Bullish view

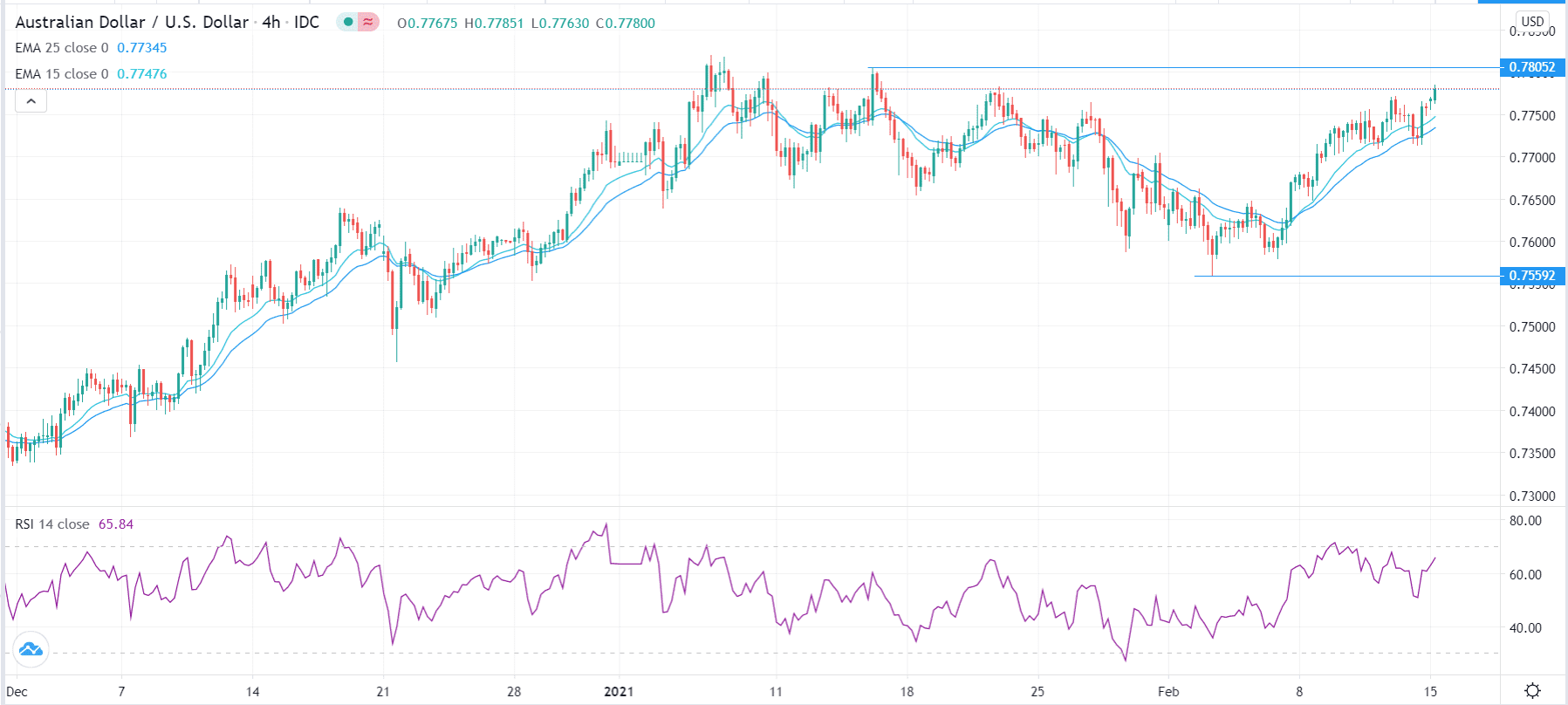

- Buy AUD/USD and set a take-profit at 0.7800.

- Add a stop-loss at 0.7715 (Friday’s low).

Bearish view

- Set a sell-limit order at 0.7800 and a take-profit at 0.7715.

- Add a stop-loss at 0.7840.

The AUD/USD price rose in early trading helped by the Chinese lunar new year celebrations, weak US dollar, and the expected surge in Australian house prices. The pair rose to 0.7783, which is the highest it has been since January 14.

Weak US Dollar, High Commodity Prices Push the Aussie

The AUD/USD is rising mostly because of the overall weak US dollar. The US Dollar Index has declined by more than 0.15% today as investors worry about the rising US debt. The currency has also fallen by 0.20% against the Canadian dollar, 0.18% against the Swedish krona, and 0.40% against the British pound.

In a statement during the weekend, the non-partisan Congressional Budget Office (CBO) said that the total US debt will rise above the US GDP even before Congress passes the new $1.9 trillion stimulus package. The trend will continue rising as the new administration increases the total US deficit to fund infrastructure.

Meanwhile, the talk of US stimulus has led to relatively high commodity prices. The price of copper has jumped by 0.70% while crude oil has jumped by more than 1.50%. Similarly, iron ore, platinum and palladium prices have also risen by more than 0.50%. This is important because the AUD/USD pair is often seen as a proxy for global commodity prices.

The AUD/USD is also rising because of the Chinese lunar new year celebrations. Historically, these celebrations tend to lead to more demand for Australian goods.

At the same time, analysts believe that housing prices in Australia will increase sharply in the near term. According to the Commonwealth Bank, house prices will rise by as much as 16% in the next 2 years, helped by low-interest rates and high demand from international buyers.

AUD/USD Technical Outlook

The AUD/USD price started bouncing back on February 2 when it dropped to 0.7560. On the four-hour chart, the price has moved above the 25-day and 15-day moving averages while the Relative Strength Index (RSI) is also rising. The pair seems to be forming a cup and handle pattern whose upper part is at 0.7800. Therefore, the pair may continue rising as bulls target this level.