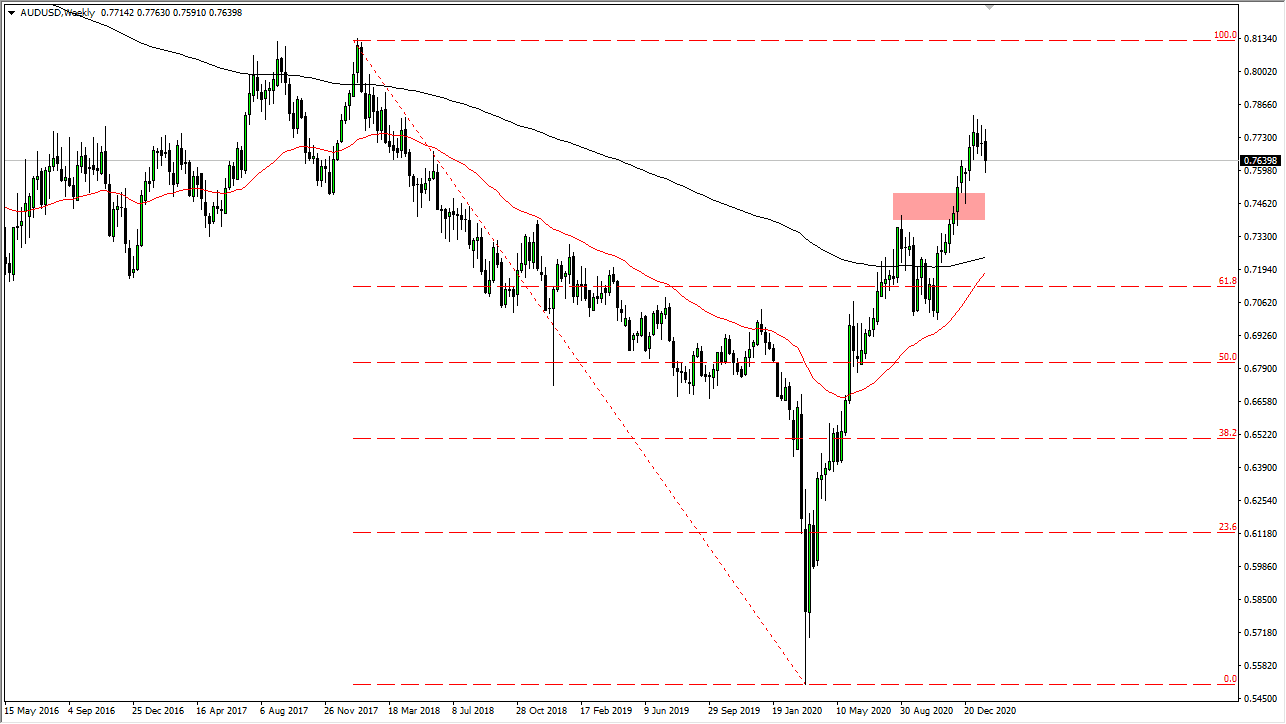

AUD/USD

The Australian dollar initially tried to rally during the week but then sold off as there was more of a “risk off” tone around the world. There is still plenty of support in this market and, when you look at the daily chart, we are still very much in a bullish flag. As soon as we get some good news when it comes to the coronavirus numbers or perhaps even stimulus, this pair will rally. We also have an RBA meeting soon, which could be what the market is trying to focus on. This is all about the dollar as far as pulling back is concerned, but I do not think it is a longer-term trade.

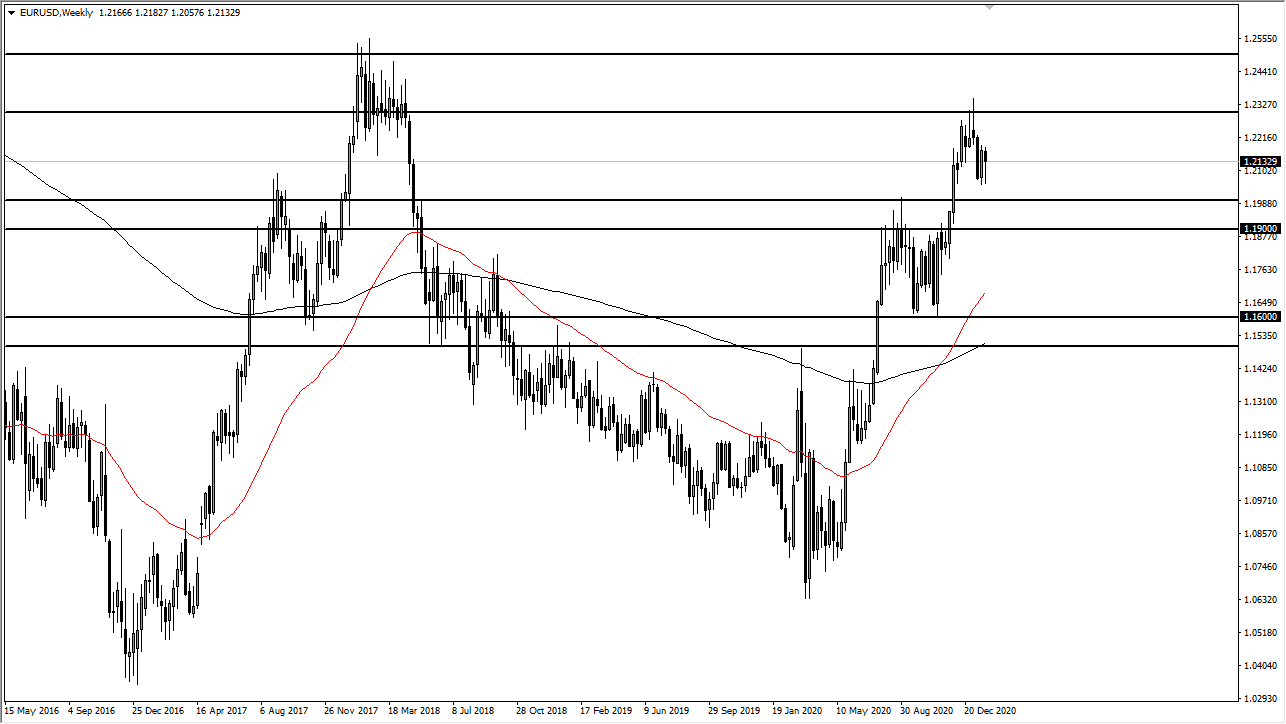

EUR/USD

The euro fell rather hard during the course of the trading week, but found enough support to bounce again and form a bit of a hammer. There is a shooting star up at the 1.23 level, so I think that we are trying to get back up there. Every time we pull back a bit, we find buyers, perhaps trying to stay within this consolidation area. This is a market that will continue to be very noisy, but I think range-bound is probably the most applicable word to use.

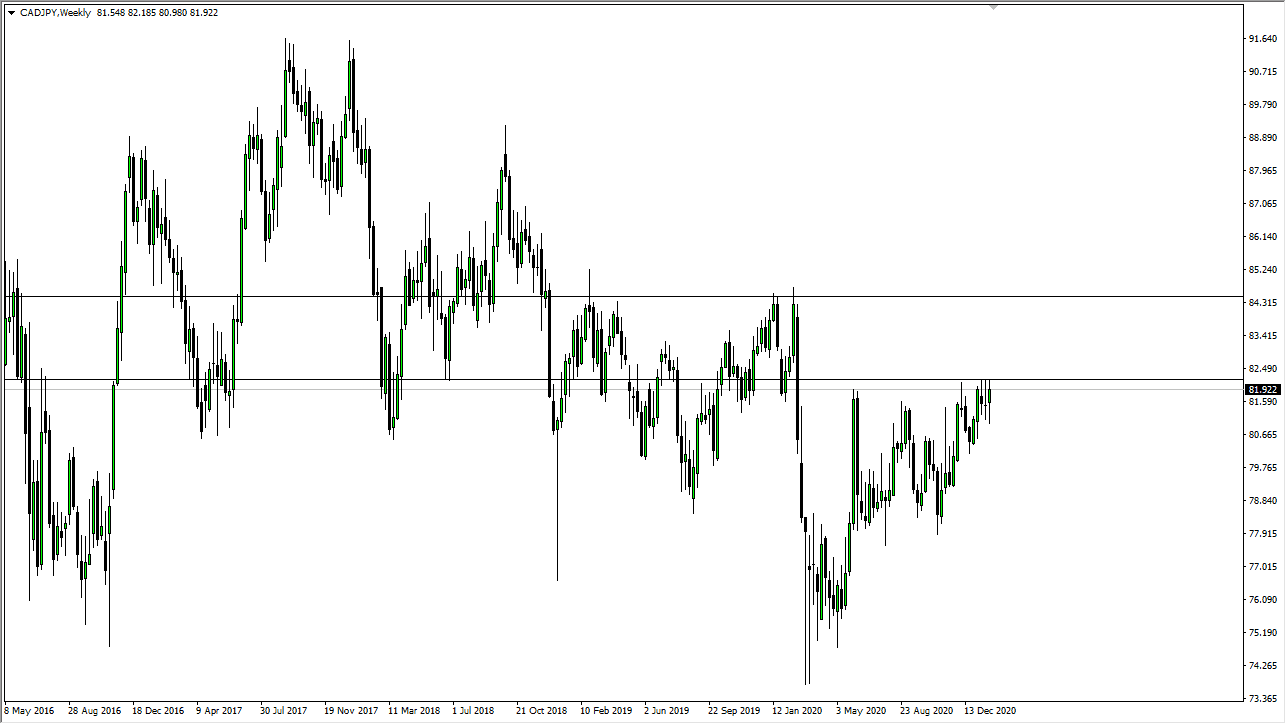

CAD/JPY

The Canadian dollar has continued to show resiliency against the Japanese yen, but has formed a triple top on the weekly chart. If we can break above the 81.25 handle, then it is likely we will go much higher. If we do not, and perhaps even drop down below the lows of the trading week, then we could fall apart and go looking towards the 79 level. This is a very interesting pair to watch, because we are at such a crucial juncture. Pay attention oil as well, as oil is highly influential.

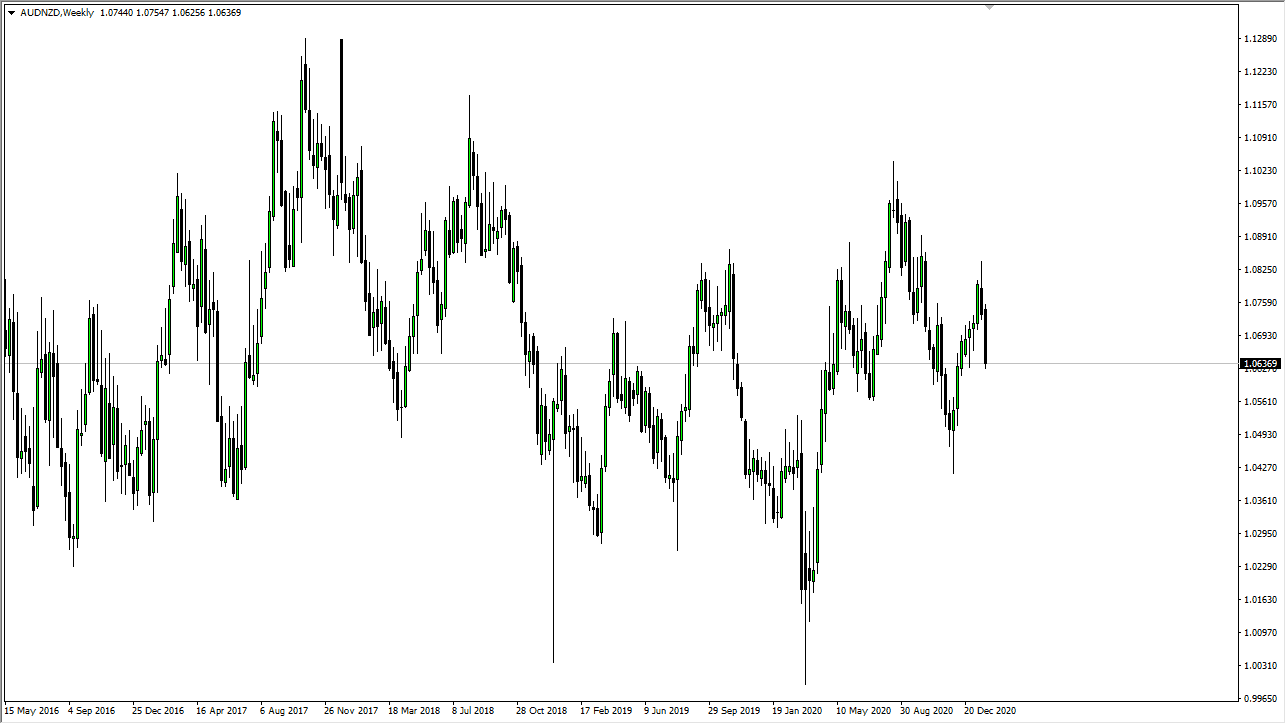

AUD/NZD

The Australian dollar has fallen hard during the course of the week, and it looks as if it will take out support rather quickly. If it does, then it is likely that we will go looking towards the 1.04 level. The interest rate differential between the two bonds are blowing out in favor of New Zealand, so that could continue to put downward pressure here. Nonetheless, the last week’s action certainly makes things look ugly all of a sudden.