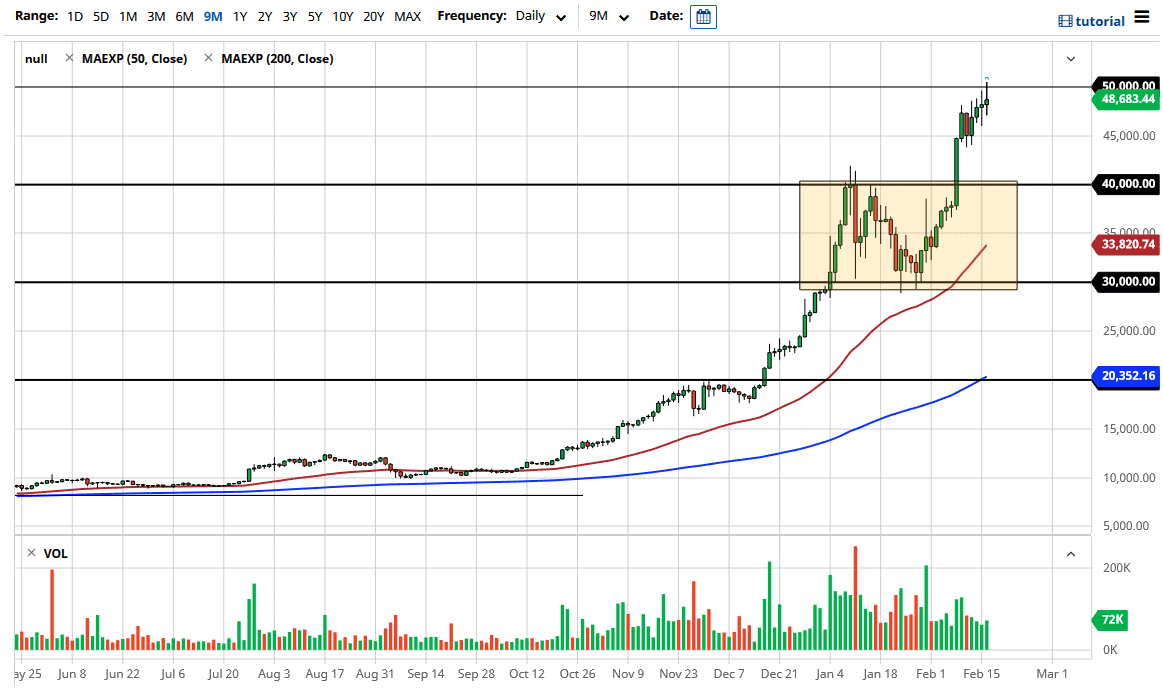

Bitcoin markets have been all over the place during the trading session on Tuesday as we can continue to see quite a bit of volatility in the market. The $50,000 level above is a large, round, psychologically significant figure, so the fact that we reached above it was a headline grabber. However, the candlestick looks as if it is a bit of exhaustion just waiting to happen, so I think we may get a short-term pullback.

The market could pull back closer to the $45,000 level where we should see a significant amount of support. We could also go down to the $40,000 level, and although it sounds like it might be a bit difficult, the reality is that it would simply be a pullback in what has been a very strong uptrend. At this point, if we break above the top of the candlestick during the trading session on Tuesday, then it will open up another leg higher. In normal markets, I would be very concerned about that, but Bitcoin does tend to be very erratic and impulsive at times. Nonetheless, it would be much healthier if we could pull back a bit, given that enough value coming back into the market could attract even more buyers.

Whatever happens, I do not see a scenario in which you should be selling Bitcoin anytime soon, as it has been so bullish. However, you should not necessarily just jump in whenever. Like anything else, you want to buy it when it becomes “cheap.” In other words, you want to look for pullbacks and take advantage of them when they occur. The fact that the candlestick on both Monday and Tuesday were relatively benign tells me that there is still a lot of work to do if we are going to try to break out to the upside. I do think that Bitcoin will break out above the $50,000 but I also believe that we are getting overstretched at the moment, so this is an opportunity to look for cheaper pricing. In general, I suspect that once we break above the $50,000 level, the market will go looking towards the $60,000 level next, as it is a large figure that a lot of people will pay close attention to.