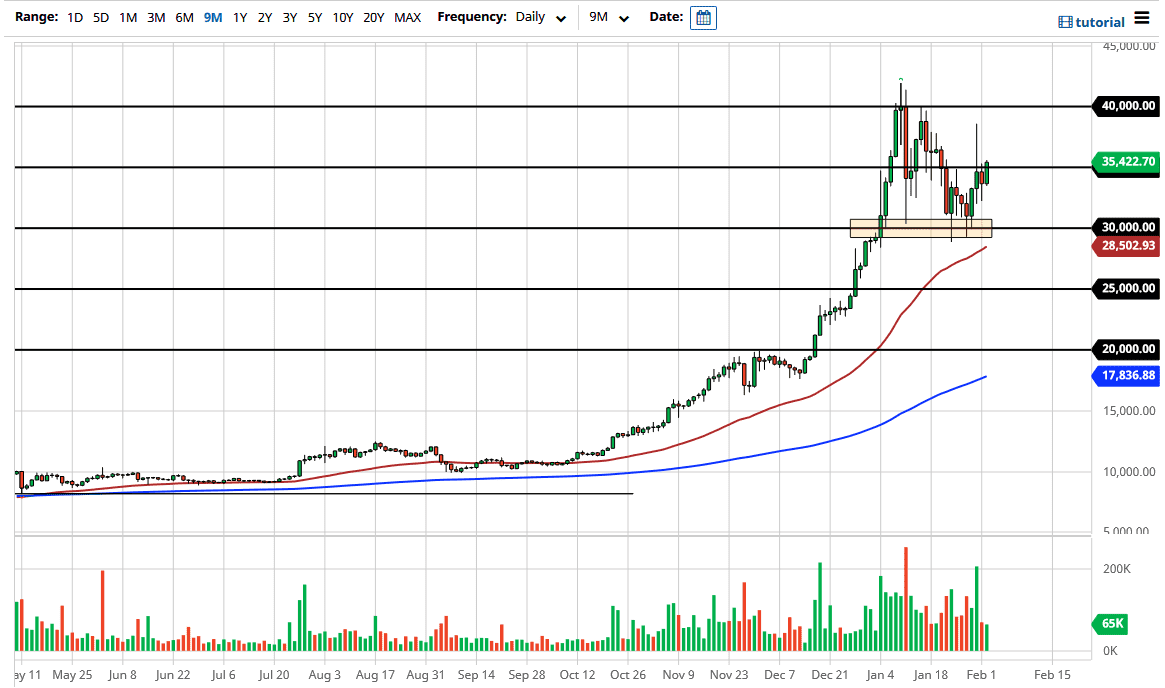

The Bitcoin markets rallied a bit during the trading session on Tuesday, as we have broken above the $35,000 level yet again. However, there is a significant amount of noise above, especially when you look at the candlestick from just two sessions ago, where we got the massive spike and then sold off drastically. This is not to say that we cannot go higher, just that it may not be a straight shot to the $40,000 level.

When you look at the market, it is easy to imagine a bullish flag, and I think that a lot of traders are looking at this as such. The $30,000 level has held quite nicely and is now supported by the 50-day EMA. The 50-day EMA is followed by a lot of retail traders, which makes up a huge portion of this particular market. One thing is for sure: they have been willing to step in and buy Bitcoin on these dips, so I suspect that a major correction is not necessarily something imminent.

I thought that perhaps we could break down towards the lower level of the original breakout - and that is still certainly possible - but at this point, it looks like we are probably likely to stabilize in this general vicinity. That means more of a range-bound market with an obvious upside bias, especially if the US dollar starts to sell off again. Currently, it is strengthening right along with Bitcoin, which means that Bitcoin is decoupling from the stimulus narrative that we had seen previously. It is not moving higher because of a fading US dollar; it is moving higher because people are seeing this kind of nonsensical spending around the world. This is the exact same argument that is made for gold and silver.

The US dollar is starting to recover a bit, which is interesting because we may be seeing flows into Bitcoin coming from other parts of the world, not just the United States. It is very possible that we are starting to see a bit of European inflow picking up, right along with Asia. Nonetheless, I think we are going to go looking towards the top of the candlestick from a couple of days ago, and then perhaps try to make a move towards $40,000. At the very least, I think we are going to chop sideways while we trying to build momentum to break out.