The USD/JPY pair regained its bearish momentum at the beginning of Thursday's trading, falling from the 104.40 resistance level to stabilize around the 103.60 support level. Despite this, the US dollar strengthened its position as the best-performing major currency in the week after December's inflation numbers confused investors, in a process that appears to have revived concerns about a possible reduction in the Fed's quantitative easing program in 2021.

US Federal Reserve policymakers led by Jerome Powell are facing a major logistical challenge in the wake of the Democratic Party’s victory in the Georgia state election last week, giving the incoming administration of President-elect Joe Biden a narrow but viable majority in Congress, which likely means increased spending. Commenting on this, Derek Halbene, Head of Research and Global Markets at MUFG says, “The year-to-date move up in 10-year returns is now 28 basis points before the returns corrected lower yesterday, and under any circumstances this is a remarkable move in seven days. This is paving the way for a stronger USD correction in the short term.”

Investors have so far assumed that the release of federal government spending will be automatically lifted by the Fed, which has matched its bond purchases closely to the government's extraordinarily growing spending needs throughout the pandemic. Matching the extraordinary demands of the public was essential to maintaining "market performance" and minimizing the economic scars from the epidemic.

But if FOMC members allow investors to continue assuming that they will aid extravagance or indiscretion in the incoming administration, they risk aiding and ultimately instigating a "tantrum". Nelson Wilson, Senior Market Analyst at Markets.com, says: “The 'tapered talk' appears to be part of a thoughtful discussion designed to focus our attention on the possibility of tapering to avoid slackening without panicking the markets later.”

This was likely the reason that although economists did not see a credible case for curtailing the bank’s near-term bond-buying program of $120 billion per month, Fed officials also began thinking out loud about the likely timing of an eventual tapering exercise. Great care was taken to make clear that such a move would be explicitly linked to the achievement of legal employment and inflation, and not the whims of the Treasury in the Biden administration that would be led by former Fed Chair Janet Yellen.

Therefore, this may be the reason why the Forex markets responded by buying the US dollar even after the December inflation numbers released yesterday. Accordingly, investors will pay close attention to the forthcoming statements from the monetary policy officials of the US Federal Reserve, and today we will hear Jerome Powell’s remarks.

US inflation rose 0.4% in December alone, raising the annual rate of consumer price growth to 1.4% and not far from the Fed's symmetrical target of around 2%. The most significant core inflation rate, which ignores volatile prices for energy, food, and regulated goods like tobacco and alcohol, rose by less than 0.1% but left a place above the benchmark at around 1.6%.

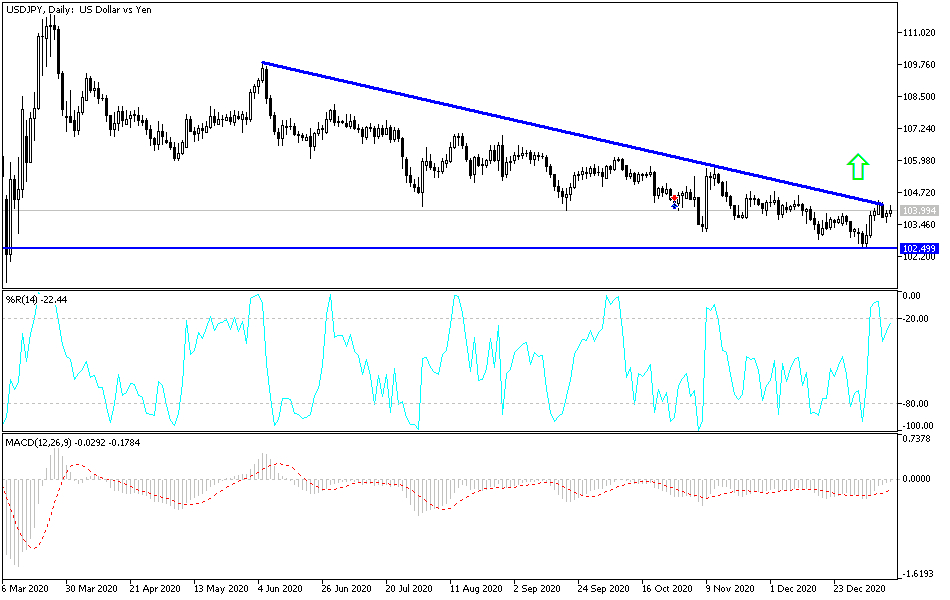

Technical analysis of the pair:

The bears still dominate the USD/JPY's performance. There will be no reversal of the bearish trend without breaching above the resistance 106.00. Accordingly, the closest targets of the bears are now the support levels 103.35, 102.80 and 101.90. Despite the boring performance of the currency pair, I still prefer it to buy from every downside and think that the aforementioned levels are appropriate for that. In addition to the extent of investor risk appetite, the currency pair will be affected by the announcement of the number of US unemployment claims and statements by Fed Chair Jerome Powell.