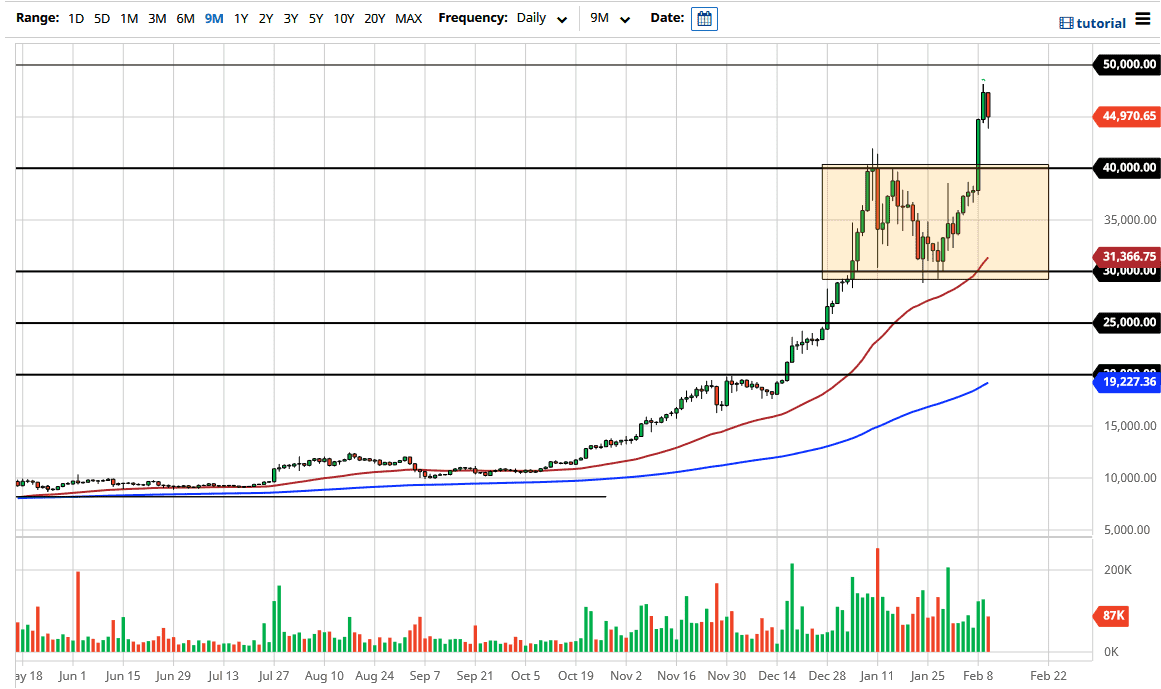

Bitcoin markets pulled back a bit during the trading session on Wednesday as the market clearly had gotten ahead of itself. The $45,000 level has offered little bit of support in the short term. I think that given enough time, we will probably drift closer to the $40,000 level in order to turn around and find a significant amount of buying pressure again. After all, we have just seen this move play out between $30,000 and $40,000 just below, so I think we are going to see a bit of a return to that.

This market will continue to see a lot of volatility and a lot of “FOMO.” It is only a matter of time before we find value hunters looking to get involved in order to try to reach towards the $50,000 level above. That is a large, round, psychologically significant figure that a lot of people will pay attention to. It will cause a lot of headlines in the financial media, so one would think that there would be a significant amount of profit-taking.

When you look at this chart, you can see clearly that we are in an extraordinarily strong uptrend, so there is no way to short this market. I believe at this point you are looking for pullbacks as potential value. I would be a bit surprised to see a simple slice through the $50,000 level, especially due to the fact that we have gone parabolic yet again. These parabolic moves make the market less stable and secure, so it takes a lot less to get people to panic and run for the exits all at the same time. I do not think that is going to happen, rather I think it is probably going to look like the last time we went parabolic and then drifted lower, but you can see in the box underneath. Speaking of the box underneath, the measured move from that consolidation area is to reach the $50,000 level, so I still think of that as a target. You should be able to find value on dips, but the biggest reason we broke out in the past couple of days has been involving Tesla buying Bitcoin, which in and of itself is probably not reason enough to go higher.