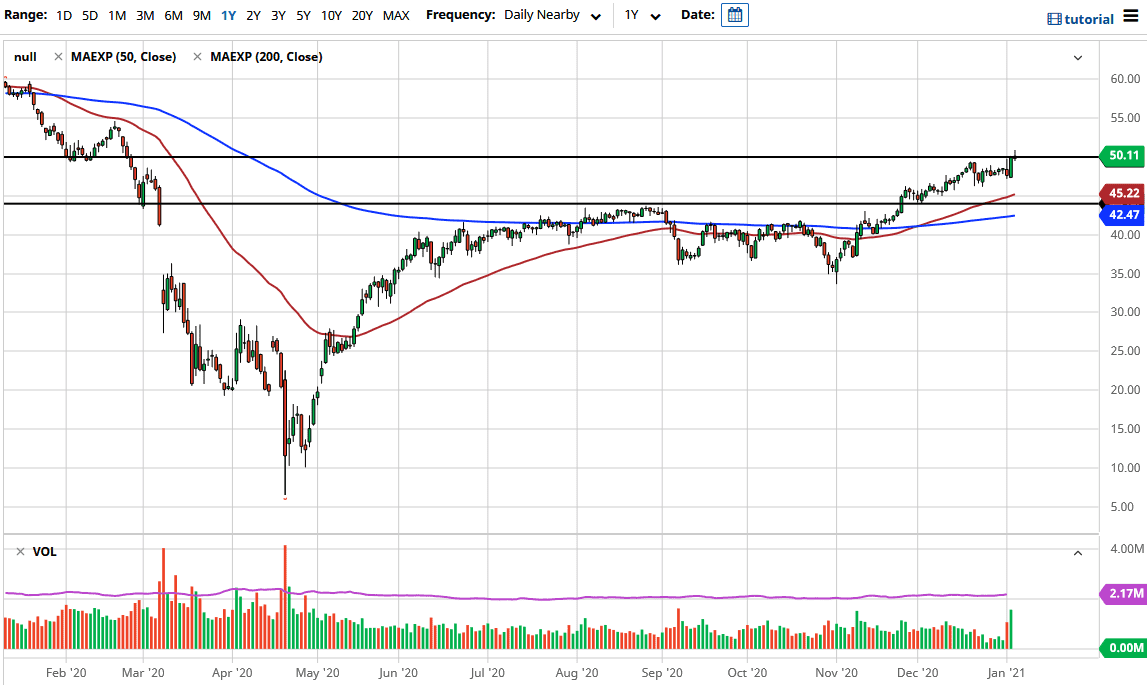

The West Texas Intermediate crude oil market rallied significantly during the trading session on Wednesday, but gave back all the gains to end up forming a shooting star right at the $50 level. As candlesticks go, this is about as ugly as it gets. This market is not necessarily going to be bearish, but it looks like we could pull back right back into the consolidation area that we have been in previously. The bottom of the candlestick from the previous session sits down at the $47.43 level, an area that I think should offer support and potentially a target if we break down below.

On the other hand, if we were to break above the candlestick for the session here on Wednesday, then the market could go looking towards the $52.50 level, possibly even the $55 level after that. This is a market that will hear a lot noise, so there are many opportunities to see problems. It will eventually have to make some type of bigger move, but in the short term, it is likely that we will continue to see volatility pick up. I believe that one of the biggest potential influences from outside of the crude oil market is going to be the US dollar, and how it moves is negatively correlated to what happens with crude oil most of the time.

The idea is that perhaps there would be stimulus coming that could boost demand for crude oil, but overall, I do not think that is likely to happen. The market will probably continue to see a lot of back and forth action, but it is very unlikely that the market will see sustained demand come back into this marketplace. What we see here is a market that is starting to get close to the top, even if it is not completely there yet. I think there is a little bit more work to do, and the market will probably continue to grind sideways overall in order to build up some type of base to make the next move.