During the trading session on Monday, there were large sell orders that came into the marketplace to push prices down. Quite often, this can be a sign of larger so-called “whales” jumping into the market to lighten some of their wallets. This is one of the major problems with Bitcoin: a huge percentage of cryptocurrency is in the hands of just a handful of wallets. In a market like that, you have to worry about the big players moving the market quickly.

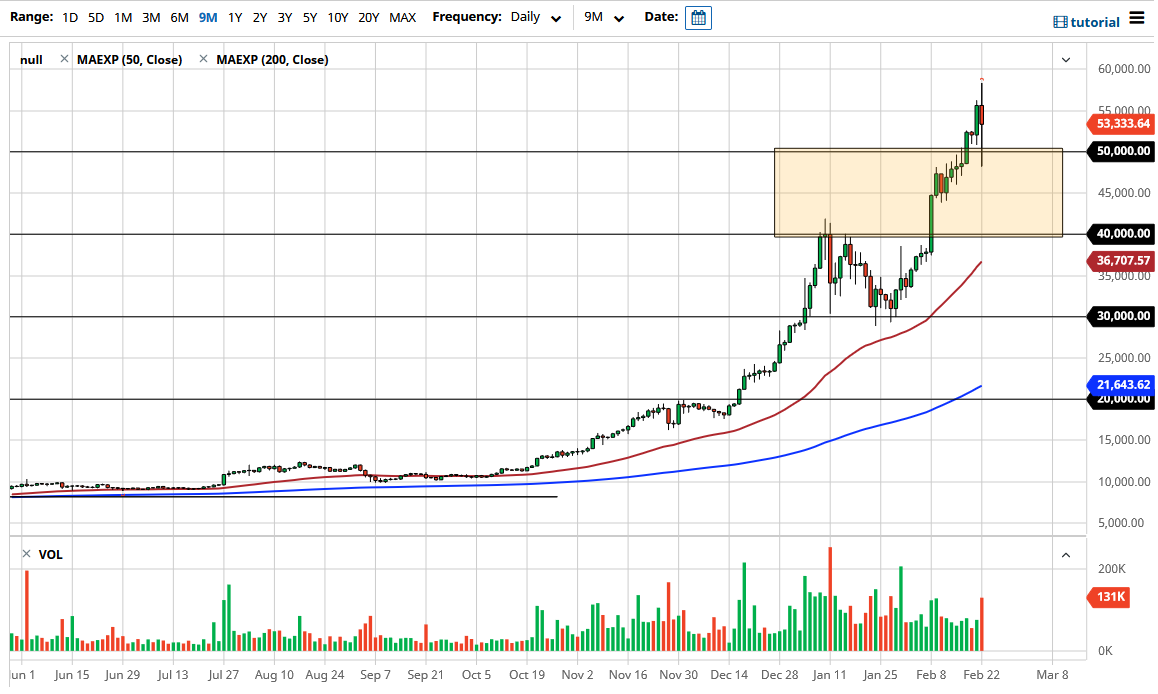

Having said that, you can see that the market has recovered, so although it certainly had some traders sweating, the reality is that the market has been as high as $58,300 or so, just as it dropped as low as $48,100 before bouncing again. This is the nature of the market, so this is why trading leveraged products in crypto is a great way to lose money. On the other hand, those who are long-term investors are probably used to this type of noise, and probably did not even know it happened.

Larger institutions are starting to come into the marketplace and pick up Bitcoin, so that certainly has traders getting excited about the prospects of Bitcoin actually being used as money someday. It is a bit ironic, because although Bitcoin is supposed to be the “money of the future”, the biggest problem it has is that there is such a speculative mania in it that it will never be able to be money until it stops. It is kind of a Catch-22, so unless you are a speculator, you better plan on holding this money for years. My suspicion is that you will probably get a massive crash again, and this will be especially true if we do not stabilize anytime soon.

There is something about Bitcoin traders that makes them think that there are no cycles in the market, so unfortunately every time we get speculative like this, a lot of new traders get hurt. This is not to say that I would be a seller of Bitcoin, but just that the session on Monday was a perfect example of just how dangerous a parabolic move like this can be if you try to jump into it far too late. The $50,000 level looks to be somewhat supportive, but I like $40,000 much more if we can get down there. Based upon the recent technical analysis, the market should go looking towards $60,000 eventually, and after the action on Monday you can see just how easily that could happen.