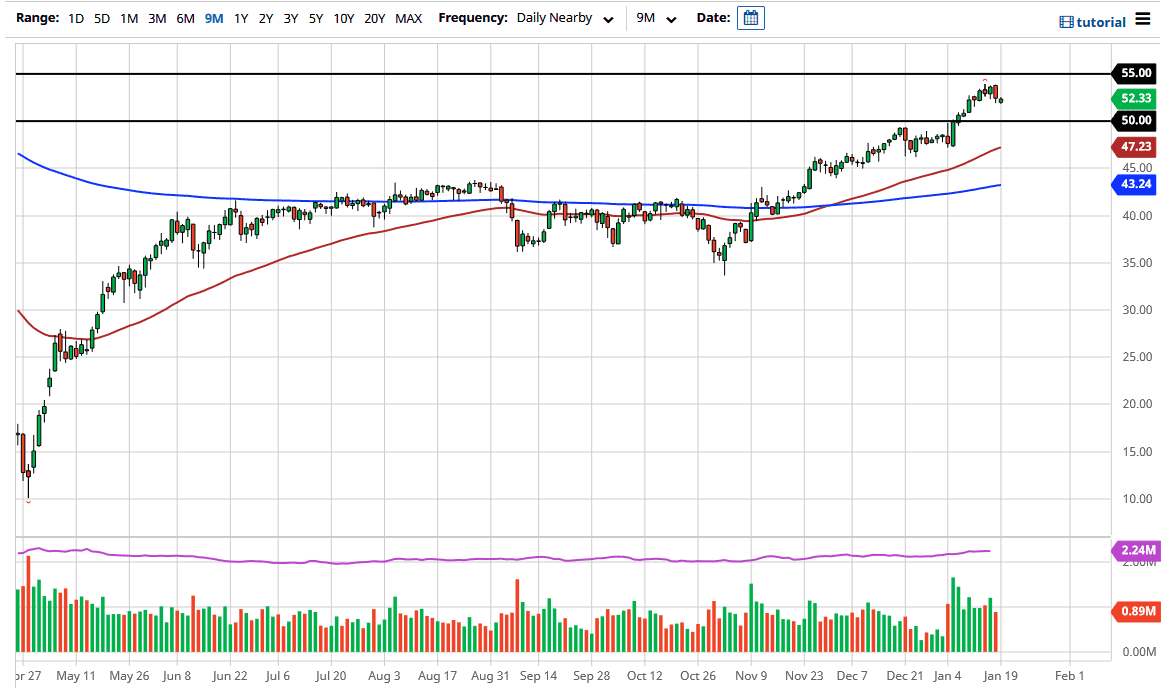

The West Texas Intermediate Crude Oil market gapped a bit lower to kick off the trading week on Monday, but as it was Martin Luther King, Jr. Day in the United States, there was a serious lack of volume. After all, most of the volume comes during the US session, so the electronic session overnight is not typically what large traders monitor. We are in the middle of a major consolidation area, which suggests that it could be “fair value.”

To the downside, the $50 level underneath is massive support, just as the $55 level above is massive resistance. We are right in the middle, so I think there are buyers and sellers in both directions. This is a market that probably needs to pull back just a bit in order to collect itself again, because we have gotten ahead of ourselves at this point, perhaps trying to get excited about the idea of stimulus more than anything else.

The 50-day EMA is at the $47.23 level, from where the most recent push higher has started. This market is trying to find direction, and the idea of stimulus has a lot of people betting on more demand. However, we have seen several stimulus packages in the past that did not bring up demand, so I do not know what is going to change at this point. There is also a big push due to the fact that the vaccine is here, and it should have the market turn towards the idea of normalcy. It is likely that we will continue to see a “buy on the dips” mentality in the short term, but eventually people will start to focus on actual demand. We are not there yet, and the US dollar has a certain amount of influence as well. The idea of a falling US dollar has lifted crude oil because it takes more of those same US dollars to buy a barrel of oil based upon market dynamics.