Bullish signal

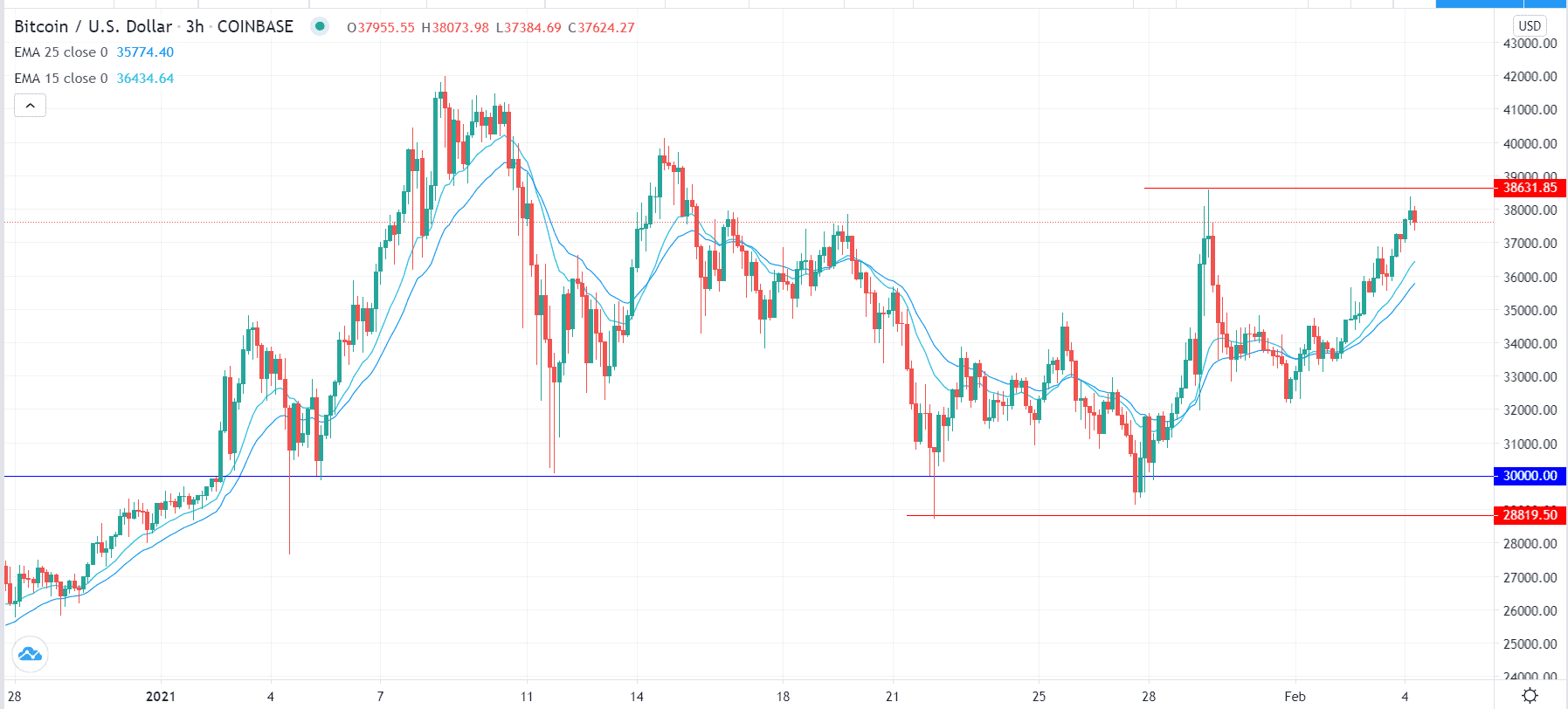

Set a buy stop at $38,700 (slightly above the January 29 high).

Add a take-profit at $40,000 and a stop loss at $37,000.

Bearish signal

Set a sell-stop at $37,000 and a take-profit at $35,000.

Add a stop-loss at $38,700.

The Bitcoin price rallied in overnight trading on renewed demand for cryptocurrencies. The BTC/USD price rose to $38,413, which was the highest level since January 29. Other cryptocurrencies like ETH, LTC, and BCH also rallied, taking the total market cap to more than $1.12 trillion.

Rising Demand Pushes

The BTC/USD rose in the overnight session after PayPal released its earnings results. The company said that it had started seeing robust demand for Bitcoin, a product it started offering a few months ago. The firm also said that it was building a complete business unit that will focus on digital assets.

According to the CEO, the company will achieve this both organically and through acquisitions. A few months ago, Bloomberg said that the firm was considering buying several crypto-focused companies, including BitGo, a company that provides custody services to institutional investors.

Bitcoin price is also rising as institutional inflows remain strong. Recent data by GreyScale showed that more institutional investors are investing in digital currency as an alternative to gold.

In a report yesterday, Mike McGlone, a Bloomberg analyst, said that the currency had shown a lot of resilience above the $30,000 level. He predicted that the price could soon bounce back to $50,000 in the near term.

The BTC/USD is also resilient because of the current expansionary Federal Reserve. In the past Fed meeting, the bank said that it will not change the current policy of low-interest rate and quantitative easing any time soon.

Meanwhile, Congress is still deliberating on another stimulus package. Some members of Senate, including Joe Manchin of West Virginia, have criticized the current proposal by Joe Biden. Still, there is a possibility of a compromise. A stimulus will be a good thing for Bitcoin prices.

BTC/USD Technical Outlook

In the past few weeks, Bitcoin price has moved below $30,000 about five times. In each of these times, the cryptocurrency has found itself rising above this level. It has also risen by about 30% from its lowest level on January 27.

Also, it is being supported by the 25-day and 15-day exponential moving averages and is slightly below the January 29 high of $38,630. Therefore, a cross above this resistance will see the price continue rallying as bulls target $40,000.