The West Texas Intermediate crude oil market initially rallied early on Monday to reach towards the $50 level, an area that will attract a lot of attention because it is a large, round, psychologically significant figure. We have since fallen quite a bit, as traders are trying to figure out what happens next. OPEC+ is currently meeting and scheduling to extend talks even further. In that case, the question remains whether or not there will be a continuation of the overall production cuts that we have been witnessing over the last several months. Many of the countries cannot decide exactly what they want to do, with some wanting to release more, while others want to keep the status quo.

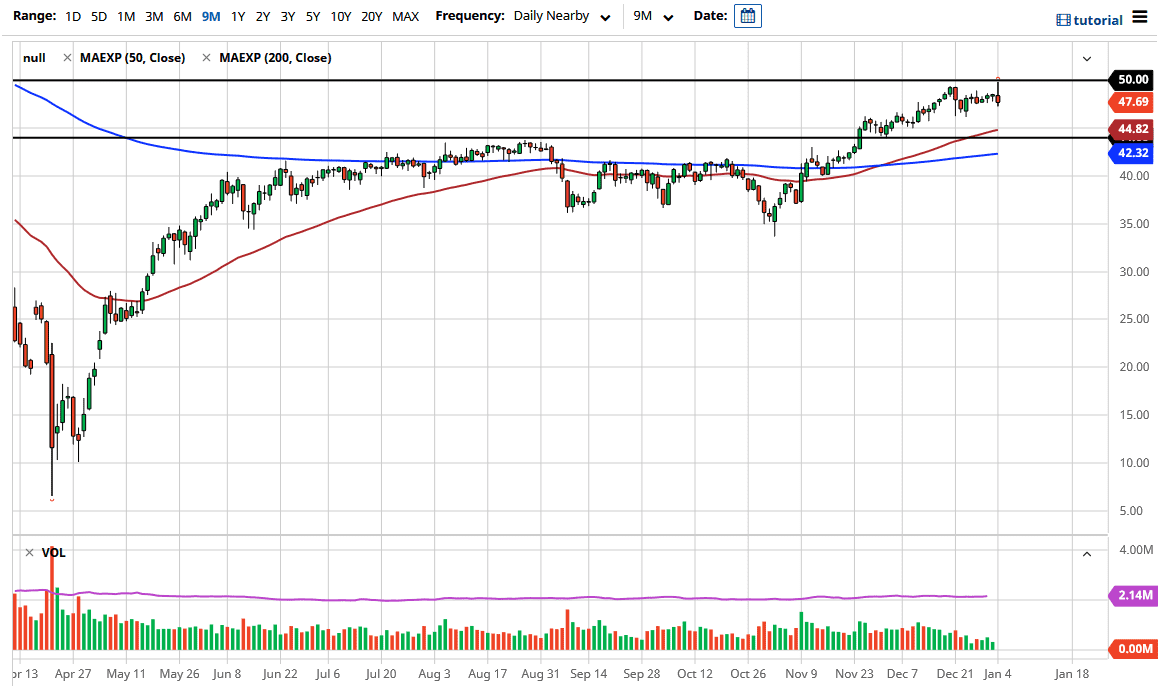

One should also pay attention to the US dollar, because barrels of are priced in the commodity. The currency headwinds are not as strong, but the technical headwinds certainly will be, due to the fact that the $50 level will attract a lot of attention just because of the round figure. To the downside, the 50-day EMA sits just above the $44.80 level, and we have seen structural support at the $44 level. This is essentially a market that is stuck in a range, something that I talked about last week.

Obviously, some big decision coming out of OPEC+ will have massive implications, but it does not look like something big will come out of it. Therefore, we will probably bounce around in this area for the short term, while the trading public gets its feet back firmly on the ground after the holidays. Keep in mind that the jobs number is also on Friday so that can have a bit of influence as well. If we do break above the $50 level, then the next target will be roughly $52.50, where we had seen some technical resistance in the past. Nonetheless, you are probably relegated to trading short-term charts at best, as it seems like the markets cannot make up their mind as to where they want to go for a longer-term trade.