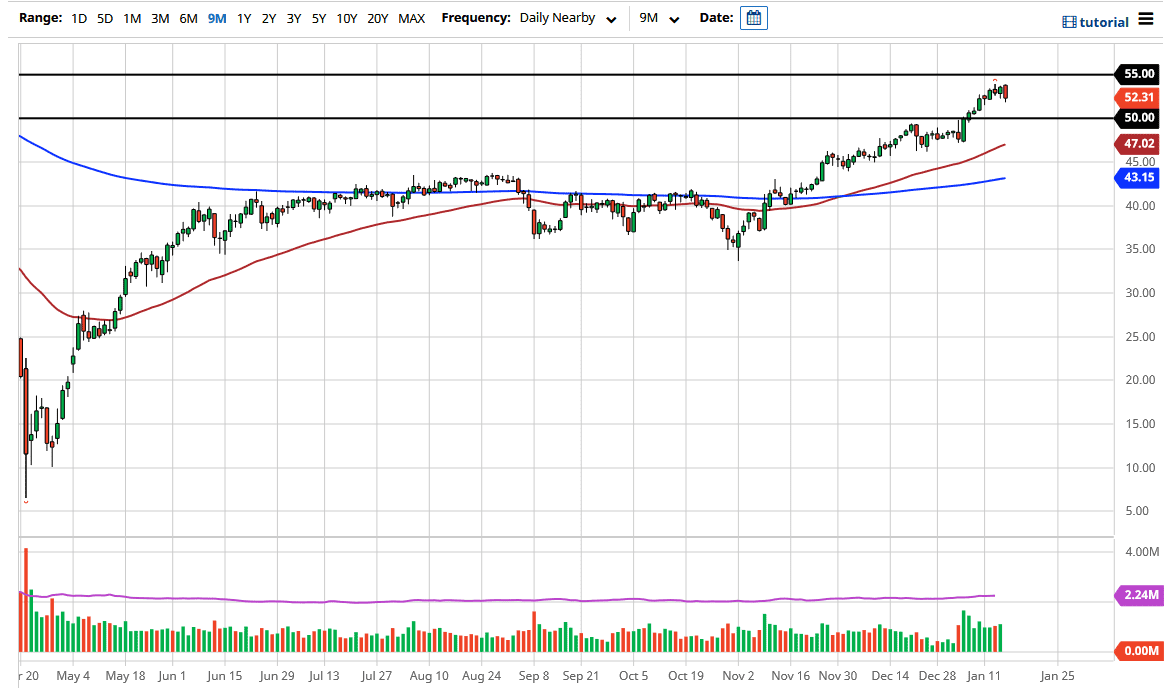

The West Texas Intermediate Crude Oil market has pulled back a bit during the trading session on Friday, but I think this has been needed. After all, the crude oil markets have been rather bullish as of late, and at this point in time I think that they need to at least digest the gains at the very least. After all, the demand for crude oil is a bit suspect at this point in time and we had seen such a rise from the lows. The $55 level above is resistance, and I think it will be difficult to break anytime soon. Furthermore, a lot of this has been driven by the US dollar losing value.

That being said, during the Friday session we had a lot of people worried about the fact that the Biden stimulus plan may not be as large as initially as support, and that of course has the US dollar gaining in strength just a bit. This also has people worried about whether or not there will be increased demand, but really at this point I think it is a bit much to ask for stimulus to lift the markets by themselves, because we have priced in so much between November and now.

One of the biggest things that I take away from the market is the fact that the stimulus in the past has not created more demand over the longer term, and I do not think that it changes anytime soon. After all, the market is going to have to deal with the fact that economies around the world have shut down and quite frankly a lot of those businesses simply are not going to come back. Yes, we may get an increase but to get to the previous levels is a huge stretch. When you look back at the history of pandemics, going back 650 years, the average return to “normalcy” when it comes to economic activity is somewhere in the neighborhood of around 25 years. That does not mean that the next 25 years are going to be miserable, it is just that we do not typically spring right back to where we once were like a lot of traders are assuming. After all, a lot of the small businesses around the world are simply gone.