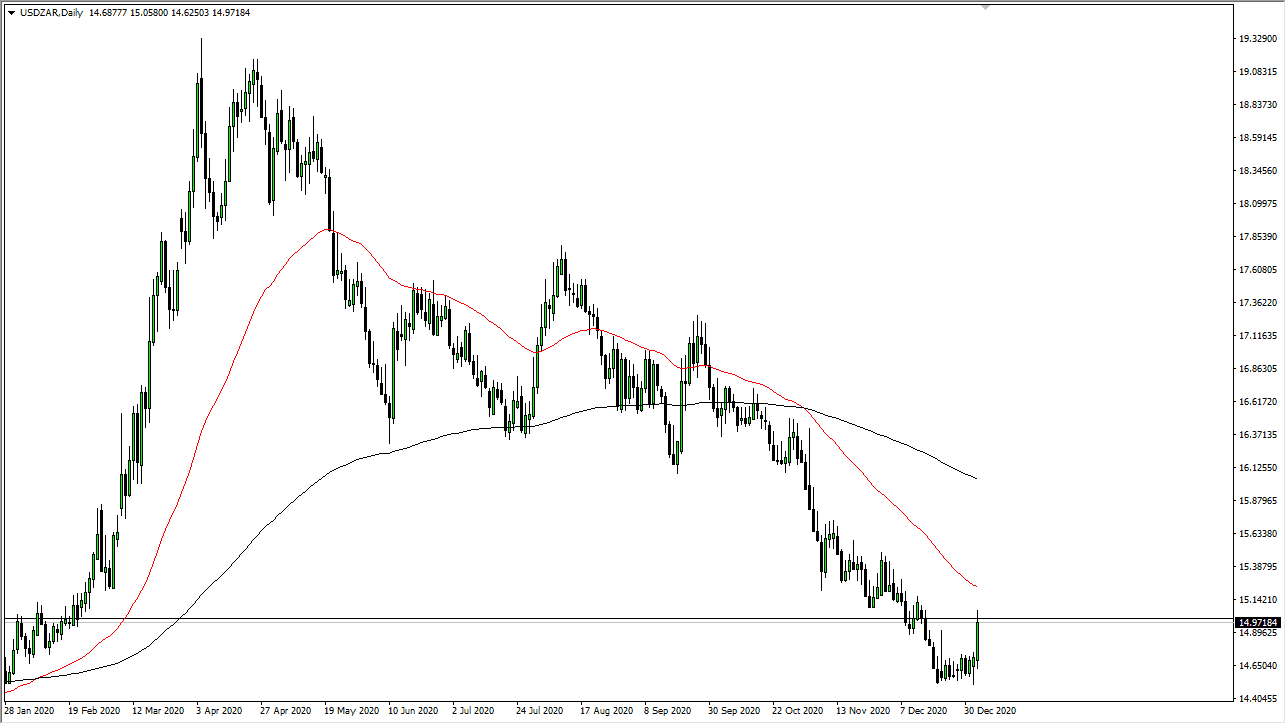

The South African rand lost quite a bit of strength during the trading session on Tuesday to reach towards the 15.00 level. This is a market that is in a major downtrend, and it is only a matter of time before the selling comes back into play. In fact, the late part of the session started to see a bit of selling in that general vicinity, but the size of the body suggests that there could be a bit of follow-through. The 50-day EMA sits near the 15.25 handle, which will likely cause a bit of resistance, so I am waiting to see what the next daily candlestick looks like. The market forming something like a shooting star would be a perfect signal.

I have no interest in buying this pair, even though we are oversold at the moment. The South African Rand is getting a bit of a boost due to the fact that the US dollar has been sold off so drastically, but nothing runs in one direction forever. Simply waiting for signs of exhaustion which you can use to jump into the market is where we will go looking forward.

To the downside, I believe that the 14 rand level is a medium-term target, but that does not mean that it will be easy to get there. Looking at this chart, I think that the higher we go, the more likely we are going to see a nice opportunity to short this market. I do not think that the trend will change anytime soon, at least not until we get a massive “risk off move” from a macro standpoint. You should never fight this type of trend, but we could get a significant amount of opportunities going forward. That does not necessarily mean that the market is one you should simply jump into, but you need to look at the overall picture and realize that in order to change everything, we would need to get well above the 200-day EMA, something that we are light years away from at this point. This simply should end up being a nice retracement which we can continue to use.