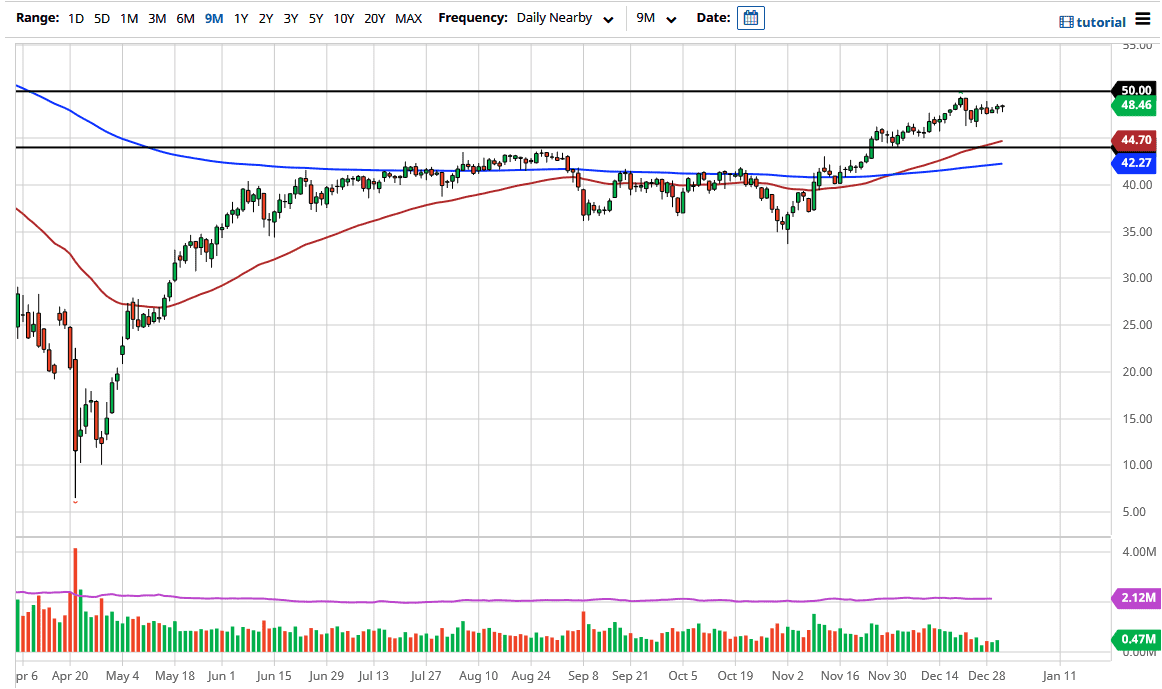

The West Texas Intermediate crude oil market did very little during the trading session on Thursday, which was expected due to thin volume and a short day. We are essentially in the middle of a significant range to which the market continues to pay attention. The $50 level above is resistance, just as the $44 level underneath is support. It is worth noting that the 50-day EMA is starting to break above the $44 level as well, so that could come into play as support.

I do not believe that the market is going to break out of this range in the short term, but if it did, it would almost certainly be to the upside. We have seen a lot of momentum come into this market, as well as a lot of selling when it comes to the US dollar. The US dollar being sold off continues to put upward pressure on commodities overall, and crude oil will not be any different. After all, a barrel of oil is priced in the same US dollars, so it will take more of them to buy one.

I think we will fluctuate in this general vicinity, and what we see here is a market that is more than likely going to be very range-bound until we get a bigger catalyst. If we do break above the $50 level, then we will probably go looking towards the $52.50 level, possibly towards the $55 level. At this point, the market will continue to focus on stimulus more than anything else. Furthermore, you have to keep in mind that the Biden administration will continue to flood the markets with stimulus as well, so that should also work against the value of the US dollar.

One of the biggest problems that we may have is the fact that there simply is not enough demand out there. There were signs of a serious lack of demand before the pandemic, so now that we are still going to see sluggish growth, it is difficult to imagine that suddenly supply will become overwhelmed by buying demand.