Bearish View

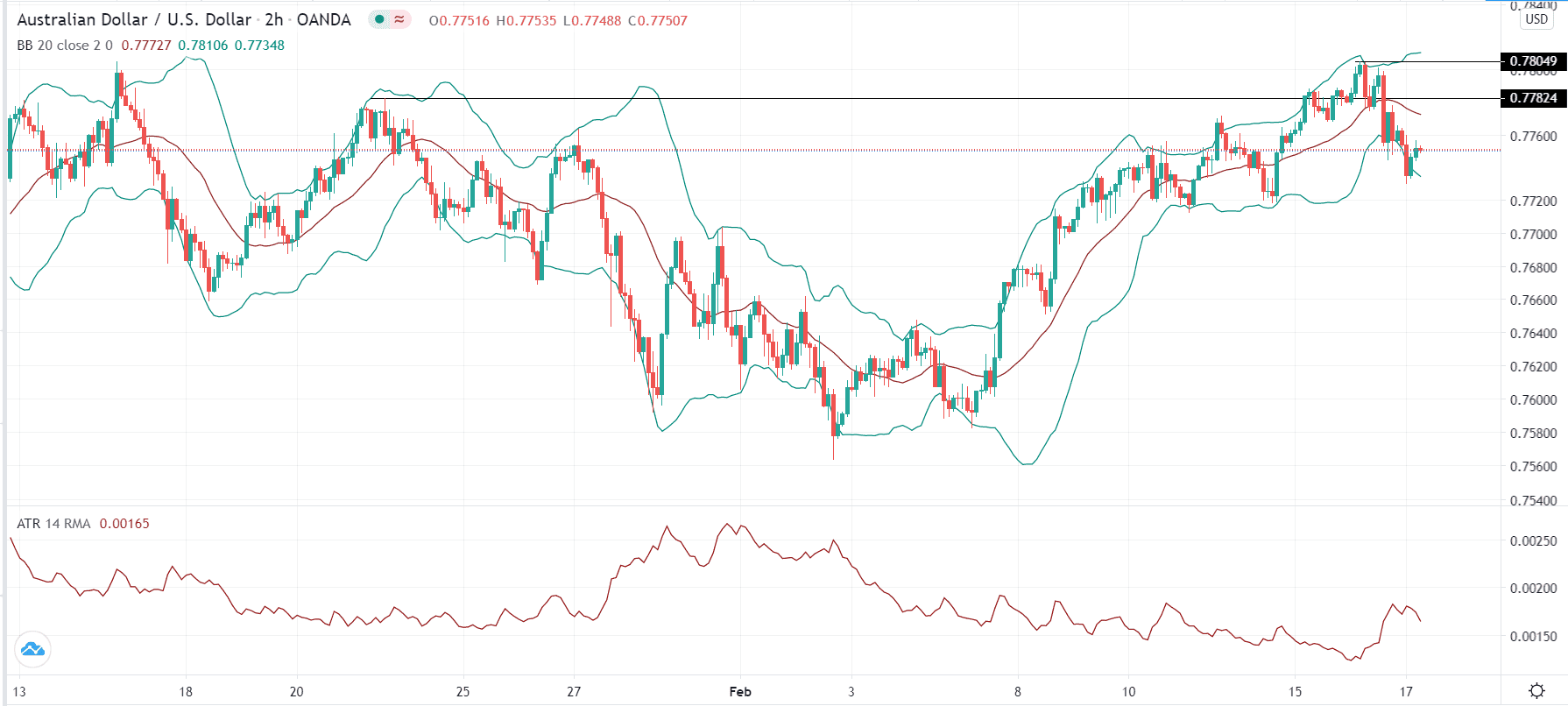

Set a sell-stop at 0.7730 (yesterday’s low) and set a take-profit at 0.7650.

Add a stop-loss at 0.7780 (middle of the Bollinger Bands).

Bullish View

Set a buy stop at 0.7780 and a take-profit at 0.7800.

Add a stop-loss at 0.7700.

The AUD/USD price pulled-back yesterday as the US dollar strength returned. The pair dropped to a low of 0.7730 from the year-to-date high of 0.7805.

Australian Dollar Falls Ahead of Jobs Data

The AUD/USD declined mostly because of a sudden rise of the US dollar. The US Dollar Index rose from $90.10 to an intraday high of $90.75. This happened as the short- and longer-term yields of US treasuries rose in expectation of higher inflation.

Analysts believe that the US Congress will accelerate deliberations of the next $1.9 trillion stimulus package. These funds will go towards households, select companies, and state and local governments. The package will also lead to a substantial US deficit and total debt.

Still, analysts expect that it will spur inflation, pushing the Fed to hike interest rates earlier than expected. After rising by 1.4% in January, some analysts expect the headline inflation will rise to 2.0% by the end of the year.

The AUD/USD pair is falling ahead of the important Australian employment numbers that will come out tomorrow. Economists polled by Reuters expect that the country’s unemployment rate fell from 6.6% in December to 6.5% in January. They also see the participation rate to have remained unchanged at 66.2% as the economy added more than 40,000 jobs.

Before then, the pair will react to the important US retail sales and Producer Price Index (PPI). Economists expect the US retail sales rose by 0.9% in January while the core sales rose by 1.0%. Further, they expect the PPI and core PPI rose by 0.9% and 1.1%. The pair will also be affected by the performance of key commodities like copper and iron ore.

AUD/USD Technical Outlook

The AUD/USD pulled back from yesterday’s high of 0.7805 to a low of 0.7730. On the two-hour chart, the price has moved below the 25-period moving average. It is also between the lower and middle lines of the Bollinger Bands while the Average True Range (ATR) has started rising. In the short-term, the pair may resume the downward trend as bears attempt to move below 0.7700.