The USD/JPY pair tried to rebound upward during the last trading session, but the bounce's gains did not exceed the 104.10 resistance level, and the pair stabilized near it. The currency pair still has a bumpy road ahead to reverse the overall bearish trend.

Japan recently appeared on the list of countries most affected by the coronavirus. Japanese opposition lawmakers criticized the emergency declaration issued by the government on Sunday, describing it as too late to stop the increase in cases. They also called for more tests, which are delayed in Japan, being more expensive and difficult to obtain except for critically ill conditions. Yukio Edano, the former economic minister, told NHK TV: "It is necessary to think about the worst possible scenario, but the response has always been based on a very optimistic outlook."

The opposing lawmakers, Turanosuke Katayama and Kazuo Shi, also criticized the state of emergency as being too limited in scope, area and duration. The announcement, which began on Friday, asked restaurants to close at 8 pm for the duration of a month and focused on the Tokyo region. Japanese Prime Minister Yoshihide Suga defended the announcement and said that the growing curve of infection spread would diminish within a month.

The total number of deaths related to COVID-19 has reached nearly 4,000 nationwide so far. Concerns are growing about hospital pressure. In Tokyo, the number of infections has recently increased to more than 2,000 per day.

In the U.S., California health authorities recently reported a record high of 695 deaths due to the coronavirus, as many hospitals became strained amid an unprecedented number of cases. The state's Health Department said that the number raises the number of deaths in the state since the beginning of the epidemic to 29,233. The increase in the number of cases that followed Halloween and Thanksgiving has led to record hospitalization in California, and now the most critically ill patients are dying in unprecedented numbers.

Already, many hospitals in Los Angeles and other hard-hit areas are struggling to keep up, and they have warned that they may need to ration care as intensive care beds dwindle.

After reporting that US job growth has slowed over the past few months, the Labor Department released a report last Friday that unexpectedly showed a drop in US employment in December. The Department of Labor said that employment in the non-agricultural sector decreased by 140,000 jobs in December after it increased by 336,000 jobs, which was revised upwards in November. The drop surprised economists, who had expected an increase in employment of 71,000 jobs compared to the increase of 245,000 jobs originally reported for the previous month.

US employment declined for the first time since April, as the recent increase in coronavirus cases led to a drop in employment in the entertainment and hospitality sector, which lost 498,000 jobs. Employment in private education also decreased, while job losses were partially offset by gains in professional and commercial services, retail and construction.

Meanwhile, according to the report, the US unemployment rate reached 6.7% in December, unchanged from November. Economists had expected the unemployment rate to reach 6.8%. The unemployment rate was unchanged, with the labor force increasing by 31,000, compared to an increase of 21,000 in the household employment survey. The report also stated that average hourly wages for employees jumped $0.23, or 0.8 percent, to $29.81. Annual wage growth jumped to 5.1% in December from 4.4% in November.

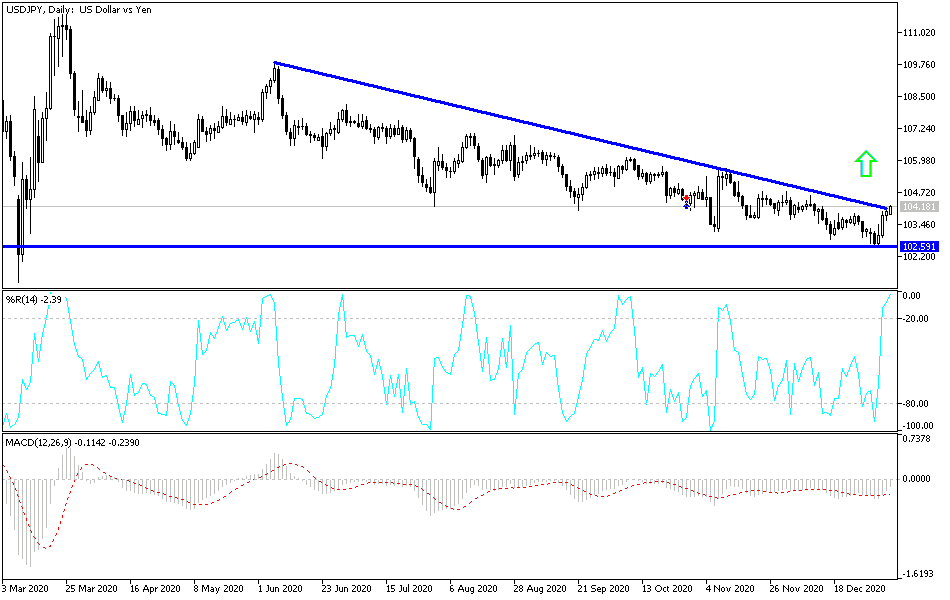

Technical analysis of the pair:

As shown on the daily chart below, the USD/JPY pair remains in the range of a downward channel and the recent rebound gains have not reversed the general outlook. The return of stability below the 103.00 support level pushes the technical indicators to strong oversold areas. I still prefer to buy rather than sell.

Today's economic calendar:

Today is a holiday in Japan and there is no important US economic data.