The USD/JPY pair jumped to the 104.20 resistance level after a downward stability around the 103.58 support level before the announcement of the Federal Reserve's monetary policy. In its first monetary policy decision of 2021, the US Federal Reserve kept interest rates unchanged as widely expected and revealed that it plans to maintain the asset purchase program at the current pace. According to the bank, it will maintain the target range for the federal funds rate between 0% to 0.25%, and has said again that it expects to leave rates at levels close to zero until labor market conditions reach levels consistent with the maximum number of job opportunities and inflation is on its way.

The statement accompanying the bank’s decision also revealed that it plans to continue buying bonds at a rate of at least $120 billion per month. The statement reiterated the assertion first issued last month, when the Fed said it would maintain asset purchases at the current rate until "more substantial progress" is made toward its goals of maximizing employment and price stability.

Commenting on the bank’s statement, Paul Ashworth, chief US economist at Capital Economics, said: “We do not expect the Federal Reserve to begin reducing its asset purchases until early next year, and we believe that the first US interest rate hike can be postponed until 2024.”

The pace of economic recovery has slowed in recent months, with vulnerabilities concentrated in the sectors most affected by the ongoing coronavirus pandemic. In its December 2020 meeting statement, the bank said that economic activity and employment continued to recover but were still well below their levels at the beginning of the year.

The latest statement also referred to the launch of coronavirus vaccines, indicating that the course of the economy will depend heavily on the course of the COVID-19 virus, including advances in vaccines. Also, the Fed reiterated that it will continue monitoring the implications of the information received on the economic outlook and will be ready to adjust the monetary policy stance as appropriate if risks arise that may impede the achievement of its objectives.

Ahead of the policy announcement, US factory durable goods orders were reported to increase 0.2% in December, weighed by a significant drop in the volatile aircraft sector. According to official figures, the increase in durable goods orders, which is expected to last for at least three years, came after stronger increases of 1.2% in November and 1.8% in October. Orders for commercial aircraft, which have been hit hard by a sharp drop in air travel during the pandemic, decreased 51.8% in December. Separately, Boeing reported on Wednesday that it lost $8.4 billion in the fourth quarter, capping a record loss for the whole of 2020.

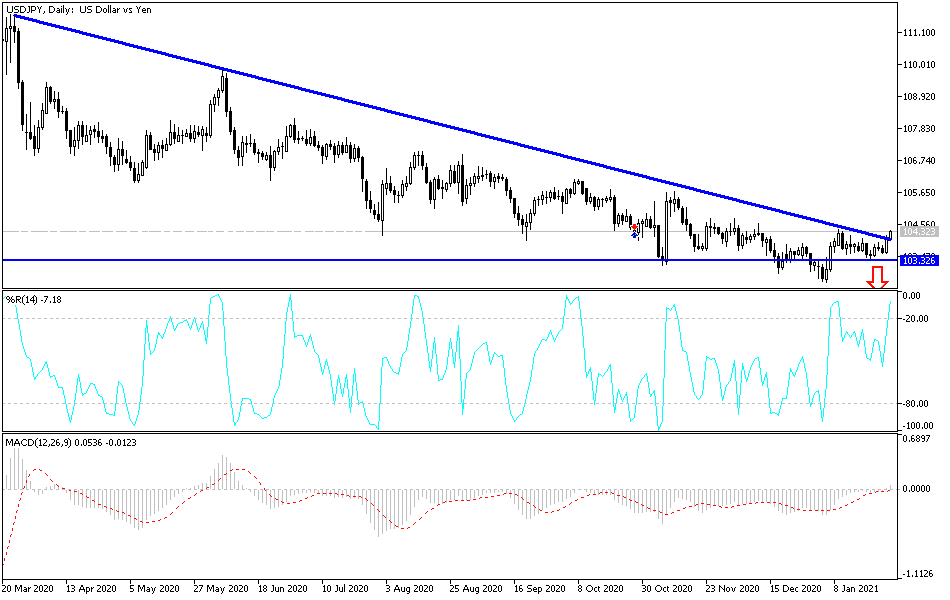

Technical analysis of the pair:

Despite attempts to correct to the upside, the USD/JPY still need more impetus to confirm the reversal of its bearish outlook. A trend reversal would likely occur after a breach of the 106.00 resistance level, and on the downside, stability below the support level of 104.00 will maintain the bearish trend and prepare for testing stronger bearish levels. The closest of those are currently 103.55, 102.90 and 102.00. I still prefer buying the currency pair from every downside.

The currency pair will be affected today by the extent of investor risk appetite, along with the announcement of the rate of US economic growth in the fourth quarter of 2020, in addition to the announcement of the number of weekly unemployment claims and new US home sales.