The 2021 first-quarter outlook for South Africa remains uncertain, with stricter lockdown measures across South Africa to contain the spread of the mutated COVID-19 virus expected. Some economists suggest that an economic contraction may result from it, depending on the length of restrictions. Issues facing the US economy trump worries over South Africa, and the USD/ZAR faces breakdown pressures inside its short-term resistance zone.

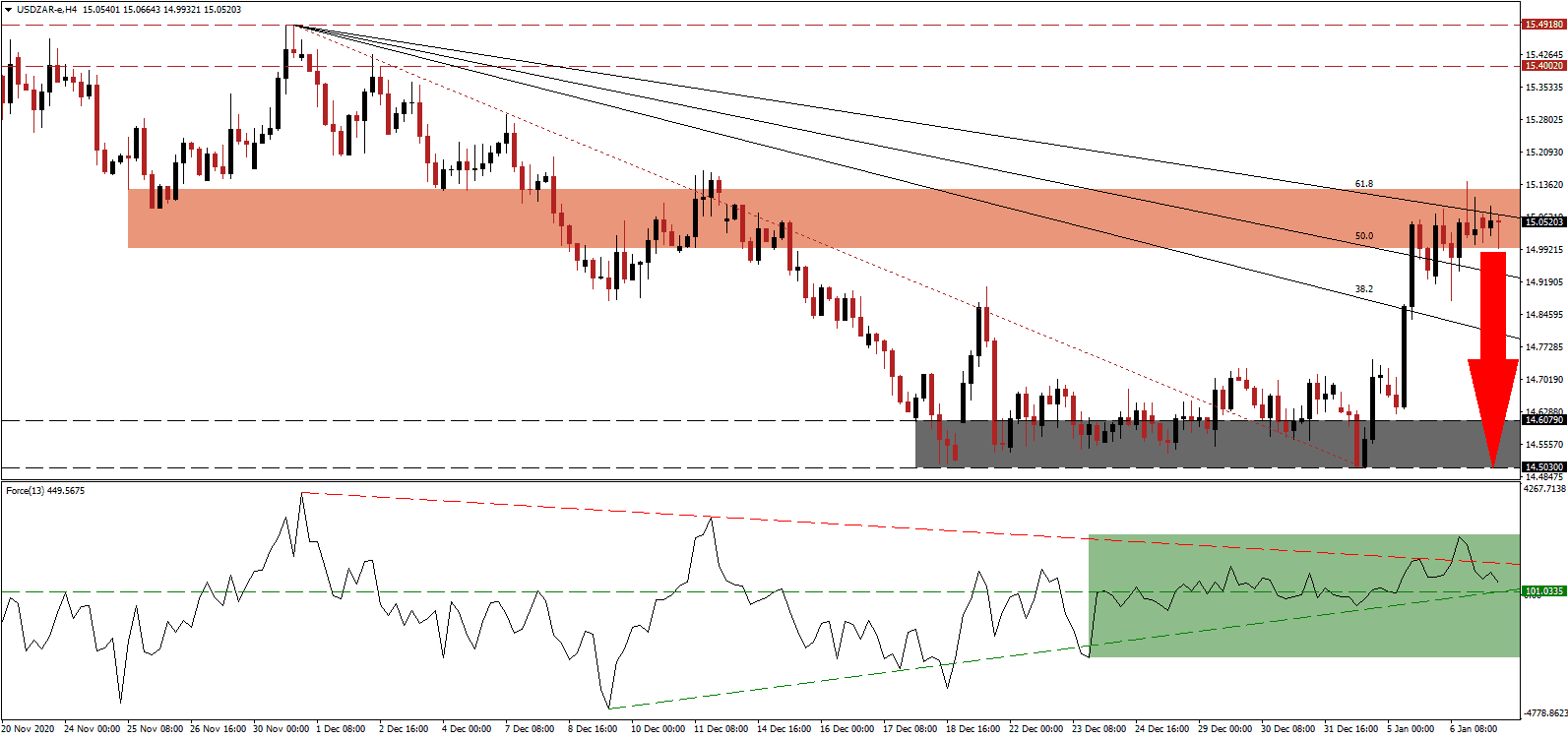

The Force Index, a next-generation technical indicator, retreated below its descending resistance level. It is now accelerating towards its horizontal support level, as marked by the green rectangle. Traders should anticipate a collapse below its ascending support level amid intensifying bearish momentum. Bears wait for this technical indicator to move below the 0 center-line to regain complete control over the USD/ZAR.

South African health insurance companies pledged to purchase COVID-19 vaccines for uninsured individuals totaling their number of members. Estimates suggest that it will result in 14,000,000 purchases, easing the government's burden to vaccinate its population. After the USD/ZAR reached its short-term resistance zone between 14.9932 and 15.1260, as marked by the red rectangle, a profit-taking sell-off is likely.

According to the World Bank, in its latest assessment, the South African economy will expand by 3.3% in 2021. It is 0.7% below the previous forecast of 4.0% growth, before decreasing to 1.7% in 2022. A breakdown in the USD/ZAR below its descending 50.0 Fibonacci Retracement Fan Support Level can pressure price action into its next support zone between 14.5030 and 14.6079, as identified by the grey rectangle.

USD/ZAR Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 15.0500

Take Profit @ 14.5000

Stop Loss @ 15.1700

Downside Potential: 5,500 pips

Upside Risk: 1,200 pips

Risk/Reward Ratio: 4.58

Should the Force Index spike above its descending resistance level, the USD/ZAR may temporarily extend its advance. Given growing political and economic pressures in the USD, the medium-to-long-term outlook remains bearish. The upside potential remains limited to its resistance zone between 15.4002 and 15.4918, grating Forex traders a secondary selling opportunity.

USD/ZAR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 15.3000

Take Profit @ 15.4900

Stop Loss @ 15.1700

Upside Potential: 1,900 pips

Downside Risk: 1,300 pips

Risk/Reward Ratio: 1.46