The USD/JPY began the week on a bearish note as it plunged to the 103.63 support level, remaining near it at the beginning of today's trading. Global financial markets are monitoring the resurgence of coronavirus cases in the world's third largest economy, which may explain the yen’s slow start to 2021. Traditional safe-haven assets have been the best-performing currencies over the past 12 months, as investors search for refuge and security from the uncertainty and disruption caused by the rapid outbreak of new strains of the coronavirus and the return of lockdowns to contain the pandemic.

According to the Ministry of Economy, Trade and Industry (METI), the capacity utilization rate cut its five-month growth streak, falling 2.9% to 92.6 points in November. In October, capacity utilization increased by 6%. Japanese industrial production fell 0.5% month-on-month in November, ending five consecutive months of growth. Japan reported lower production of cars, chemicals, transportation equipment and business-oriented machinery. Therefore, industrial production decreased at an annual rate of 3.9%. The Reuters Tankan Index for January, a monthly survey of leading Japanese companies, rose to -1, from -9 in December. The index has been in contractionary territory since October 2019.

Moreover, the Tertiary Industry Index, which measures a variety of economic factors, fell 0.7% in November, below the median estimate of 0.3%.

Japan is going through a second wave of COVID-19, with the number of new daily cases exceeding 5,000. In total, Japan has reported more than 331,000 total cases since the start of the COVID-19 crisis, with the death toll reaching 4,305.

Joe Biden will be inaugurated tomorrow with a US economy hit hard by the epidemic.

Current account balances have grown by $2.4 trillion since the outbreak began. Housing prices are rising due to increased demand. Every additional vaccine brings the world's largest economy closer to fully re-opening up. Commenting on this, Jason Furman, Chief Economist in the Obama administration, said: “If the US economy is improving dramatically by spring or early summer, that may actually help Biden accomplish more of his agenda…because success can breed success.” He pointed to the potential for growth that would facilitate the path of the infrastructure and climate investment program.

But suspending any effort to boost the economy is an enduring partisan divide that contributed to the attack on the US Capitol building this month as Biden was due to be confirmed as president-elect. As a result, politics increasingly shape Americans' sentiments about the economy, and offer political incentives for lawmakers to cooperate.

Also, there are concerns over whether the rampant epidemic and the slow pace of vaccination so far could herald more serious problems on the coronavirus front which could hurt economic recovery.

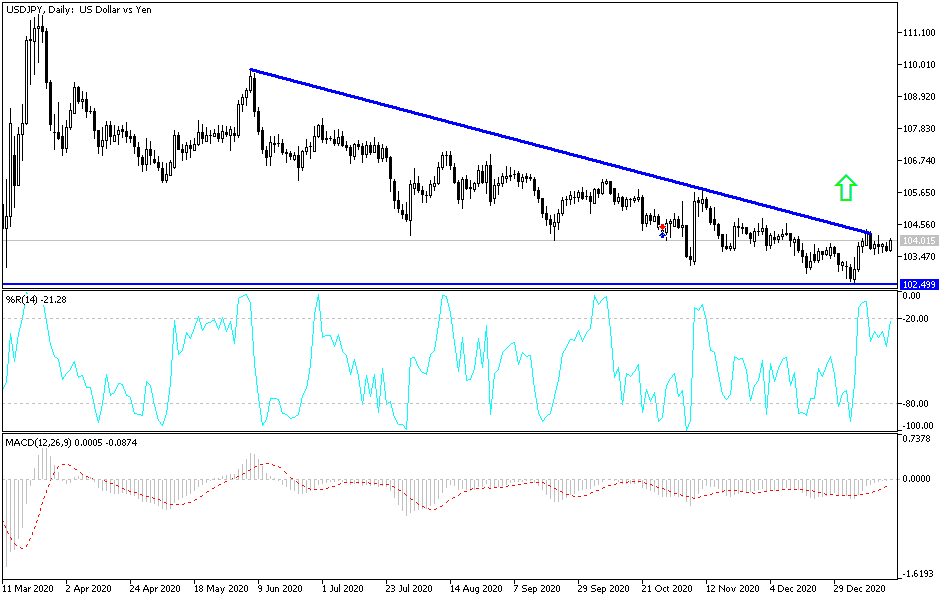

Technical analysis of the pair:

The USD/JPY remains in a bearish trend, and stability below the support 104.00 supports the move towards stronger support levels, the closest of which are currently 103.55, 102.80 and 101.90. The other two levels are better, from our viewpoint, to consider buying the pair, pending the expected bounce. On the upside, I still see that a breach of the 106.00 resistance level would be the closest opportunity to breach the long-awaited upside. Technical indicators are still heading towards strong oversold areas.

Amid the absence of important US economic data for the second day in a row, the currency pair will react to the extent of investor risk appetite.