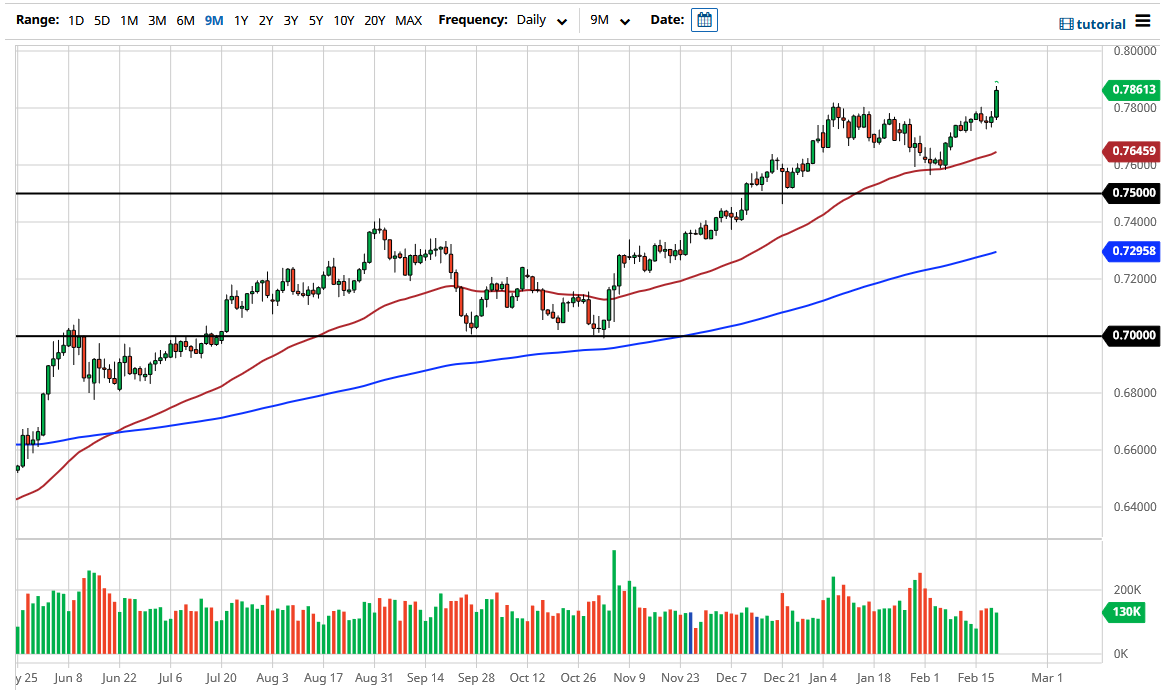

The Australian dollar has been very bullish during the trading session on Friday, breaking above the massive 0.78 resistance level which has been such a problem for some time. At this point, if we see the market pull back, it is likely that the market will continue to go higher, perhaps reaching towards the 0.80 level. The 0.80 level is a major round figure, but the market will probably try to see a certain amount of profit-taking. That being said, the market is likely to see a lot of interest paid to that level, due to the fact that the 0.80 level has been a major pivot point on the monthly charts.

If we do pull back from here, I would anticipate seeing quite a bit of support near the 0.78 handle, and it is probably a bit too bad that we broke out on Friday, because this is a move that could have kept going for a while. Having said that, I think that there will more than likely be people willing to pick up the Aussie today. The idea is that we could see inflation, and that should drive the value of the US dollar lower while the Australian dollar benefits from commodity markets.

We have seen a lot of reports that Chinese demand for iron and copper has started to strengthen again, and that drives the Australian dollar much higher. I do not have any interest in shorting this pair right now, and we just broke out of a bullish flag that could in theory measure for a move to the 0.86 level. But I do believe that the area around 0.80 is going to be very difficult, and will probably take a lot of effort to finally break out of. One thing that is obvious, though: the candlestick is rather impressive-looking on Friday, and I think that it is only a matter of time before traders pile into pick this up yet again. The 50-day EMA underneath is sitting at the 0.7645 handle, and that is where I think there should be a significant amount of buyers waiting to pick up the trend.