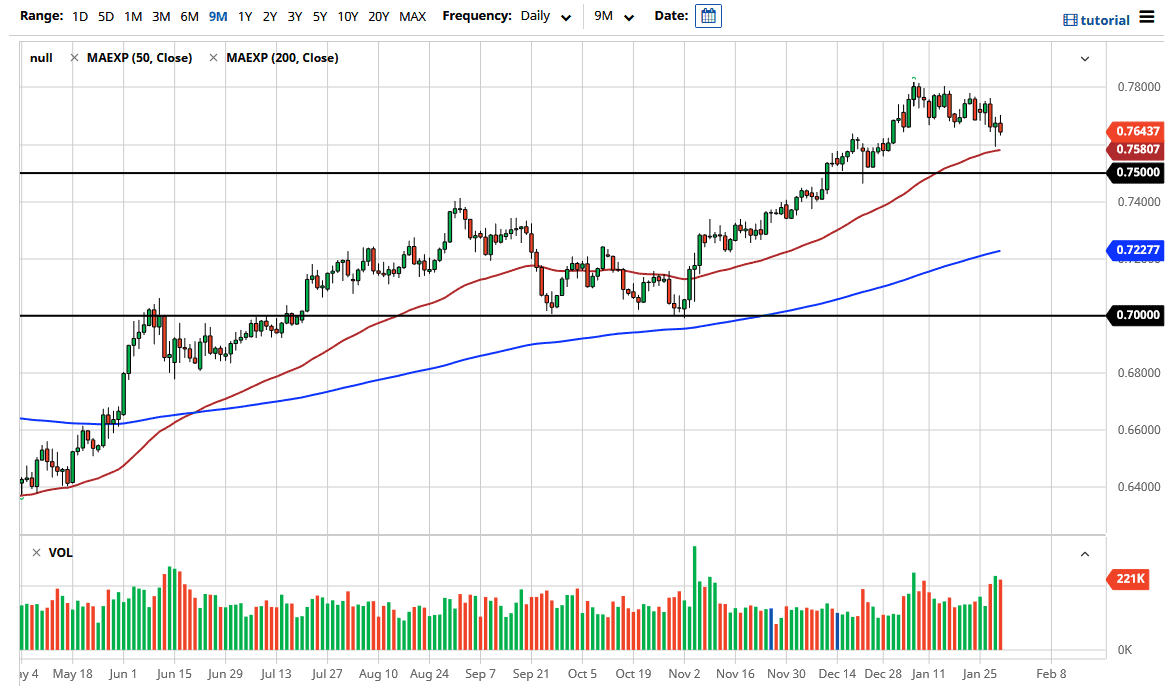

The Australian dollar has been all over the place during the trading session on Friday, in what could be best described as choppy trading. There are a lot of concerns out there when it comes to the idea of global growth and the reflation trade. It is very likely that stimulus is coming sooner rather than later, and that should continue to bode well for the Aussie dollar longer term. This does not necessarily mean that we will take off straight up in the air right away, but I do think that we are probably going to see a bit of a recovery after this dip. I think there is support all the way down to the 0.75 handle, so at some point we should get a bounce that is needed to continue the overall uptrend. This is a market that continues to be very noisy, but that is going to be true about all markets.

The 50-day EMA sits just below, so one would have to think that there is a certain amount of technical support. We are looking at the possibility of more of a grind and base-building going forward, as we continue to see a lot of cross-currents when it comes to the global economy. There is absolutely no certainty out there, and it seems like the chaos is only going to get worse. That will make trading difficult, and the Australian dollar will certainly be a victim of that.

The longer-term trend is still to the upside, and eventually, we will probably go looking towards the 0.80 level. We need to get past the 0.78 level between now and then, though, so keep that in mind. If we can break past the 0.78 level, it would be a significant turnaround and could send this market looking towards the 0.80 level much quicker than originally thought. At this point, you have to favor buying dips, but you need to be very cautious because headlines have caused issues more than once. It is going to be difficult to hang on to this trade if you have too big a position.