The West Texas Intermediate Crude Oil market is essentially hovering at this point, roughly in the middle of the larger consolidation range. The oil market has shown itself to be very resilient, perhaps based upon the entire idea of stimulus. Furthermore, the US dollar falling has boosted crude oil Price is right along with other commodities, based upon the idea that it will take more of those greenbacks to buy a barrel of oil. Whether or not that is sustainable is a completely different question, but at this point the US dollar falling should continue to help the oil market. However, if it were to turn around that could be a very ugly turn of events indeed.

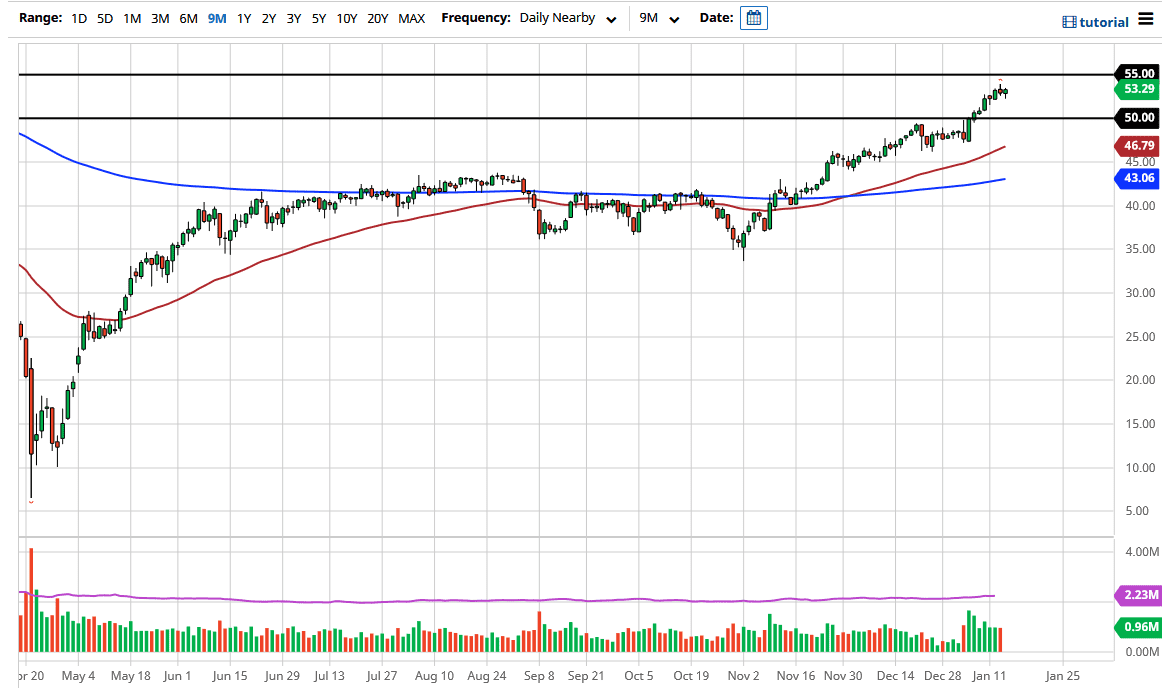

At this point, we have to look at this market as bouncing around between the $50 level on the bottom, and the $55 level on the top. I think overall this is a market that has the most likely attitude of simply going sideways and trying to figure out what to do with itself. The longer-term outlook for oil is somewhat mixed, because depending on you listen to, there may or may not be demand later in the year. In the short term, people are betting on the reflation trade, which of course helps the idea of all commodities going higher, not just this one. The crude oil market will be greatly influenced by the idea of economies opening up, which of course is still a bit of a question due to the fact that we continue to see massive lockdowns around the world. Yes, it is supposed to be short-term and temporary, but at this point in time one still has to wonder whether or not there is enough demand? After all, before the pandemic we had a demand problem to begin with, so one has to wonder whether or not we are suddenly going to see enough demand to wipe out supply. As things stand right now, the Rig Count in the United States is still somewhat benign, so that does help somewhat but at the end of the day if there is not enough economic expansion, it really will not matter because people will be buying oil. In the short term, I think we go sideways in this five dollar range. Ultimately, I believe that if you are patient or not, we should get a clear signal. Right now, it does look like a lot of time killing.