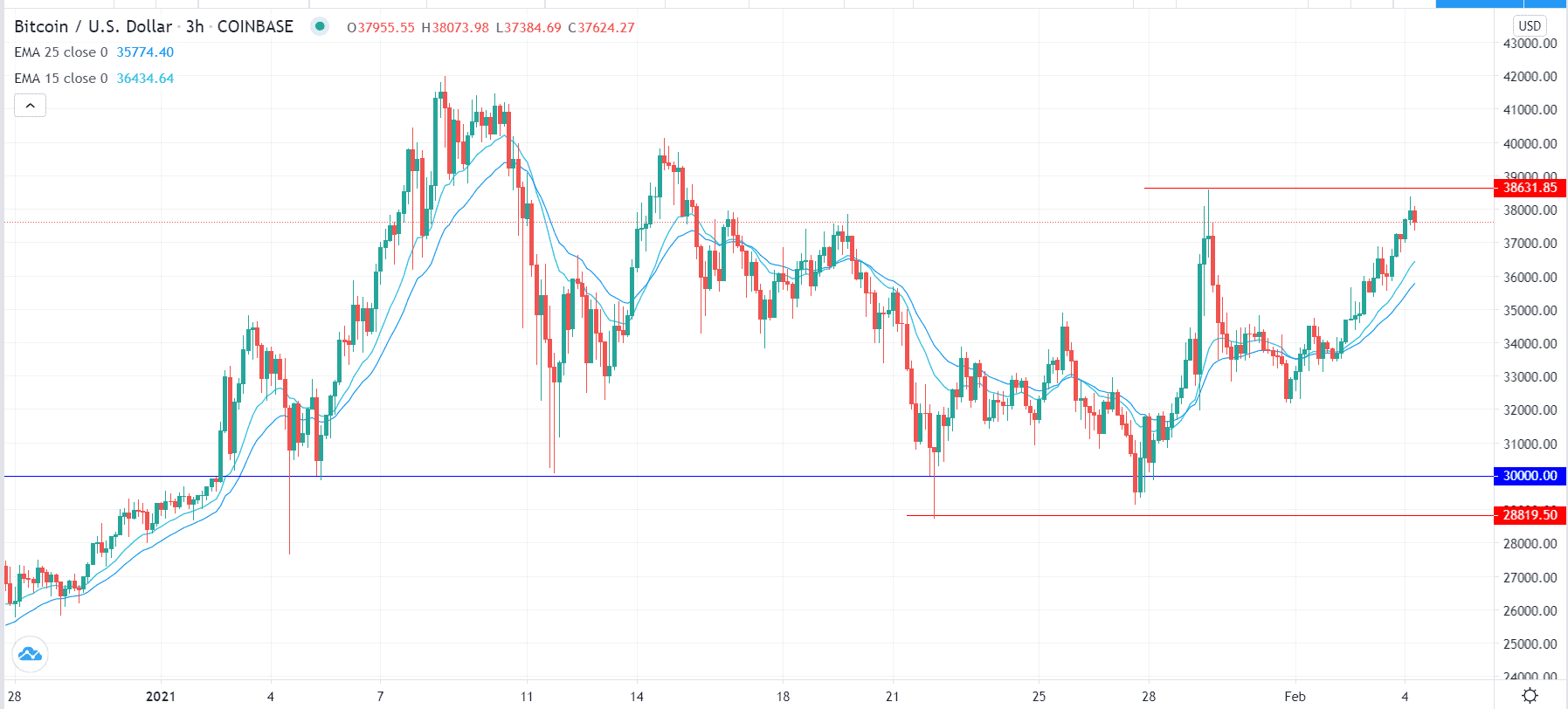

Bitcoin rallied again during the trading session on Wednesday, as it looks like we are going to threaten that huge wick from three sessions ago. We will probably continue to see upward pressure, as the market is almost certainly going to go looking towards the $40,000 level above. The $40,000 level is a major resistance barrier, not only due to the large, round, psychological effect, but also the fact that we have seen significant resistance there from a structural standpoint as well. If we can break above there though, it would certainly signify that Bitcoin is going to continue going higher.

Bitcoin continues to gain on a multitude of reasons, not the least of which is that the Federal Reserve is printing money as quickly as it can. Beyond that, there are a lot of other central banks around the world doing the same thing, so I think that in general we will see a rush towards things that are not fiat currency.

Bitcoin breaking above the $40,000 level almost certainly opens up a move towards the $50,000 level eventually. I do not necessarily know that we will shoot straight up in the air like we had, but it is hard not to notice the fact that we have formed a massive flag at this point. That is technically a bullish sign, so I think that a lot of traders will continue to buy the dips. The $30,000 level has offered significant support, and the fact that the 50-day EMA is approaching that level is another reason why we would be looking for buyers.

We are probably going to continue to fluctuate and show signs of exhaustion from time to time, but eventually there will be a reason to go higher. If we were to break down below the $30,000 level, then it is possible that we could see a drop down to the $25,000 level, maybe even the $20,000 level, which is where we see the 200-day EMA heading. I do not expect to see a major breakdown, but have to keep that in the back of our minds.