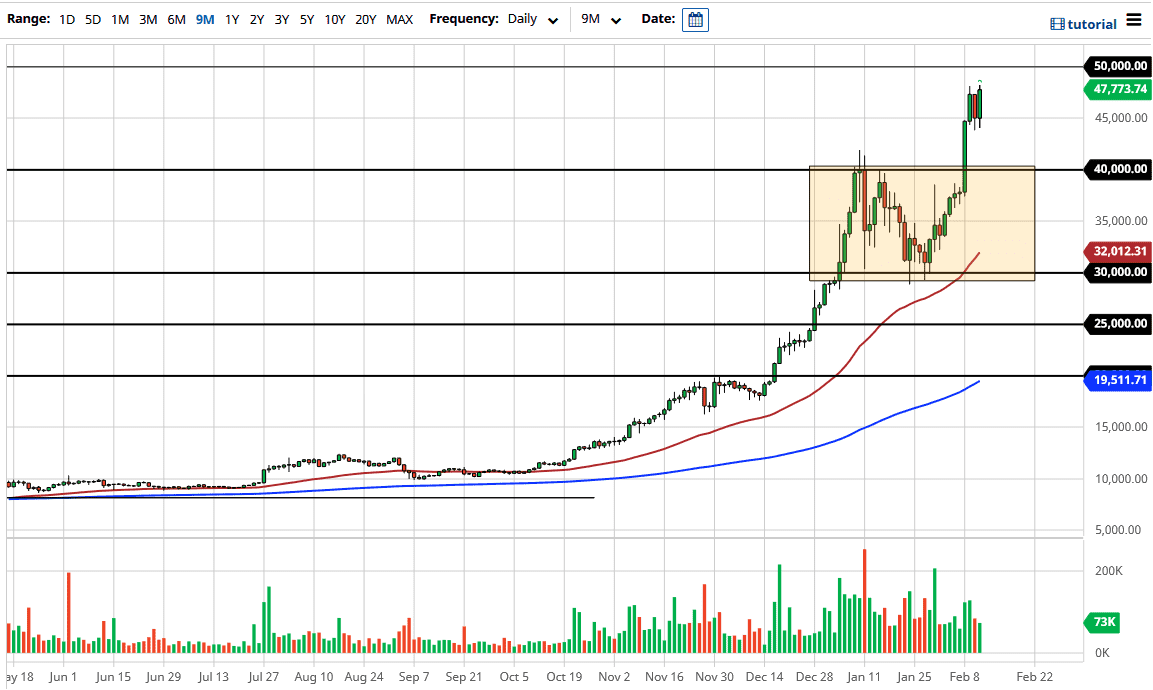

The Bitcoin market rallied during the trading session again on Thursday after initially dropping a bit. The $45,000 level continues offer short-term support, and it certainly looks as if we are going to make a move towards the psychologically important $50,000 level above. That being the case, I think that what we see here is the possibility of an attempt to reach the $50,000 level immediately. I would prefer to see some type of pullback in order to offer value for traders looking to own Bitcoin, but at the end of the day we may not get that opportunity. In fact, I believe that the best trade would be to see a market pulling back towards the $40 level underneath which of course is a large, round, psychologically significant figure, and an area where we had broken out of previously.

We are obviously in a very bullish run, so it makes sense that we would see buyers coming back in to take advantage of a longer-term uptrend, but I would prefer to see an attempt to find lower pricing in order to get involved. The $40,000 level was an area where we had seen a huge push back, so I think ultimately this is likely to see a lot of support, assuming that we can even get that type of move.

On the other hand, if we were to break above the $50,000 level, it is likely that we could go looking towards another “buy-and-hold” frenzy, which Bitcoin seems to be prone to. All things been equal, there is no way to short this market anytime soon, it is simply far too strong. Looking at the chart, I think that it would take something rather drastic to start selling, perhaps a move below the $30,000 level, something that we are nowhere near right now. That being said, we will watch for signs of exhaustion and/or fundamental news that changes, but right now it is clearly a very bullish market and I think that is going to continue to be the case for the foreseeable future. With all of that being the case, I do like the idea of finding value when it shows itself, but right now it seems like the market is trying desperately to break above or at least to that $50,000 level so value is hard to find.