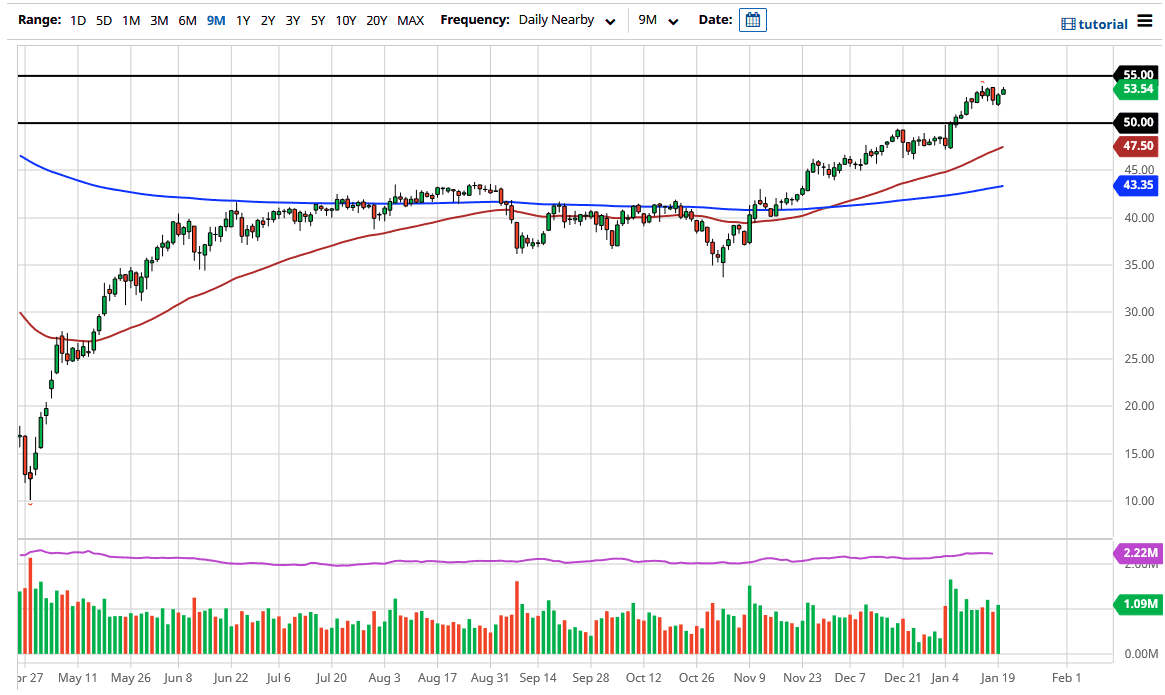

The West Texas Intermediate Crude Oil market initially tried to rally during the trading session on Wednesday but gave back the gains in order to show signs of slowing down. At this point in time, the $55 level should offer a significant amount of resistance, based upon structural movement previously. Furthermore, I think that people are starting to question whether or not there is going to be enough demand to suggest that crude oil market should continue to go higher, and therefore I think that we are looking at a market that is in the process of trying to figure out whether or not it is in a topping pattern.

In the short term, I think it is relatively important to think that the market needs to work off some of the froth to begin with, so it is possible that we simply bounce around between the $55 level and the $50 level underneath. With this, I think that the market will probably be very noisy and sideways in general, but that makes quite a bit of sense as we need to deal with the idea of stimulus either helping or being ineffective. After all, the United States is currently going through the idea of stimulus coming, but the question is not so much as to whether or not it happens, but whether or not it is going to be big enough to move the markets? Joe Biden wanted $1.9 trillion, but at this point it looks very unlikely that he gets that massive number.

One thing to keep in mind is that the demand simply was not there before the pandemic, so at this point it is a bit difficult to imagine that we would suddenly see massive amounts of demand return. The US dollar falling is probably the biggest help for the crude oil market right now, so I would keep in the back of my mind the markets are heavily influenced by stimulus going forward and political talk back and forth will continue to be one of the main factors in driving where we go next. Ultimately, I think this is a market that continues to be choppy, and I would not be surprised at all to see more noisy behavior. With this in mind, I think that we are looking at a scenario that continues to see a lot of back and forth.