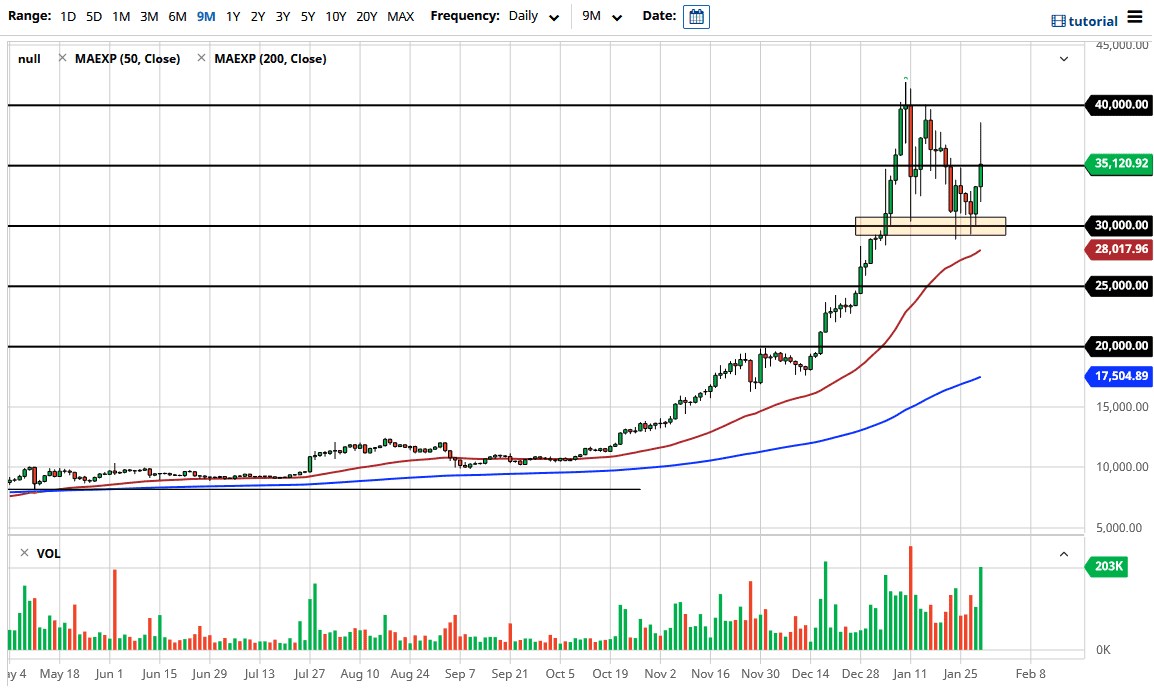

Bitcoin has been all over the place during the trading session on Friday as the markets have gotten far ahead of themselves. You can see that we sliced through the $35,000 level to reach towards the $39,000 level before selling off again. All I can say is that the shape of the candlestick does very little to inspire confidence, especially considering just how volatile the markets in general have been recently. Part of this is due to volatility picking up on Wall Street with the options game going on, and at the end of the day we have several people that have gotten into this market only to turn around and lose $3000 almost immediately. This is a very difficult market to be involved in right now, unless you are thinking more long term.

I know there are people out there who think Bitcoin is going to $1 million a coin, and that is entirely possible. If you are of that thought process, then the $3000 from the high of the day is not a big deal in the big scheme of things. However, most retail traders are playing with “scared money" and levered money. In the United States, you cannot really get much in the way of leverage, but there are other countries around the world where you can get astronomical amounts of leverage in the CFD market. I have no idea what market you are trading, but at first glance, this chart looks like one that is probably going to end up going back down to the $30,000 level.

If we were to break through the top of this wicked candlestick, that would be an extraordinarily bullish sign and could send this market to finally reach above the $40,000 level. If we were to break down below the $29,000 level, then I think we could see a bit more of a correction which might lend itself to longer-term value hunters coming back into the market to take advantage of it. That is my thesis in general, but I think it will be nauseatingly volatile between now and then.