The West Texas Intermediate crude oil market broke higher during the trading session on Tuesday as OPEC+ progresses with its meeting. The net change overall is going to be zero, as Russia and Kazakhstan are going to increase output by a total of 75,000 barrels for the month of February, while Saudi Arabia is willing to cut its production by the same. In other words, it is net zero, and it is likely that we will see plenty of interest in owning crude oil because of this.

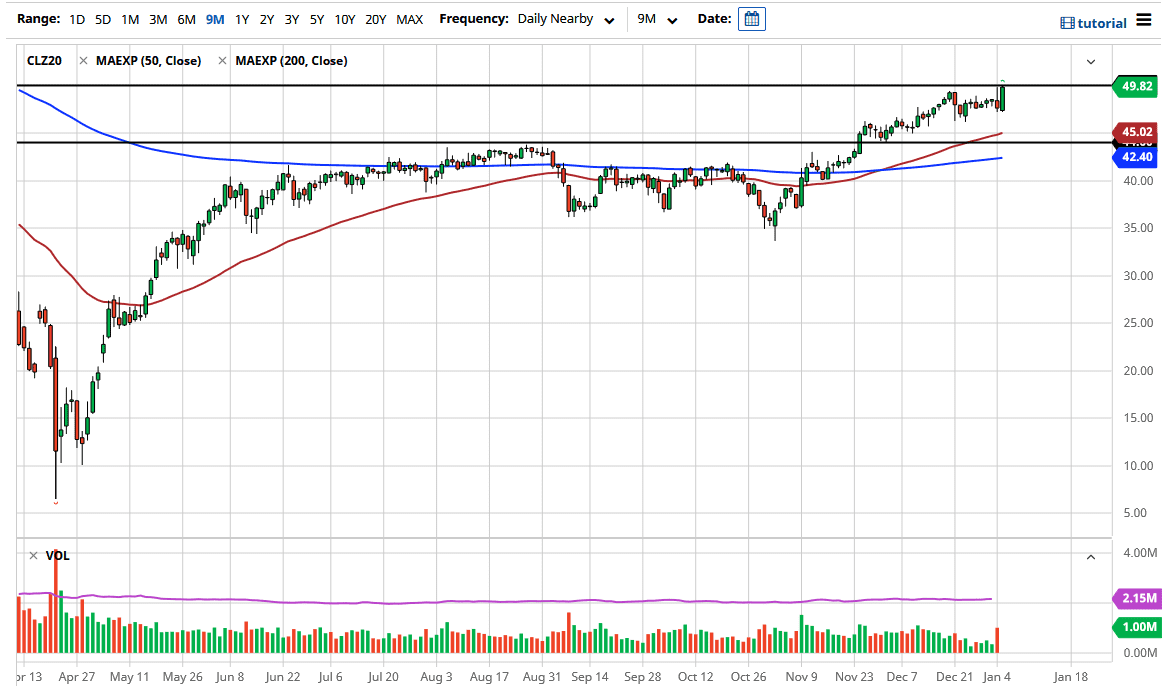

Late in the day on Tuesday, we sliced through the $50 level, after initially trying to break above it on Monday. This is a very bullish sign and could send this market much higher, with the initial target being the $52.50 level. Part of this is also beyond the OPEC meeting, though; it also comes down to the US dollar getting sold off quite drastically, which makes sense, because the price of oil is denominated in those dollars. It is going to take more of those greenbacks in order to buy a barrel.

The 50-day EMA underneath at the $45 level is starting to try to catch up, and it should offer a bit of “dynamic support”, meaning that buyers will probably be looking at this as a potential buying opportunity. This is based upon the idea of continued demand and the reflation trade, and the market is one that remains bullish due to the idea that stimulus will help. However, I have to wonder how much demand there actually will be. After all, the market has shown that demand was weak ahead of the coronavirus outbreak, so to think that there will be more at this point is a bit of a stretch, although that may actually be the truth for the short term. Because of this, I believe that the oil market has only a certain amount of room to run to the upside. I clearly would not be a seller, though, and I would be even more interested in a pullback to pick up bits and pieces of value. This will be especially true if the US dollar continues to fall, due to the fact that the greenback continues to support all commodities, not just this one.