Bearish case

Place a sell-stop at 0.7591 (Jan 28 low).

Have a take-profit at 0.7500 and a stop loss at 0.7700.

Bullish case

Place a buy stop at 0.7700.

Add a take-profit at 0.7750 (Jan 27 high)

Set a stop-loss at 0.7650.

The AUD/USD is in a tight range today after the relatively mixed economic data from China and Australia. Traders are also waiting for the important Reserve Bank of Australia (RBA) interest rate decision set for tomorrow.

China and Australia PMI

The manufacturing sector in Australia rebounded last month as the country continued its recovery process. According to the Australian Industry Group (AIG), the Manufacturing Index rose from 52.1 in December to 55.3 in January. Further data by Markit showed that that the PMI increased from 55.7 to 57.2.

However, the situation was different in China, the country’s biggest trading partner. Yesterday, data by China Logistics revealed that the Manufacturing PMI dropped from 51.9 in December to 51.3 in January. This was below the estimated 51.6.

The Non-Manufacturing PMI also dropped from 55.7 to 52.4 while the composite fell from 55.1 to 52.8. Today, data by Caixin and Markit revealed that the PMI fell from 53.0 to 51.5 mostly because of the lockdowns imposed in parts of the country. While these numbers are above 50, they signal that the strong momentum of the Chinese economy is fading.

The AUD/USD is also holding steady ahead of the important RBA interest rate decision set for tomorrow. In it, economists expect that the bank will leave interest rate unchanged at 0.10%. It will also likely commit to continue supporting the economy during the recovery.

The AUD/USD is also reacting to the relatively strong commodity prices. The Bloomberg Commodity Index (BCOM) has started the week well, rising by about 0.25%. The best-performing commodities are silver, natural gas, and copper. The Australian dollar is often viewed as a proxy for commodities.

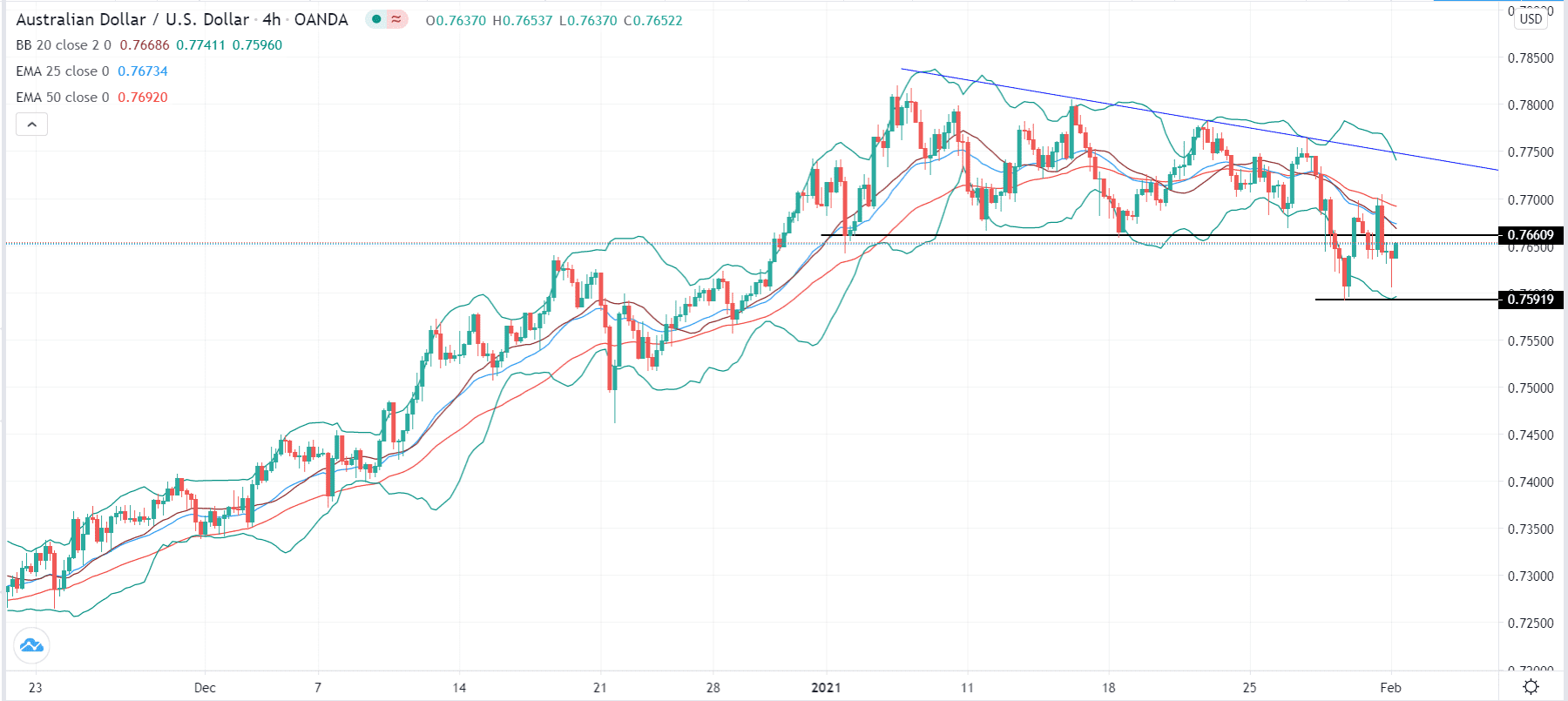

AUD/USD Technical Outlook

The AUD/USD is trading at 0.7650, which is slightly above last Friday’s low of 0.7593. On the four-hour chart, the price is slightly below the descending blue trendline that connects the highest points in January. It also seems to be forming a descending triangle pattern.

The price is also between the middle and lower lines of the Bollinger Bands and is below the 25-day and 50-day EMAs. Therefore, in the near term, I suspect that the pair will break-out lower. This prediction will be confirmed if it manages to move below last week’s low at 0.7591.