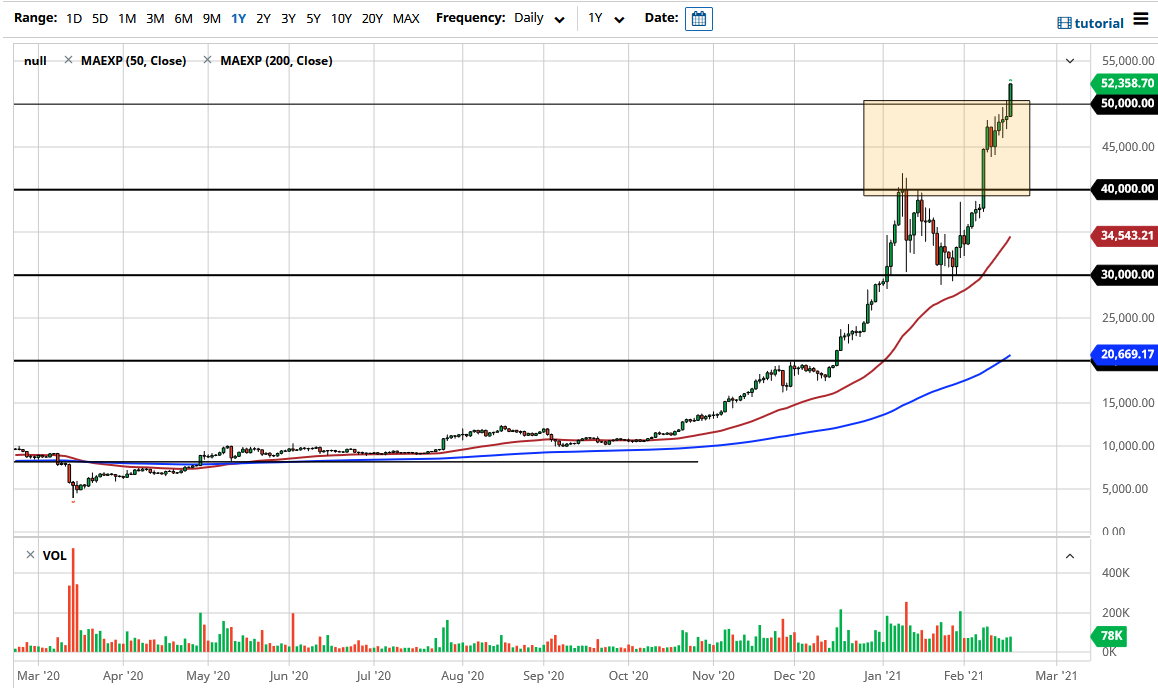

The Bitcoin market rallied significantly during the trading session on Wednesday as we have now sliced through the $50,000 level handily. While this is a market that has been overextended for quite some time, the reality is that people are getting in at any price. This is the very definition of a bubble that is about to pop, but the biggest catch with a bubble is that you never really know how long it runs.

The bubble popping is essentially what longer-term traders will be hoping for because it gives them an opportunity to buy Bitcoin at lower price. I am seeing so many parallels to the last time that we did this it is not even funny, but I do think that there will be a pullback that people will be looking towards. The fact that we closed that the very top of the candlestick suggests that we have further to go, and that there will be plenty of momentum to push this market higher. I think short-term pullbacks down to the $50,000 level should give you an opportunity to get in, as the market is almost certainly going to go looking towards the $60,000 level based upon the technical analysis at least.

Bitcoin is far overvalued at this point, and a lot of what we are seeing is “FOMO”, as companies announce that they are buying bits and pieces of a supply. However, keep in mind that even $1.5 billion from Tesla is a very small bit of the value of the company. Nonetheless, I do not have any interest in shorting this market, because you would have lost several times in a row. This is a market that will eventually run out of momentum, and as we have gotten so parabolic, the pullback could be rather drastic. Nonetheless, be cautious about your position size, and look at pullbacks as opportunities, because this type of volatility can cause massive headaches. The $45,000 level underneath should also be supported if we do break down below the $50,000.