Despite the improvement in US consumer confidence, the USD/JPY remains stable around the 103.60 support level. The pair is awaiting today's US Federal Reserve policy statement and comments from Fed Governor Jerome Powell, at a time when markets are aggressively awaiting further stimulus plans by the new US administration.

US consumer confidence rose in January 2021 as Americans became more optimistic about the future. Accordingly, the Conference Board stated that the US Consumer Confidence Index rose to a reading of 89.3, higher than the reading of 87.1 recorded in December 2020. The increase was driven by the Rising Expectations Index, which measures perceptions about the future path of income, business and labor market conditions. However, the current status indicator has further weakened, reflecting fears of a resurgence of COVID-19. “The slow spread of vaccines and the continuing epidemic continue to dampen consumer confidence despite the potential for more financial aid and a brighter health situation,” said Cathy Bostancic, chief US financial economist at Oxford Economics.

For the month of January, the report showed that opinions on current conditions have weakened, with the percentage of consumers rating business conditions as negative from 39.7% to 42.8%. Consumer perceptions of the job market also declined, as the percentage of consumers who said that jobs are abundant decreased from 21% to 20.6%. In terms of future prospects, the percentage of consumers who expect an improvement has increased. The survey found that the number of people who expect to purchase a home in the next six months has improved to 7.2% compared to 6% in December. Accordingly, economists took this increase as a good indication that existing home sales will show an improvement in the coming months.

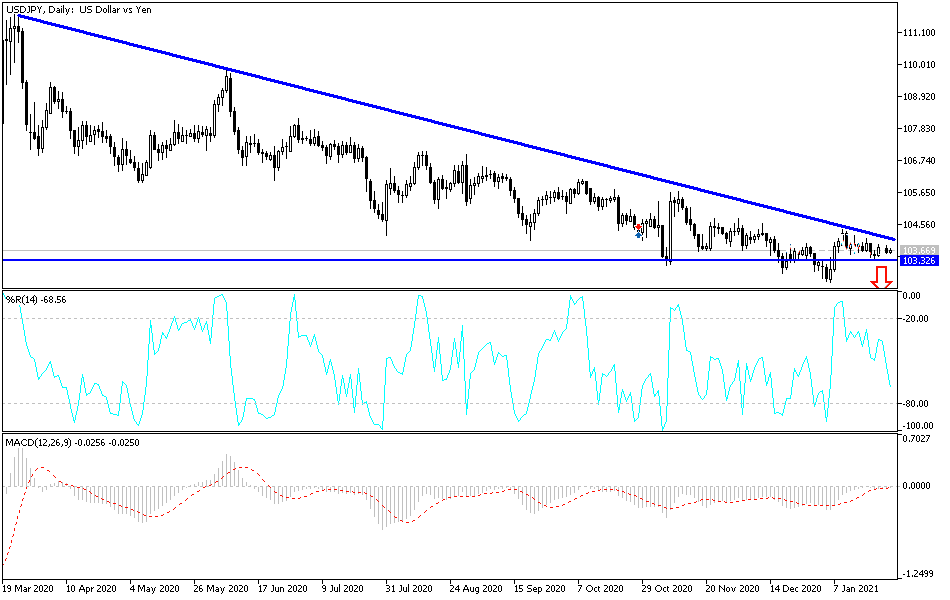

Technical analysis of the pair:

There is no change in performance or expectations for the USD/JPY. The pair's trend is still bearish, and stability below the 104.00 support heralds a stronger downward move towards the support levels at 103.55, 102.90 and 102.00. Nevertheless, I would still prefer buying the currency pair at every downside. There will not be a reversal higher without first breaching the 106.00 resistance level.

Today, the currency pair will be affected by investor risk appetite, as well as the reaction to the US Federal Reserve's announcement of its monetary policy decisions and the statements of Governor Jerome Powell.

Expectations strongly indicate that the bank will not change the US interest rates and attention will be given to the tone of the bank’s policy statement and Powell’s statements.