The crude oil markets tried to rally initially during the trading session on Tuesday but gave back the gains as we start to reach towards the FOMC. The Federal Open Market Committee will obviously have a significant influence on what happens with the US dollar, and thus what happens in commodity markets on the whole. Crude oil markets are part of the “reflation trade”, but it does look like maybe we have hit a little bit of a wall of worry.

One thing that you should look at is the fact that the weekly chart has formed a couple of shooting stars. While that does not necessarily guarantee that price is going to pull back, it does guarantee that there are sellers above trying to actively make that happen. We are pressuring an area that was the beginning of the sell-off from the pandemic, and there are longer-term concerns when it comes to oil. The shale production in the United States should start speeding up now that the price is over $50, and beyond that, the longer-term outlook for crude oil is not that great, as green energy becomes more of a mantra for most places.

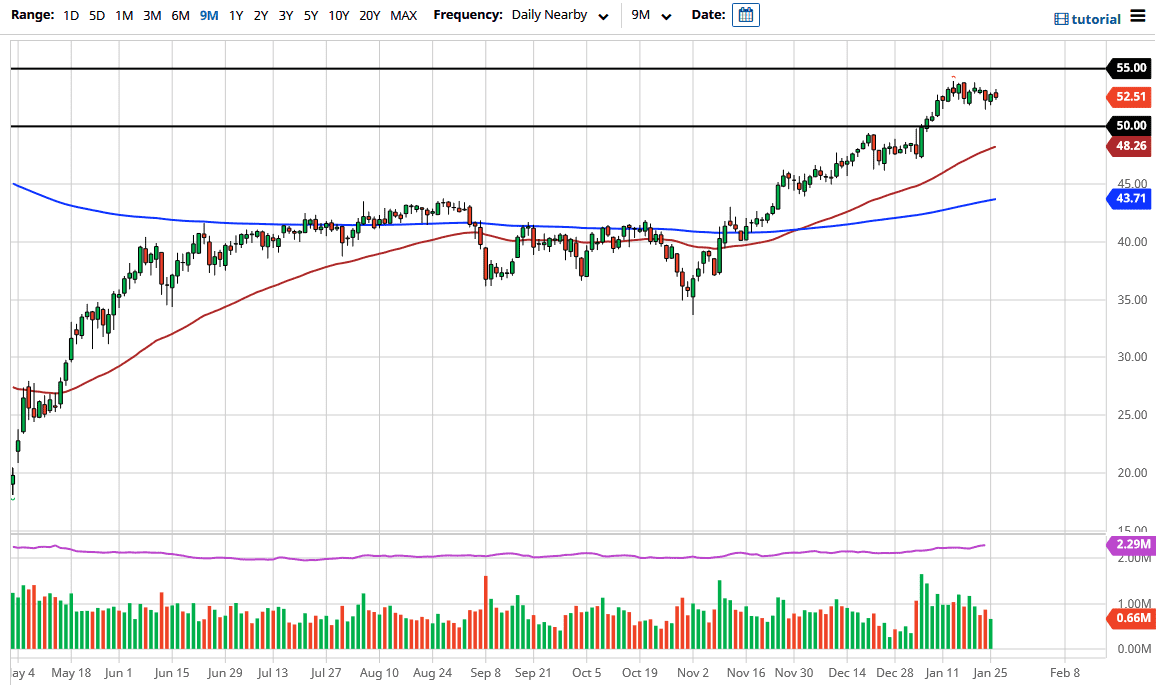

These are things that do not necessarily happen overnight, though. In the short term, we have to look at the technical analysis and the support and resistance levels. Currently, the $50 level underneath is significant support, while the $55 level above is resistance. I think that we are looking at a somewhat range-bound market, but even if you are very bullish of crude oil, you probably want to see some type of pullback in order to feel comfortable with the overall uptrend. In the short term, though, I think we probably bounce around between these two levels with perhaps a pullback being the most likely of outcomes initially. If we can break down below the $50 level, that could make things a bit uglier, but the 50-day EMA sits at the $40.25 level and should come into play as well. Keep in mind that the crude oil market has gotten a bit ahead of itself, so this pullback might be exactly what it needs longer term, regardless of your outlook. One thing is for sure: you should keep your position size relatively minimal.