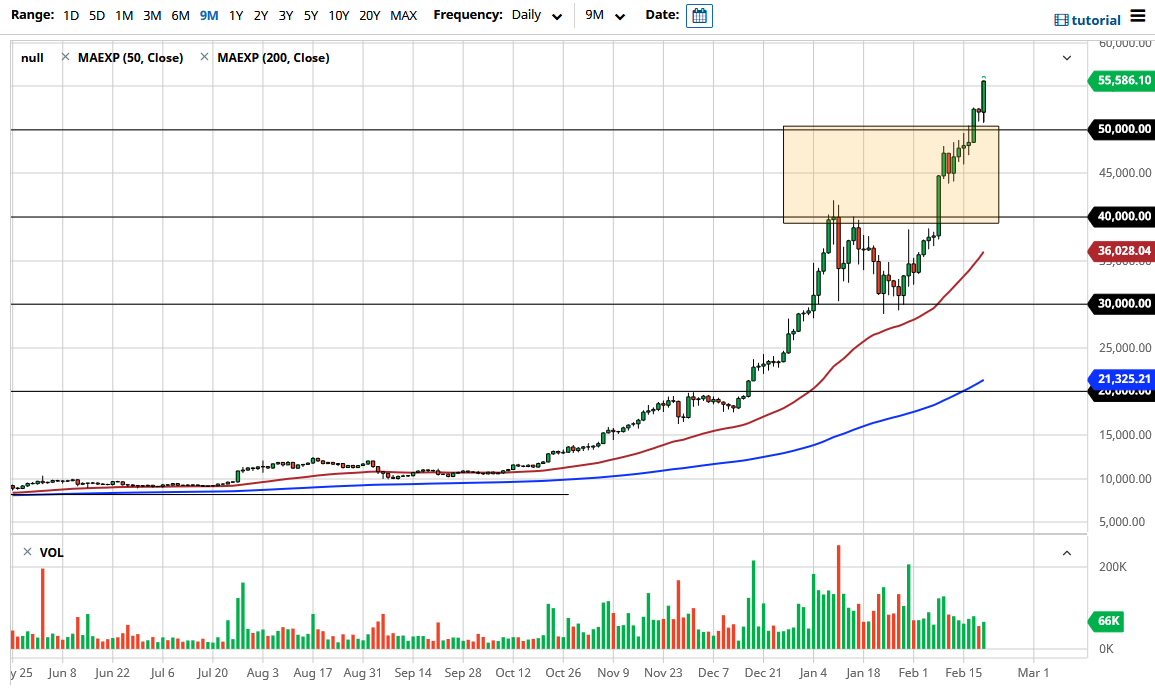

The Bitcoin market initially pulled back a bit during the trading session only to turn around and show further buying pressure. It appears that we are starting to get into another parabolic run again, which is great if you are already involved in the market, but if you are not, it becomes a very difficult and dangerous thing to do. The size of the candlestick also suggests that it is going to be difficult to get a pullback in order to make it a palatable trade. With this type of move it is going to correct eventually, but how far will it correct?

The $50,000 level underneath is a large, round, psychologically significant figure, and was tested for just a bit in order to turn things around. The market breaking above the $55,000 level is yet another milestone, and when you look at the previous consolidation area, we should have a move to the $60,000 level coming. At this point, the question is not so much whether or not this is a bullish market, or should you be a buyer of it; but ue That is the risk you are going to take, so you have to be thinking more along the lines of a longer-term “buy-and-hold” situation and be aware that Bitcoin may drop $20,000 suddenly. After all, when you have this type of parabolic move, the pullback is normally quite violent.

Currently, Bitcoin is being used as a way to get away from what is seen as potential massive inflation, but at this point inflation is still possibly not as big as people think. It is a different type of inflation than a lot of people are thinking. We could be looking at “stagflation”, and in the longer macroeconomic sense of things, we have no idea what Bitcoin will do in that scenario, because we have not seen true “stagflation” since the 70s. Obviously, we have no track record comparative, but I think at this point the one thing that you should see here is that you cannot short this market.