Bitcoin has broken out during the trading session on Monday, clearing the $40,000 level rather quickly. This was based on the fact that Tesla bought $1.5 billion worth of Bitcoin, but perhaps more importantly, Tesla will begin accepting Bitcoin as payment. While this is a sign that Bitcoin may be accepted more widely, it is somewhat of a no-brainer in the sense that only a handful of people will be using Bitcoin to buy a Tesla, and with the volatility that Bitcoin presents, it is difficult for me to imagine that a lot of people will be willing to use Bitcoin to buy a Tesla if that same asset could be worth 40% more rather quickly. On the other hand, it could fall 40%, and then Tesla would be left holding the bag.

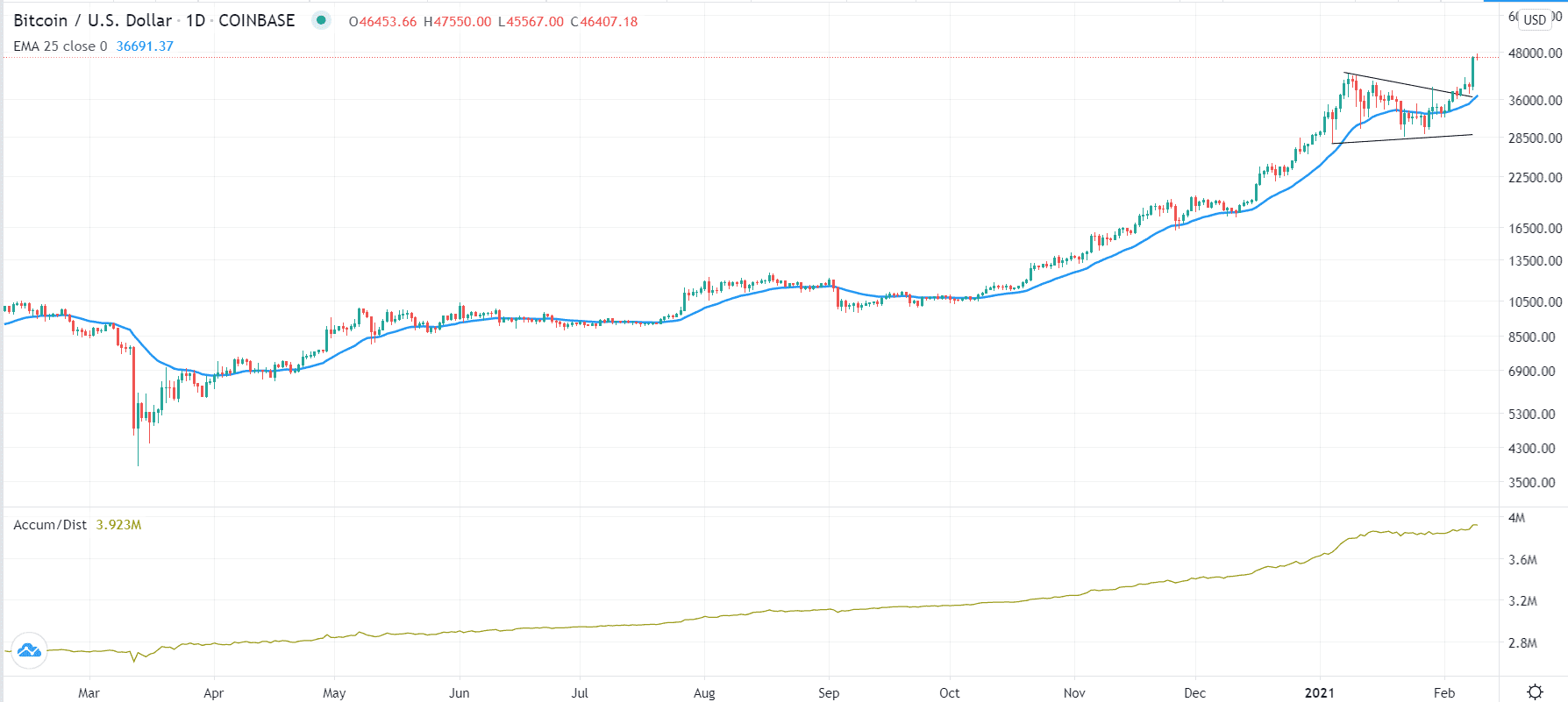

The size of the candlestick does suggest that we are going higher regardless, and that is all that matters. We tried to reach towards the $45,000 level but we have pulled back just a little bit. Now that we have pulled back a bit during the $45,000 level, then it is likely that we could retest the $40,000 level again. Nonetheless, the market is likely to not only look at the $40,000 level as important, but the 50-day EMA is just above the $30,000 level suggesting that we could see a lot of support in that area, perhaps offering a “floor in the market.”

I think that you will have to be a buyer of dips in this market, and now it appears that the most recent move was not so much a descending channel, but more of a bullish flag. If that is going to be the case, then the target going forward would be $60,000. In general, this is a market that I think continues to see plenty of volatility, but we should see plenty of buying opportunities going forward. We obviously cannot sell this market, so at this point you have to look for some type of value going forward. Do not get me wrong; I think that we will get the occasional significant pullback, but clearly, we are nowhere near that right now. The US dollar strengthening and weakening seems to have stopped being a huge factor in this market.