The US dollar fell against most other major currencies as risk sentiment improved in the market amid hopes of further economic stimulus. Investors kept their focus more on the statements of incoming Treasury Secretary Janet Yellen during her confirmation hearing before the Senate Finance Committee. In pre-prepared remarks, Yellin called for additional incentives to address the impact of the ongoing coronavirus pandemic, saying the government needs to "act big." The USD/JPY is settling in a bearish range between 103.52 and 104.19, and stabilized around 103.70 as of this writing.

Yellen acknowledged the mounting national debt facing the incoming US administration, but claimed that the benefits of another relief package would far outweigh the costs. Accordingly, Yellen said, it is now time to "act big" without worrying about the national debt. "Without further action, we risk a longer and more painful recession now and long-term scars for the economy at a later time," she said.

Last week, Biden released details of a $1.9 trillion plan to support the US economy, which will include $1,400 in cash for most Americans. Democrats are also pushing to increase the minimum wage for workers and boost benefits for laid-off workers. The hope is that such a stimulus could support the economy until later this year, when the deployment of vaccines that would restore life to a more or less normal level will increase.

"If most of this is implemented, it indicates a significant recovery in economic growth as we approach the fourth quarter of this year," said David Kelly, Chief Global Strategist at JPMorgan Funds. Dismal reports have been piling up about how the outbreak of the pandemic increased the number of workers applying for unemployment benefits and shoppers feeling less confident.

The death toll in the United States as a result of virus exceeds 400,000 people in the last hours of US President Donald Trump's presidency, who was responsible for getting the vaccines developed at a speed which many said would be impossible.

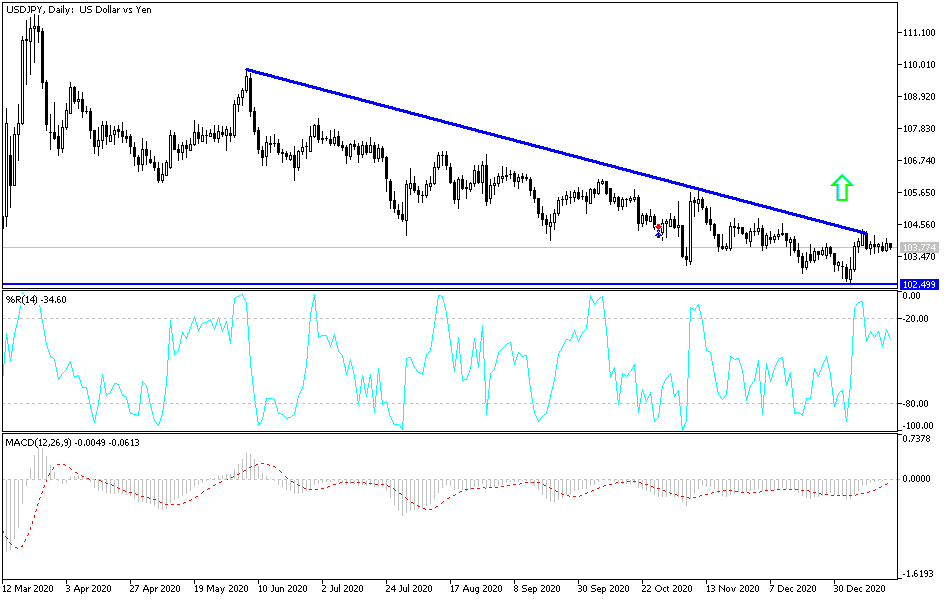

Technical analysis of the pair:

There is no change in my technical view of the performance of the USD/JPY, as the outlook is still bearish, and stability below the 104.00 support supports a move towards stronger downward levels. Technically, the stability of the pair for several trading sessions in a row in a narrow range foreshadows a strong move coming in one of two directions, and despite being bearish, the movement of technical indicators to strong oversold areas confirms that buying from every descending level is the best trading strategy for the pair instead of going bullish. An upward shift in the trend may occur if the currency pair breaks through 106.00 resistance. ]

Today's currency pair will focus on the inauguration of the new US president and investor risk appetite.