pessimistic outlook for the currency in 2021, although the lack of upside for many of the major competitors is a potential curve that could provide short-term support for the US Dollar Index in the coming weeks.

It appears that Democrats have won both seats in the Georgia Senate runoff election. Ian Shepherdson, Chief Economist at Pantheon Macroeconomics, said: “This does not mean, however, that Democrats will now be able to activate President-elect Biden's agenda to build back better, because the plan includes a large net increase in spending over the next ten years. So it needs 60 votes, but to be clear, the balance of power, influence and agenda setting in Washington has just changed dramatically. ”

Republicans will now be a minority in both Houses of Congress, where the Democrats have an absolute majority, giving the Biden administration freedom. Democrats will fall short of the required supermajority in the Senate to enact certain programs without needing the support of some Republican Senators, let alone any so-called moderates in the Democratic Party, although a less economical approach to spending remains in hand. Cumbersome regulation is practically guaranteed.

Wasteful fiscal impulse and long-term concerns about America's "twin deficits", which consist of both budget deficits and current account deficits, have been mainstays of the broadly bearish outlook for the dollar this year. The United States has long suffered from observations of widening deficits, and they were frequently cited during President Donald Trump's tenure as reasons for the dollar's decline.

The US Dollar Index is heavily influenced by the movements of the EUR/USD, USD/JPY, and GBP/USD, which together account for about three-quarters of the flows measured by the scale, and there are a set of reasons for why these exchange rates may support the dollar over the coming weeks.

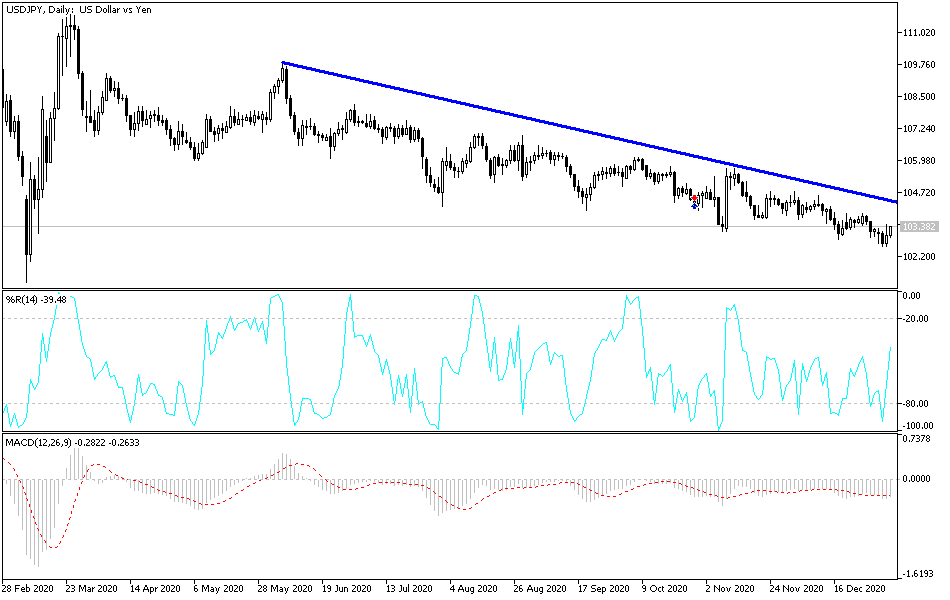

Technical analysis of the pair:

The general trend of the USD/JPY is still bearish, and stability around and below the support level of 103.00 still supports the bears' control of performance and warns of a stronger and closer downward move. Currently, support levels for the pair are 102.65, 101.90 and 101.00. At the same time, those levels will push the technical indicators into strong oversold areas. Therefore, it is imperative to buy from every downward level rather than selling. On the upside, the bulls' first breach of the current performance will be by crossing the resistance level 106.00.

In addition to the extent of investor risk appetite, the pair will be affected by the announcement of the trade balance, unemployment claims and the ISM Service PMI.