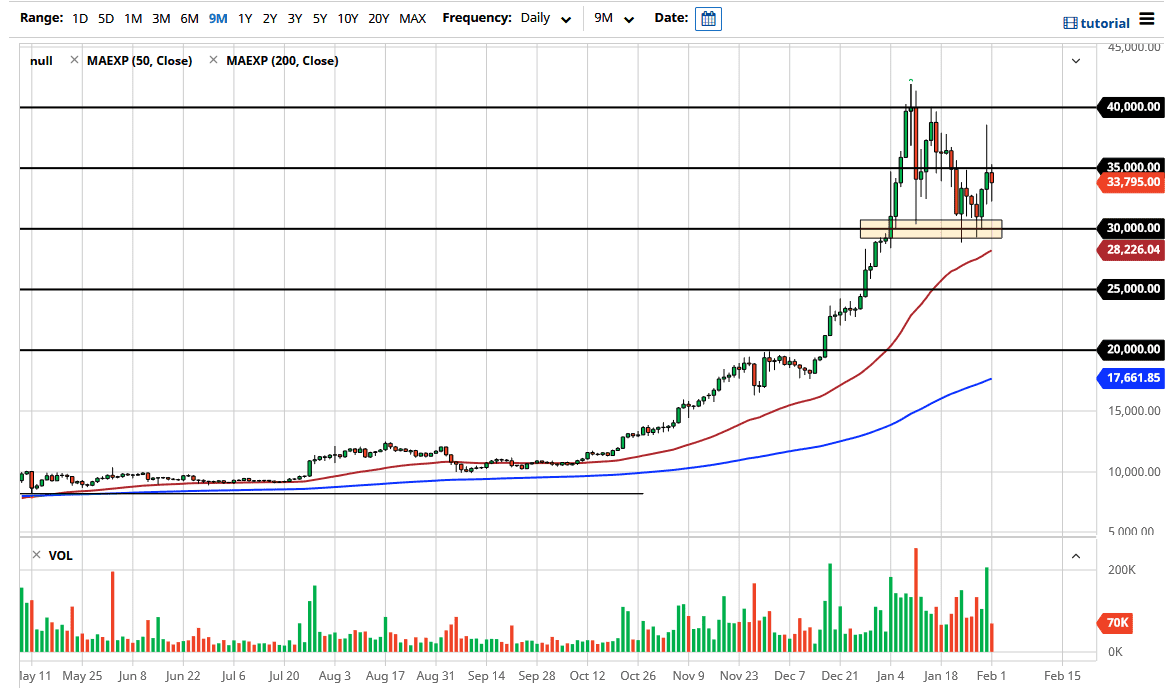

Bitcoin initially fell during the trading session only to turn around and show signs of resiliency as we recaptured most of the gains. The candlestick for the trading session on Monday suggests that there are buyers underneath, which is a good sign, considering how negative the previous candlestick was. We are essentially going back and forth around the 35,000 handle, an area that is a large, round, psychologically significant figure, and one at which we have seen both support and resistance.

Underneath, I see the $30,000 level as significant support, as it has caused a bit of a bounce more than once. If we were to break down below the $30,000 level, then the 50-day EMA, which sits currently at the $20,230 level, could offer a certain amount of support. The 50-day EMA does tend to attract a certain amount of attention, as this is a heavily technical market most of the time. This is a market that has pulled back, after having a massive surge higher. It has recovered quite nicely, and we are more likely than not to grind sideways overall, not only based upon the fact that momentum could only carry Bitcoin so far, but also because the last couple of candlesticks certainly suggest that we are trying to make a decision.

It does look like we are going to at least try to grind our way back to the $40,000 level, and perhaps even try to break higher than that. Overall, a lot of traders are looking to get involved in the Bitcoin market if we can get some stability for a while. After all, this is a market that does tend to be impulsive but has a lot of people interested in it. Furthermore, we have institutional interest in Bitcoin, but it will be a long and slow gradual process. This is not something that is going to be bought into by institutions if it runs up too far, so being sideways or even a little bit negative is probably better for Bitcoin longer term. I do not have any interest in trying to short this market, but if I did, I would do it via options, not nakedly shorting what can be an explosive market.