Bullish case

Buy the AUD/USD hoping the trend will continue.

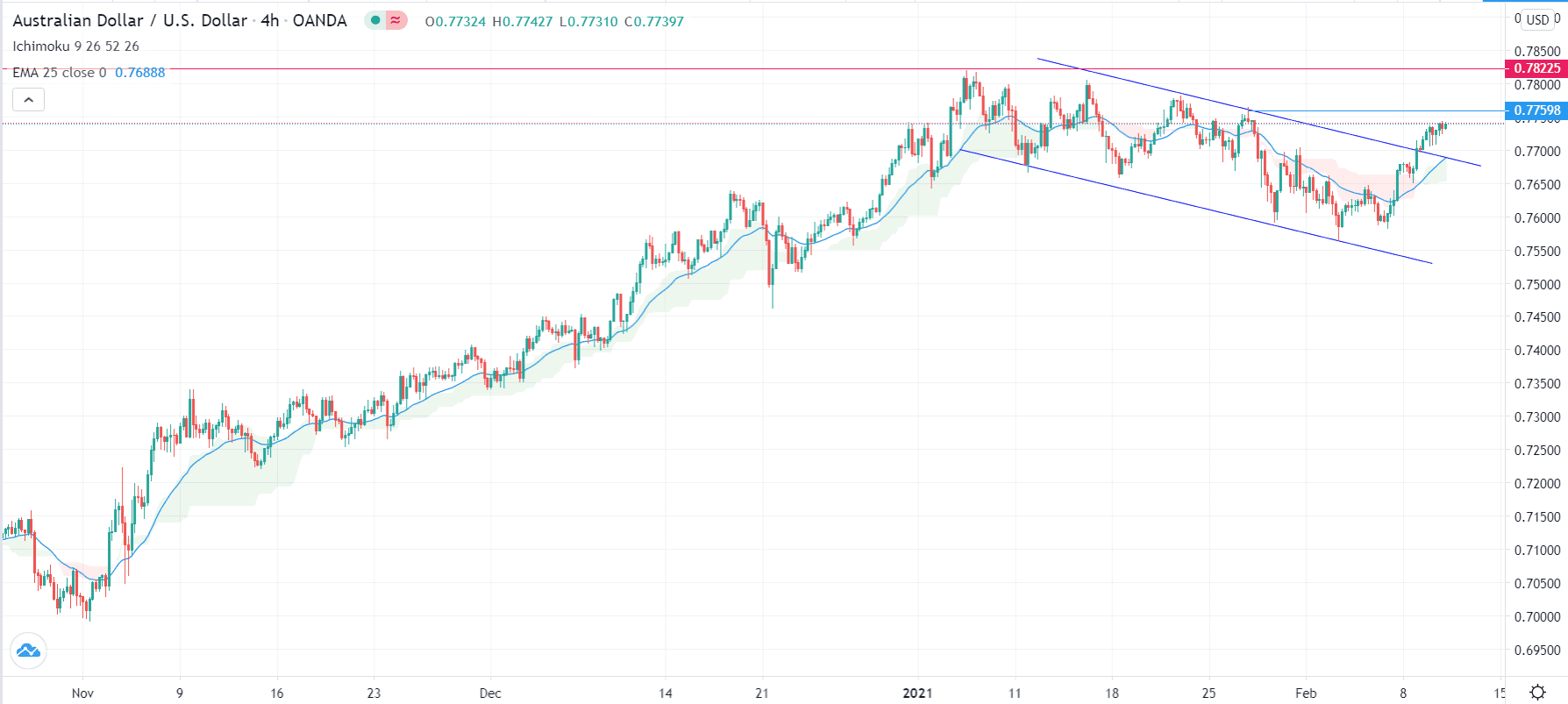

Have a take-profit at 0.7822 (YTD high).

Add a take-profit at 0.7700.

Bearish case

Set a sell-stop at 0.7700 (psychological level and the upper side of the descending channel).

Add a take-profit at 0.7650 and stop-loss at 0.7760.

The AUD/USD has risen to a two-week high, helped by a relatively weaker US dollar and high commodity prices. It is trading at 0.7741, which is 2.35% above last week’s low of 0.7563.

Weak US dollar Helps Aussie

The common theme this week has been about the overall weak US dollar. The US Dollar Index has dropped in the past four consecutive days and is trading at $90.38.

After rallying for several weeks, the US dollar reversed last week when the US released weak jobs numbers. While the unemployment rate fell and wages rose, the country managed to add about 40,000 new jobs in January. This means that the country has a long way to go to recover more than 20 million jobs that were lost last year.

As a result, the government is attempting to provide a $1.9 trillion stimulus package in addition to the $900 billion passed early this year. The impact of this stimulus will be a widening budget deficit and government debt that stands at more than $27 trillion. The trade deficit will also likely widen as Americans use these funds to shop foreign-made goods.

The AUD/USD will react to the US Consumer Price Index (CPI) that will come out in the afternoon today. Economists expect the data to show that the headline inflation rose by 1.5% in January. Earlier today, we received relatively weak inflation numbers from China.

The AUD/USD has also been helped by the overall higher commodity prices. The Bloomberg Commodity Index (BCOM) has risen to a multi-month high of $83.80. Commodities like crude oil, iron ore, and copper have all been on an uptrend. This is an important figure, since the Aussie is often viewed as a proxy for commodity prices.

AUD/USD Technical Outlook

The four-hour chart shows that the AUD/USD price has been in an uptrend in the past few days. And yesterday, the pair managed to move above the previous descending channel shown in blue. It has also moved above the Ichimoku cloud and the 25-day moving averages. Therefore, the pair may continue rising as bulls aim for the year-to-date high of 0.7822. To do this, bulls will need to defend the important psychological level of 0.7800.