The US dollar's decline against the Japanese yen continues in 2021, despite the dollar’s gains against the rest of the other major currencies. The pair fell to the 102.71 support level before settling around the 103.00 level as of this writing. The bearish momentum of the pair is still the strongest. The Georgia Senate elections this week, along with the Federal Reserve’s release of its most recent meeting minutes and the release of US jobs numbers, may reverse the pair's current bearish outlook or collapse it to stronger descending levels and ignore the movement of technical indicators into oversold areas.

US construction spending increased 0.9% in November, as the strength in home construction more than offset the weakness in other parts of the construction industry. The November gains came after a further 1.6% increase in October and left construction spending to rise 4.4% during the first 11 months of 2020 compared to the same period in 2019, according to the US Department of Commerce. For the month of November, spending on residential construction increased by 2.7% with the pace of single-family construction increasing 5.1%, while apartment construction was flat, according to the new data. Record low mortgage rates have stimulated strong housing demand even as the global pandemic has led to widespread shutdowns of other parts of the economy.

While housing activity, fueled by a decrease in the supply of available homes, stands 16.1% higher than it was a year ago, spending on non-residential private projects is 9.5% lower than last year's levels, with hotel and motel construction dropping 26.5% from the level. In November 2019, office construction decreased 6.6%. Many analysts believe that the increase in work-from-home positions for many Americans due to the coronavirus will translate into reduced demand for office space in the coming years as companies choose to allow employees to do more work away from the office.

For the month of November, spending on non-residential projects decreased by 0.8% with spending on office buildings declining by 8.1%. Spending on government projects fell 0.2% in November. Many state and local governments face severe budgetary constraints as a severe recession has reduced tax revenues.

Commenting on the findings, Robiella Farooqi, Chief US Economist at High Frequency Economics, said: "In general, the trend in the residential sector remains steady, especially single-family construction, reflecting insufficient inventories of new and existing homes." She also said that housing construction should remain robust, but that non-residential and government construction activity is likely to remain weak "due to weak demand associated with disruptions caused by virus containment as well as budgetary constraints."

China's manufacturing activity improved in December, but at its weakest rate in three months as the economy recovers from the coronavirus pandemic while its trading partners grapple with rising infections. According to the results of recent Chinese data, the monthly PMI issued by the business magazine Caixin fell to 53 from 54.9 in November. On a scale of 100 points, numbers over 50 show activity growth. The separate PMI by an official industry group, the China Federation of Logistics and Procurement, fell to 51.9 from 52.1 in the previous month.

China is the only major economy on track to record positive economic growth in 2020 while the United States and Europe grapple with rising case numbers that have prompted governments to reimpose travel and business controls.

The sub-indices of exports and employment increased in both surveys, but at a slower rate than in December. Commenting on the figures, Economist Wang Zhi of Caixin Insight Group said in a statement: "We expect the post-epidemic economic recovery to continue for several months." Caixin said the survey's business confidence sub-index fell to its lowest level in three months.

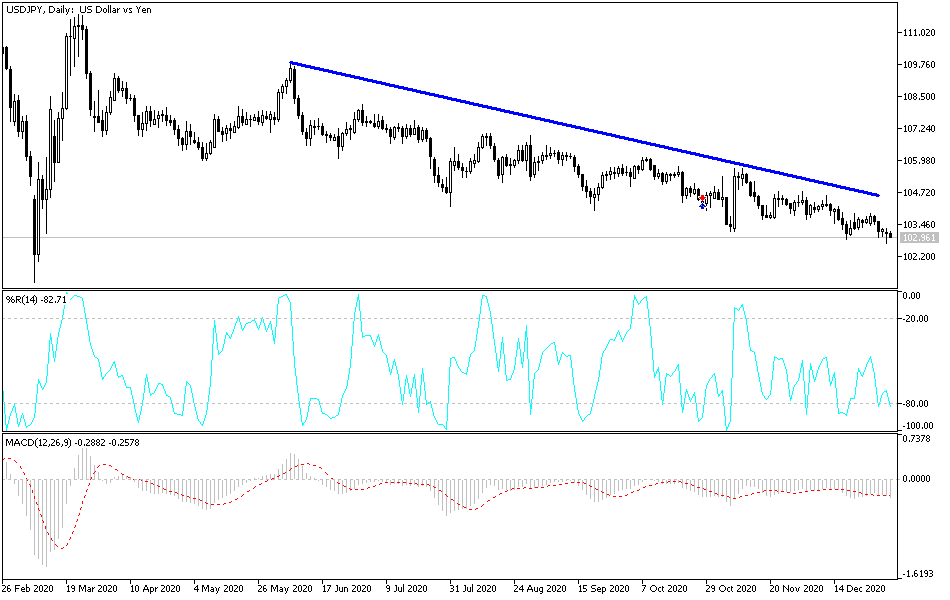

Technical analysis of the pair:

The USD/JPY's trend is still bearish. Technical indicators have reached oversold areas, and accordingly, the support levels at 102.70, 101.90 and 101.00 are best suited for buying now. On the upside, bulls will not control the performance without crossing the 106.00 resistance level. In addition to the extent of investor risk appetite, the currency pair will interact today with the announcement of the US ISM Manufacturing PMI reading.