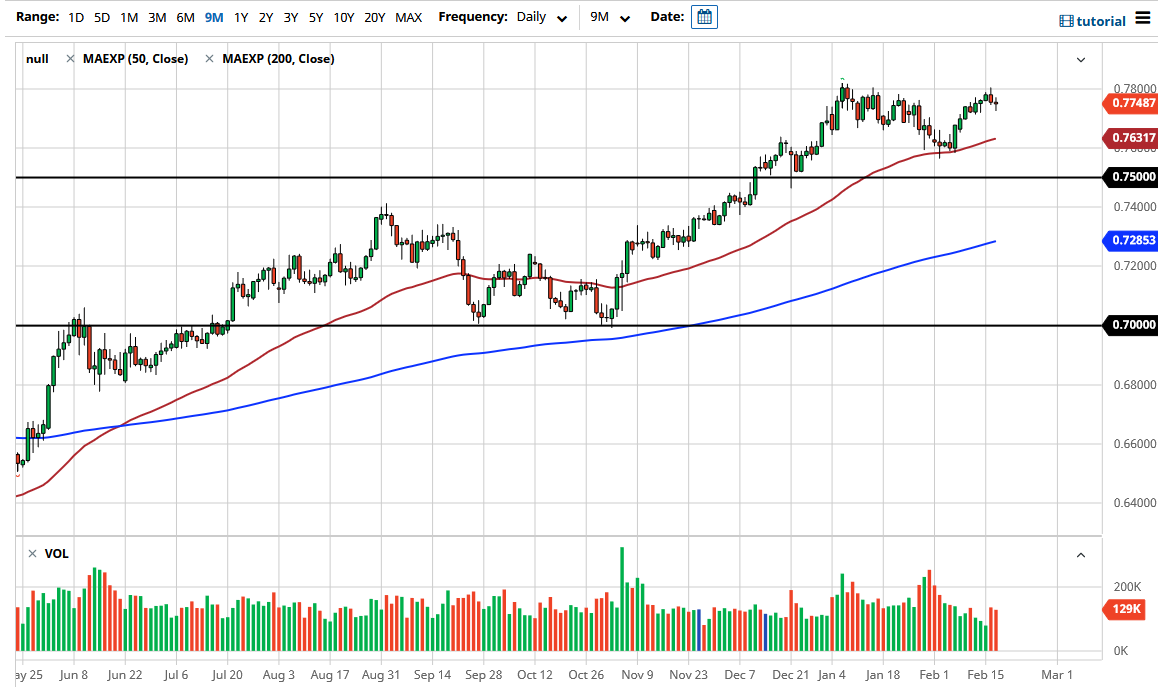

The Australian dollar fluctuated during the trading session on Wednesday as we had failed at the 0.78 level on Tuesday. This is a market that is a bit stretched, so it would not be a huge surprise to see a pullback from that 0.78 handle. The Wednesday candlestick was rather neutral so you can read into it what you want, but the one thing that I think should be obvious is that the 0.78 level has been extraordinarily difficult to break above. If we do, that should allow this market to go higher and to challenge the 0.80 level, which is a major area of importance on longer-term monthly charts.

To the downside, if we were to break down below the bottom of the candlestick, then I think the market will go looking towards the 50-day EMA underneath. It is currently at the 0.7631 level and rising. It is because of this that I think that a lot of people still expect this market to rally, but it is worth noting that we have struggled for quite some time, so the Aussie needs some type of health going forward. The neutral candlestick suggests that there are a lot of questions to ask, but the rising interest rates in the United States continues to make the US dollar somewhat attractive, and therefore it does cause a certain amount of noise.

This is all about stimulus and the idea of more demand for Australian commodities. As a matter of fact, BHP Billiton and Rio Tinto have both shared in their earnings calls that the demand for iron coming out of China has been almost parabolic, and therefore it is likely that there will be demand for the Australian dollar as a result. Because of this, I do think that eventually we could break out to the upside, but stimulus is needed to weaken the US dollar. To the downside, if we were to break down below the 0.75 handle, then I think the Aussie could be in serious trouble. This is a market that will continue to be very noisy, but that breakdown probably needs a severe spike in the interest rates in America to make that a reality.