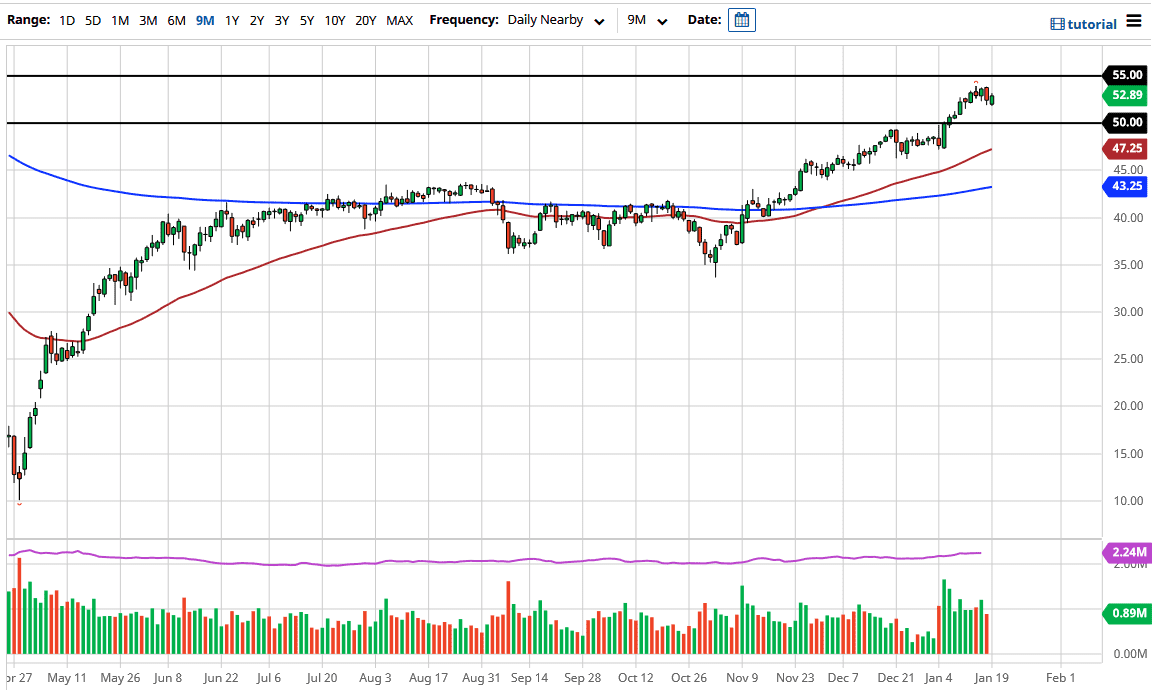

The West Texas Intermediate Crude Oil market initially gapped lower to open the trading session on Tuesday, but then turned around to rally significantly. The market is likely to continue to see a lot of back and forth action, as we are essentially in the middle of a larger consolidation area, which continues to be the way we need to pay attention to the market, in the sense that we need to pay attention to the larger areas. Those “larger areas” include the $50 level underneath, offering massive amount of support. Above, we have the $55 level that offers a significant amount of resistance, so the fact that we are going back and forth around the $53 level tells me that the market is essentially at “fair value.”

Keep in mind that the crude oil market is basically moving on the idea of stimulus and the idea of the market seeing more demand due to that stimulus, which is a nice story. However, the reality is that we have seen three stimulus packages previously that did not bring up demand, and we were losing a lot of demand before the virus hit. Given enough time, the crude oil markets will get absolutely cratered. However, we are not there yet. In the meantime, we are simply bouncing around below the $55 level above and the $50 level underneath, so I look at this as a back-and-forth type of range-bound market that will probably stay in this range for the foreseeable future. The market will continue to be very noisy based upon OPEC and the production cuts, which I think it is a major problem as well.

Look at the US Dollar Index, because it does have a bit of a negative correlation. If we suddenly see a lot of money running into the US dollar, that could work against crude oil. At this point, though, I believe that we are simply willing to go sideways to figure out what to do next more than anything else. If we do break above the $55 level, then I think it offers the possibility of a move towards the $60 level given enough time.