The USD/JPY pair tried but failed to breach the 104.00 resistance at the beginning of this week's traing, instead settling around 103.70 and losing enough momentum to reverse the general trend.

Top aides to the new US president, Joe Biden, have begun talks with a group of Republicans and moderate Democrats in the Senate about a $1.9 trillion coronavirus relief package as Biden faces mounting headwinds in his efforts to win bipartisan support for the first legislative effort in his presidency.

Lawmakers on the right are questioning the wisdom of building larger deficits, while those on the left are urging Biden not to spend too much time on party work when the pandemic kills thousands of Americans every day and costs more jobs amid tight restrictions in many societies. At least a dozen Senators met for an hour and 15 minutes in a virtual call with White House National Economic Council Director Brian Daisy and other senior White House officials on Sunday. Markets are hoping to agree to a relief package ahead of the trial of former President Donald Trump, which is set to begin within two weeks, and which attracts Washington's attention.

All in all, the White House does not seem to budge on dismantling the package or cutting the total price, even as it pushes for bipartisan support. Senators from both parties have raised questions about the economic aid allocations, particularly making direct payments of $1,400 to Americans more tailored to recipients based on need. Senators also wanted more data on how the White House reached the $1.9 trillion figure.

Biden and his aides have emphasized in their public comments that his plan is a starting point and that finding common ground for relief must be possible given the devastating impact the pandemic is having on Democratic and Republican states alike. With more than 412,000 people killed by COVID-19 and the economy losing jobs again, Biden argued there was no time to lose.

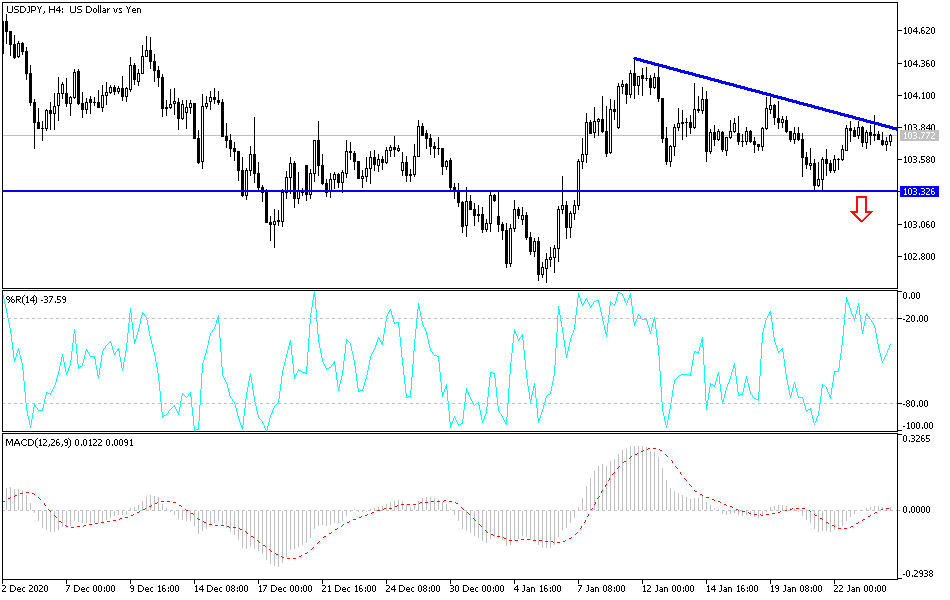

Technical analysis of the pair:

The USD/JPY remains bearish, and stability below the 104.00 support level opens up a move towards stronger support levels, the closest of which are 103.55, 102.90 and 102.00. On the upside, a breach of the 106.00 resistance level would signal an initial reversal of the trend, paving the road to a stronger upside momentum. I still prefer to buy the currency pair from every downside.

The currency pair will be affected today by the extent of investor risk appetite, along with the announcement of the US Consumer Confidence Index reading.